Rental property owners in California can lower taxable income through deductions and write-offs for mortgage interest, property taxes, repairs, insurance premiums, utilities, professional service fees, travel for property management, advertising, and depreciation. These write-offs are authorized under federal laws such as Internal Revenue Code (IRC) Section 162 for business expenses and IRC Section 163 for interest, as well as provisions in the California Revenue and Taxation Code.

Eligible property types include single-family residences, condominiums, apartment complexes, luxury estates, industrial facilities, and special-purpose properties. California’s Proposition 13, part of the state constitution, limits annual property tax increases, affecting the deductible amount. Repairs that restore a property to its original condition may be deducted in the same year, while capital improvements must be capitalized and depreciated over time under IRS Publication 946.

By aligning write-offs with both IRS regulations and California Franchise Tax Board rules, property owners in Los Angeles, Riverside, San Bernardino, Orange County, and nearby areas can legally offset rental income while meeting all legal requirements.

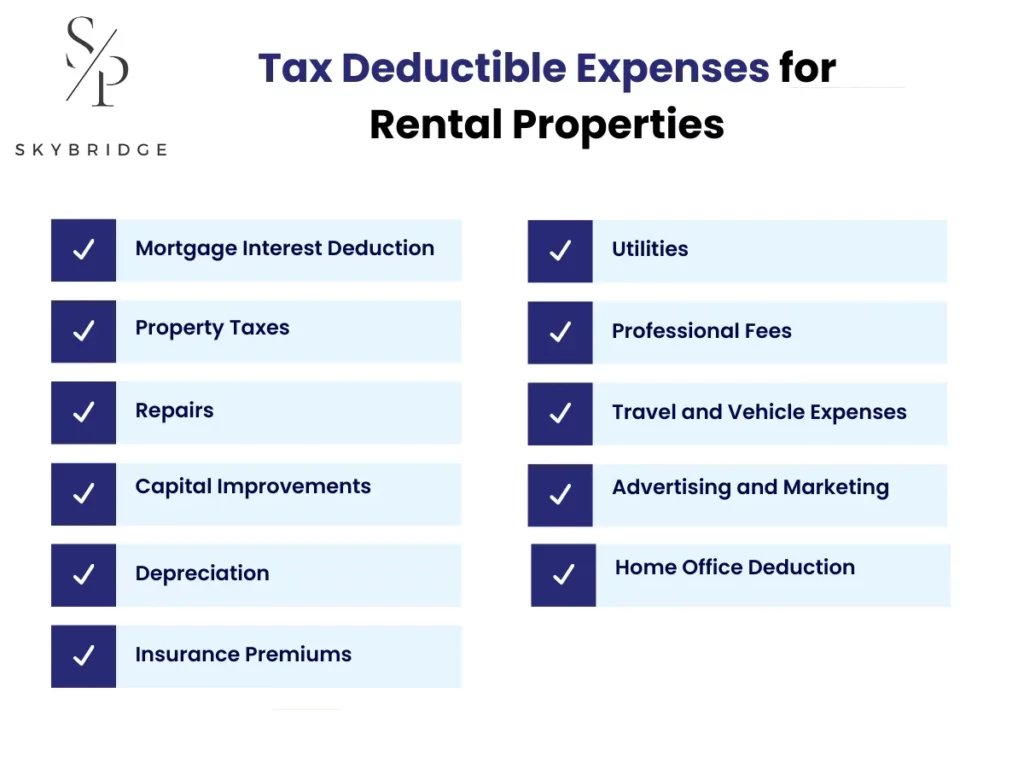

Tax Deductible Expenses for Rental Properties

In California, rental property owners can claim deductions for mortgage interest, property taxes under Proposition 13, insurance premiums, utilities, repairs, professional fees, advertising, and depreciation. These write-offs must be ordinary, necessary, and documented to meet IRS and California Franchise Tax Board rules, helping reduce taxable rental income.

Mortgage Interest Deduction

Mortgage interest is one of the largest deductions for California rental property owners under IRC Section 163. It applies to interest paid on loans used to buy, build, or improve a rental property and is deductible as a business expense on Schedule E, rather than as an itemized deduction. To qualify, the expense must be supported by documentation such as Form 1098, showing the mortgage interest paid during the tax year. This deduction covers purchase mortgages, refinancing, and home equity loans when the funds are used for property improvements.

Key points to remember regarding the mortgage interest deduction include:

- Form 1098: Shows annual mortgage interest paid.

- Loan purpose: Must relate to buying, building, or improving rental property.

- Pre-12/15/2017 loans: Deduct interest on loans up to $1 million.

- Post-12/15/2017 loans: Deduct interest on loans up to $750,000 (married filing jointly) or $375,000 (married filing separately).

- Schedule E filing: Reported as a rental business expense, not as an itemized deduction.

Property Taxes

For California landlords, property taxes are a recurring deduction that can be written off each year on Schedule E to reduce taxable rental income. Under state law, the base property tax rate is 1% of the assessed value, with Proposition 13 capping annual increases in assessed value at 2% unless the property changes ownership. Additional local assessments may apply depending on the jurisdiction. Late payments result in penalties starting at 10% of the unpaid amount, making timely payment essential for compliance and avoiding unnecessary costs.

Key points regarding property taxes that rental property owners should consider are:

- Schedule E filing: Deduct property taxes as a rental business expense.

- Base rate: 1% of the assessed property value.

- Proposition 13 cap: Annual increase limited to 2% unless ownership changes.

- Documentation: Keep county tax bills and payment receipts.

- Penalties: Late payments incur at least a 10% penalty.

- Non-deductible charges: Local improvement assessments (e.g., sidewalks) are excluded.

Repairs

Repair costs for a rental property are fully deductible in the year they are incurred and are reported on Schedule E as operating expenses. Under IRS rules, repairs are defined as work that restores the property to its original condition without adding significant value or extending its useful life. In California, deductible repairs may include fixing broken toilets or windows, patching roof leaks, repairing HVAC components, and replacing damaged flooring sections. To qualify, expenses must be ordinary, necessary, and directly related to the rental activity, with receipts and records kept for verification.

Following are the key considerations landlords should know:

- Immediate deduction: Repairs are fully deductible in the year paid.

- Schedule E filing: Report as a rental operating expense.

- Qualifying repairs: Maintain property without upgrades.

- Documentation: Keep receipts, invoices, and work orders.

- Not repairs: Improvements must be capitalized and depreciated.

Capital Improvements

Those expenses that go beyond repairs and add value, extend the rental property’s life, or change its use qualify as capital improvements. These costs must be capitalized and deducted gradually through depreciation. Under IRS Publication 946, examples include remodeling, adding new flooring throughout, installing an HVAC system, or building an addition. These expenses are reported on Schedule E through depreciation deductions, and accurate records are required for compliance with IRS and California Franchise Tax Board requirements.

Below are some crucial elements that Californian landlords should be aware of:

- Depreciated expense: Deduct over time, not in the year paid.

- Schedule E reporting: Claim through depreciation.

- Qualifying improvements: Increase value, extend life, or adapt use.

- Energy-efficient upgrades: 30% tax credit up to $3,200 annually.

- Medical modifications: Deduct if costs exceed 7.5% of AGI.

- Documentation: Maintain invoices, contracts, and payment records.

- Not improvements: Ordinary repairs are deductible in the same year.

Depreciation

The cost of owning a rental property can be recovered over time through an annual deduction allowed by the IRS. For residential rentals, this recovery period is 27.5 years using the straight-line method, as outlined in Publication 946. The deduction applies to the building’s value (excluding land) and eligible capital improvements such as remodels or system upgrades. Maintaining precise records of the cost basis and improvement expenses ensures accurate calculations and compliance with IRS and California Franchise Tax Board requirements.

Here are the essential points associated with depreciation:

- Depreciation period: Residential rentals depreciated over 27.5 years.

- Excludes land: Only the building and qualifying improvements are depreciable.

- Schedule E reporting: Deduct annually over the set term.

- Qualifying assets: Includes major upgrades, remodels, and new systems.

- Documentation: Require purchase records, improvement costs, and depreciation schedules.

- Benefit: Reduces taxable income gradually over time.

Insurance Premiums

Insurance costs for a rental property are fully deductible as a business expense when they directly relate to the rental activity. These write-offs cover premiums for landlord insurance, property damage protection, liability policies, and loss-of-income coverage. Qualifying policies include fire insurance, theft coverage, flood protection, and landlord liability insurance. The coverage must protect the property and the owner’s financial interests, and all premium invoices and proof of payment should be retained for IRS and California Franchise Tax Board compliance.

Key elements related to insurance premiums are:

- Schedule E filing: Deduct as a rental business expense.

- Requirement: Must be directly related to the rental activity.

- Documentation: Keep premium invoices and payment receipts.

- Benefit: Provides financial protection while reducing taxable income.

Utilities

Utility expenses paid by California landlords are fully deductible when they are necessary for operating a rental property. Qualifying costs include water, sewer, electricity, natural gas, garbage collection, and internet service provided to tenants. When utilities are part of the rent, the entire amount paid can be deducted. If tenants reimburse the landlord, only the portion paid by the landlord is deductible. Business office utilities such as electricity, internet, phone service, water, and HVAC are also deductible in full. For home offices, a percentage of utility costs can be claimed based on the space used exclusively for managing rentals.

Important details regarding utility deduction for landlords include:

- Schedule E filing: Deduct as a rental business expense.

- In-rent utilities: Deduct the full amount if paid, prorate if reimbursed.

- Office utilities: Fully deductible for business offices.

- Home office utilities: Deduct based on business-use percentage.

- Documentation: Keep bills organized by property and month.

Professional Fees

Professional services used to operate or maintain a rental property can be deducted in full when they are directly related to rental activity. These costs may include hiring a property manager, consulting with an attorney, working with an accountant, or paying a leasing agent. To qualify, the expense must be necessary for managing the property, reasonable in amount, and supported by proper documentation for IRS and California Franchise Tax Board purposes.

Key takeaways of professional fees for property owners are:

- Deductible expense: Fully deductible if tied to rental operations.

- Types of services: Property management, legal, accounting, leasing, and consulting.

- Contract requirements: Written agreements help substantiate the expense.

- Specialized expertise: Includes legal representation, tax planning, and dispute resolution.

- Payment proof: Maintain invoices, contracts, and payment confirmations.

Travel and Vehicle Expenses

Managing a rental property often requires travel, and many of those costs can be deducted when they are directly tied to rental operations. Trips to collect rent, meet with tenants, perform repairs, purchase supplies, or conduct inspections typically qualify. Under Publication 463, landlords must keep detailed records that show the date, purpose, location, and amounts spent. Vehicle expenses can be claimed using actual costs or the IRS standard mileage rate, and 50% of meal costs during business travel are also deductible.

Important facts regarding travel and vehicle expenses that landlords should remember are:

- Deductible travel: Rent collection, tenant meetings, maintenance, supply purchases, inspections.

- Vehicle costs: Gas, insurance, repairs, depreciation, or standard mileage rate.

- Business meals: 50% deductible during business travel.

- Required records: Date, travel purpose, property address, expenses, and receipts for amounts over $75.

- Applicable trips: Local and long-distance travel for rental-related purposes.

Advertising and Marketing

Money spent to advertise or market a rental property is fully deductible when it directly relates to attracting tenants. This includes both traditional advertising methods and online marketing efforts. Common expenses may cover listing fees, printed flyers, signage, digital ads, and costs for professional photography or virtual tours. These deductions apply whether the property is vacant or occupied, or if the goal is to secure new tenants or maintain occupancy. Records of invoices, contracts, and payment receipts should be kept to support each expense.

Key details for rental property owners regarding advertising and marketing include:

- Deductible expense: Fully deductible if aimed at attracting tenants.

- Types of advertising: Online listings, print ads, flyers, signage.

- Marketing services: Photography, videography, virtual tours.

- Applicable timing: Deductible for vacant or occupied properties when promoting rentals.

- Tax benefit: Reduces taxable income by covering tenant acquisition costs.

Home Office Deduction

California landlords who use a portion of their home exclusively for managing rental properties may qualify for a home office deduction. This can include spaces used for administrative tasks or even a workshop for repairs. Deductible expenses include utilities, maintenance, mortgage interest, insurance, and depreciation. The deduction is based on the percentage of home space used exclusively for business, calculated by dividing the office area by the total home square footage.

Important considerations for home office dedication are:

- Exclusive use requirement: Space must be used only for the rental business.

- Qualifying uses: Administrative work or repair workshop.

- Calculation methods: Simplified rate per square foot or actual expenses.

- Deductible costs: Utilities, maintenance, mortgage interest, insurance, depreciation.

- Business-use percentage: Based on office space relative to total home size.

- Documentation: Maintain floor measurements, expense receipts, and usage records.

California Property Tax System and Deductions

California landlords can deduct property taxes on rental properties as a business expense. The base tax rate is 1% of the assessed value, with annual increases capped at 2% under Proposition 13. While property taxes are deductible, assessments for local improvements are not. Landlords should maintain thorough records and understand how these rules apply to maximize their deductions and ensure compliance.

California State Taxes on Rental Income

In California, rental income is taxed as ordinary income and can be taxed at rates that can reach up to 13.3% for top earners. Property owners can reduce their taxable rental income by deducting ordinary and necessary expenses such as mortgage interest, property taxes, maintenance, and insurance.

Nonresident property managers must file California returns for income earned within the state, with taxable income determined by source rules. Any unpaid tax is subject to a 10% penalty. For short-term rentals, landlords must also be aware of transient occupancy taxes (TOT), which vary by locality and require property managers to collect and remit these taxes accordingly.

California’s Rent Control Laws

In California, rent control laws limit how much landlords can increase rent each year to make housing more affordable. Under the California Tenant Protection Act (AB 1482), rent increases are capped at 5% plus CPI or 10% of the lowest rent in the last 12 months, whichever is lower. In cities like San Francisco and Los Angeles, local ordinances may impose stricter limits and provide additional eviction protections.

Rent increases are limited to 10% annually or 5% plus local inflation. For example, in San Francisco, the maximum increase from August 1, 2025, to July 31, 2026, is 6.3%. Landlords must provide a 30-day notice for increases below 10% and a 90-day notice for increases exceeding 10%.

Exceptions include single-family homes, condominiums, and properties built after 1995, which are exempt under the Costa-Hawkins Act. Retaliatory rent increases within 180 days of a tenant asserting their rights are illegal. Local ordinances further restrict rent hikes after Section 8 or other rental assistance programs end.

Capital Gains Tax in California

When selling rental property in California, owners may face capital gains tax on the profit from the sale. California taxes capital gains as ordinary income, which can be taxed up to 13.3% for high earners. Unlike federal tax rules, California does not provide preferential rates for long-term capital gains. Both state and federal taxes apply, with the IRS recognizing two categories of capital gains tax:

- Short-term capital gains apply to properties held for less than one year and are taxed at the ordinary income rate.

- Long-term capital gains apply to properties held for over one year, taxed at 0%, 15%, or 20%, depending on income and filing status.

To reduce the taxable amount, property owners can take advantage of tax exclusions under Section 121, which allow up to $250,000 in tax-free gains ($500,000 for married couples) if the property was the owner’s primary residence for at least two of the last five years. Additionally, owners can defer capital gains tax through a 1031 exchange by reinvesting the proceeds into a like-kind property.

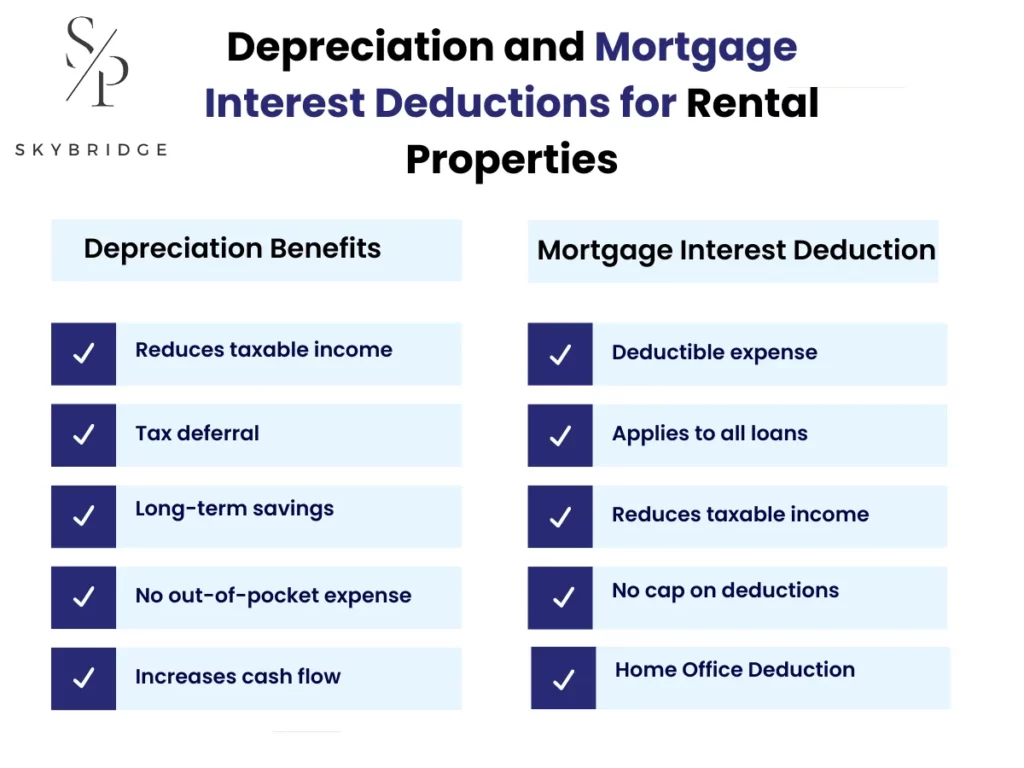

Depreciation and Mortgage Interest Deductions for Rental Properties

Mortgage interest and depreciation are two of the most effective ways to reduce taxable income for rental property owners. Mortgage interest paid on loans for purchasing or improving rental properties is deductible, directly lowering taxable rental income. Depreciation, on the other hand, allows property owners to deduct the property’s value (excluding land) over 27.5 years for residential rentals.

Depreciation Benefits

Depreciation is a powerful tax-saving tool for rental property owners, as it allows them to recover the cost of their property over time. By depreciating the value of the property (excluding land) over a 27.5-year period for residential rentals, owners can reduce taxable rental income annually. This deduction accounts for wear and tear, offering long-term savings.

Key benefits of depreciation for landlords in California include:

- Reduces taxable income: Deductions spread over 27.5 years lower taxable rental income.

- Tax deferral: Defer taxes by claiming depreciation each year.

- Long-term savings: Continuous annual deductions over the property’s useful life.

- No out-of-pocket expense: Depreciation does not require actual cash expenditure.

- Increases cash flow: Reduces taxes, leaving more rental income available for reinvestment.

Mortgage Interest Deduction

The mortgage interest deduction is a major tax benefit for rental property owners, allowing them to deduct interest paid on loans used to acquire, improve, or maintain rental properties. This deduction helps reduce taxable income, whether the loan is long-term or short-term. It applies to primary mortgages, refinanced loans, and any loans used for rental property purposes, offering substantial savings for owners with larger loans.

Important considerations of the mortgage interest deduction for property owners

- Deductible expense: Interest on loans used for property acquisition or improvement is deductible.

- Applies to all loans: Includes both long-term mortgages and short-term financing.

- Reduces taxable income: Helps lower taxable rental income, providing immediate savings.

- No cap on deductions: No limit to the amount of mortgage interest that can be deducted.

- Supporting documents: Keep records of mortgage interest statements (Form 1098) for verification.

Capital vs. Operating Expenses

The key difference between capital expenses and operating expenses lies in how they are treated for tax purposes. Capital expenses, such as major improvements or renovations, must be capitalized and depreciated over time, while operating expenses, like repairs and maintenance, can be deducted in the year they are incurred. Understanding this distinction is crucial for managing your rental property taxes effectively.

To make it clearer, here is a comparison of common capital and operating expenses:

| Expense Type | Capital Expenses | Operating Expenses |

| Definition | Major improvements that add value or extend the property’s life | Regular costs required for maintenance and operation |

| Deduction Timing | Depreciated over time (e.g., 27.5 years for residential properties) | Deducted in the year incurred |

| Examples | – Renovations (e.g., kitchen remodel)- New roofing or flooring- HVAC installation | – Repairs (e.g., fixing a leak)- Property management fees- Utilities and insurance |

Strategies for Maximizing Rental Property Tax Deductions

To maximize rental property tax deductions, property owners should plan repairs and capital improvements strategically, track all property-related expenses, and take full advantage of depreciation. Timing purchases and repairs before the year ends can lead to immediate deductions, while keeping accurate records ensures no deductions are overlooked. Working with a tax professional can help optimize savings and ensure compliance.

Tax Planning Tips

Effective tax planning is key to maximizing deductions and minimizing tax liability for rental property owners. By staying organized and making smart financial decisions throughout the year, property owners can reduce their taxable income and improve cash flow. Here are some tax planning tips to help property owners stay ahead:

- Keep detailed records of all rental property costs.

- Schedule repairs and improvements for year-end deductions.

- Utilize available credits like energy-efficient home improvements.

- Consider 1031 exchanges to defer taxes when selling and reinvesting in new properties.

- Meet with a tax advisor periodically for guidance.

Working with Tax Professionals

Hiring a tax professional is crucial for rental property owners to ensure they maximize deductions and stay compliant. They can help you navigate complex tax laws, identify overlooked deductions, and plan strategies to reduce your tax liability. Working with a professional ensures you are not missing out on opportunities that could save you money.

Below are some benefits of working with a tax professional:

- Identify deductions: Keep detailed records of all rental property costs, including repairs and management fees.

- Stay compliant: Ensure your tax filings meet IRS and state requirements, avoiding penalties.

- Optimize tax strategies: Receive advice on strategies for depreciation, capital gains, and other rental property deductions.

- Reduce tax liability: Get expert guidance on lowering your overall tax burden.

- Save time: Let a professional handle tax preparation and filings efficiently.

Record Keeping

Accurate record-keeping is crucial for rental property owners to ensure they can claim all eligible deductions and stay compliant with tax regulations. Keeping detailed records throughout the year helps avoid missed deductions and simplifies tax preparation. Proper documentation is essential if you are ever audited or need to verify expenses for tax purposes.

Here are the important records that landlords should keep:

- Receipts of repairs, maintenance, and property-related costs.

- Rental income, including rent payments and deposits.

- Form 1098 to track deductible mortgage interest.

- Records of utilities paid for the rental property.

- Copies of tax returns, depreciation schedules, and any related filings.

- Documents such as purchase agreements, renovation invoices, and insurance policies.

Common Tax Filing Mistakes and Compliance Issues for Rental Property Owners

Many rental property owners make tax filing mistakes that can lead to missed deductions, penalties, or increased tax liability. Common errors include failing to track all expenses, improperly categorizing repairs as capital improvements, or mixing personal and rental property finances. Staying organized, understanding tax rules, and keeping accurate records can help avoid these issues and ensure compliance with IRS and state regulations.

Not Keeping Accurate Records

One of the biggest pitfalls for rental property owners is failing to maintain accurate records, which can lead to errors in deductions and audit risks. Without proper documentation, owners may miss valuable deductions like repairs or overreport income. Misclassifying capital improvements as repairs can also result in incorrect depreciation calculations, increasing tax liability or penalties during an audit.

To avoid these issues, it is important to keep organized, up-to-date records of all rental income and expenses. Using accounting software such as QuickBooks or FreshBooks, or hiring a bookkeeper, helps ensure accuracy, streamline tax preparation, and maximize deductions while staying compliant with IRS regulations.

Depreciation Errors

Depreciation is often misunderstood, and mistakes in calculating it can lead to significant tax issues. A common error is using the wrong depreciation schedule, such as applying a 39-year timeline for residential rental property, when it should be 27.5 years. Another mistake is failing to claim depreciation altogether, which can result in overreporting taxable income and missing out on valuable deductions. These errors can increase tax liability and reduce potential savings.

To prevent these issues, it is essential to track depreciation each year and ensure the correct schedule is applied. Property owners should consider consulting with a tax professional to verify calculations and ensure all deductions are claimed, ultimately maximizing savings and maintaining compliance with IRS rules.

Mixing Personal and Rental Expenses

Homeowners often mix personal and rental property expenses, resulting in tax filing errors and disallowed deductions. Personal expenses, such as household utilities, personal vehicle costs, or vacation expenses, cannot be claimed as rental property deductions. These types of costs must be kept separate from rental expenses, as the IRS disallows personal expenses from being deducted against rental income. Failing to separate personal and rental expenses can result in overreporting income or claiming incorrect deductions, which could trigger an audit.

To avoid this, property owners should use separate bank accounts and credit cards for rental transactions. Keeping organized records with receipts and invoices is crucial, and consulting a tax professional can ensure only valid rental expenses are deducted.

Maximize Your Rental Property Tax Deductions in California

Maximizing tax deductions for rental properties in California involves more than just tracking mortgage interest, property taxes, repairs, and depreciation. Property owners need to ensure that every expense is documented and categorized properly. A property management company plays a crucial role in this process by handling day-to-day operations and providing expert guidance on accurate categorization of expenses, vital for maximizing deductions.

Property management companies also help rental property owners navigate the complexities of tax deductions for rental properties in California. With a deep understanding of tax laws, they ensure compliance and prevent missed opportunities for deductions. By managing both the property and financial details, they help reduce tax liability and optimize savings, allowing owners to focus on growing their investment without worrying about potential tax issues.