The Los Angeles housing market in 2025 is expected to see a 2.7% year-over-year increase in home prices, according to Redfin. This growth is driven by strong demand, limited inventory, and shifting economic conditions in the region. With the median home price standing at $1.1 million and luxury properties exceeding $2.5 million, the market continues to reflect the city’s dynamic real estate landscape, influenced by both demographic shifts and broader economic forces. High-demand neighborhoods like Beverly Hills, Downtown LA, and West Hollywood are anticipated to experience the highest price increases, fueled by ongoing demand and limited supply.

Affordability remains a critical challenge, with the median household income in LA at $79,701, which is far below the median home price. First-time homebuyers and middle-income families are being priced out, particularly in areas experiencing rapid gentrification, such as Highland Park and Echo Park. These price increases are outpacing wage growth, making homeownership increasingly unattainable for many Angelenos. These issues are likely to persist in 2025, impacting both homebuyers and renters across the region.

Despite affordability challenges, investment opportunities in Los Angeles remain strong. Areas like Inglewood, where property values have increased by 7% due to infrastructure developments like the Metro expansion, offer high ROI potential for investors seeking long-term growth. By focusing on these high-growth areas, investors can maximize returns while navigating the evolving market dynamics of Los Angeles.

Los Angeles Housing Market Overview

In 2025, the Los Angeles housing market is expected to benefit from a 20.3% increase in inventory, easing some of the supply pressure. However, demand remains high in prime areas like Downtown LA and Beverly Hills, with home prices projected to rise by 2.7% year-over-year. Areas with significant development, such as Inglewood, will see notable price growth, while affordability challenges persist, especially for first-time buyers and middle-income families.

Market Conditions and Trends

Inventory in the Los Angeles housing market has risen significantly, with 1.54 million unsold units as of May 2025, up 20.3% from the previous year, according to the National Association of REALTORS®. This increase represents a 4.6-month supply, compared to 4.4 months in April and 3.8 months in May 2024. Despite the rise in available homes, demand remains robust, with homes selling for 3.8% more than they did a year ago. As listed in Rocket Homes, the median price per square foot is $590, pushing the median home price to $876,067, a $32,259 increase over the past year, based on sales data from the last 12 months.

High-demand areas like Downtown LA and West Hollywood continue to drive price growth, while neighborhoods such as Inglewood, with ongoing development projects, will see further price appreciation. However, affordability remains a key challenge, especially for first-time buyers, as home prices continue to outpace wage growth. As a result, buyers must navigate a competitive market, while investors can still find opportunities in emerging neighborhoods.

Market Supply and Demand

In June 2025, Los Angeles saw a 9.0% increase in homes for sale, totaling 4,854 units, up from 4,455 in May, according to Rocket Homes. This increase in inventory, while notable, has not fully satisfied the persistent demand. A total of 729 homes were sold, reflecting an 8.3% month-over-month decline in sales. Despite this, competition remains high, with 47% of homes selling below asking price, 15% at asking, and 39% above asking. Notably, 61% of homes sold in June were on the market for 30 days or less, highlighting a fast-paced market, especially in high-demand areas like Downtown LA, Trousdale Estates, and Beverly Hills.

Homes are selling very close to their asking prices, with a sale-to-list ratio of 99.05%, according to Realtor. The average listing age in Los Angeles rose to 34 days in June 2025, a 30% increase compared to June 2024. Homes now take an average of 48 days to sell, up from 26 days last year. Moreover, 23% of Los Angeles homebuyers are actively searching to move out of the city, while 77% are looking to stay within the metropolitan area, indicating a strong desire for local moves despite growing prices and inventory challenges.

Real Estate Price Overview

As of June 2025, the median home price in Los Angeles has reached $970,592, according to Zillow, with prices continuing to rise across the city. Luxury properties, particularly in areas like Beverly Hills Gateway ($10,265,444) and The Flats ($9,295,784), are seeing the most significant increases due to high demand and limited inventory. The median sale price in May 2025 was $1,022,667, while the median list price in June 2025 was $1,199,300, indicating strong competition in the market.

While luxury homes continue to appreciate, more affordable areas such as Long Beach and the San Fernando Valley are experiencing more moderate price growth. Gentrification, rising demand, and new housing laws are influencing these trends. In June 2025, 43.5% of homes sold for over asking price, reflecting the ongoing competitiveness.

For 2025, prices are expected to continue rising, but at a slower pace. The increase in inventory, with 8,257 homes for sale as of June 30, 2025, may help moderate some price pressure, though demand remains strong, especially in high-demand neighborhoods. Rent in Los Angeles also continues to rise, with the average rent reaching $2,866 per month, reflecting a 20.8% increase, according to the Legislative Analyst’s Office (LAO).

Price Trends and Data

The Los Angeles housing market has seen a steady increase in home prices across various property types, driven by high demand and a competitive environment. In June 2025, the market shows continued growth, though specific property types are experiencing price shifts at different rates. Key data points from the market indicate that while single-family homes are seeing the most significant price increases, townhouses are showing a slight decline, and condos are experiencing modest growth.

Median Home Prices

As of June 2025, the median home price in Los Angeles is approximately $970,592, according to Zillow. Other sources, such as Redfin and Realtor, report slightly higher figures, with Redfin listing the median at $1.1 million and Realtor at $1.2 million. This indicates a consistent upward trend in home prices, despite varying reports from different platforms.

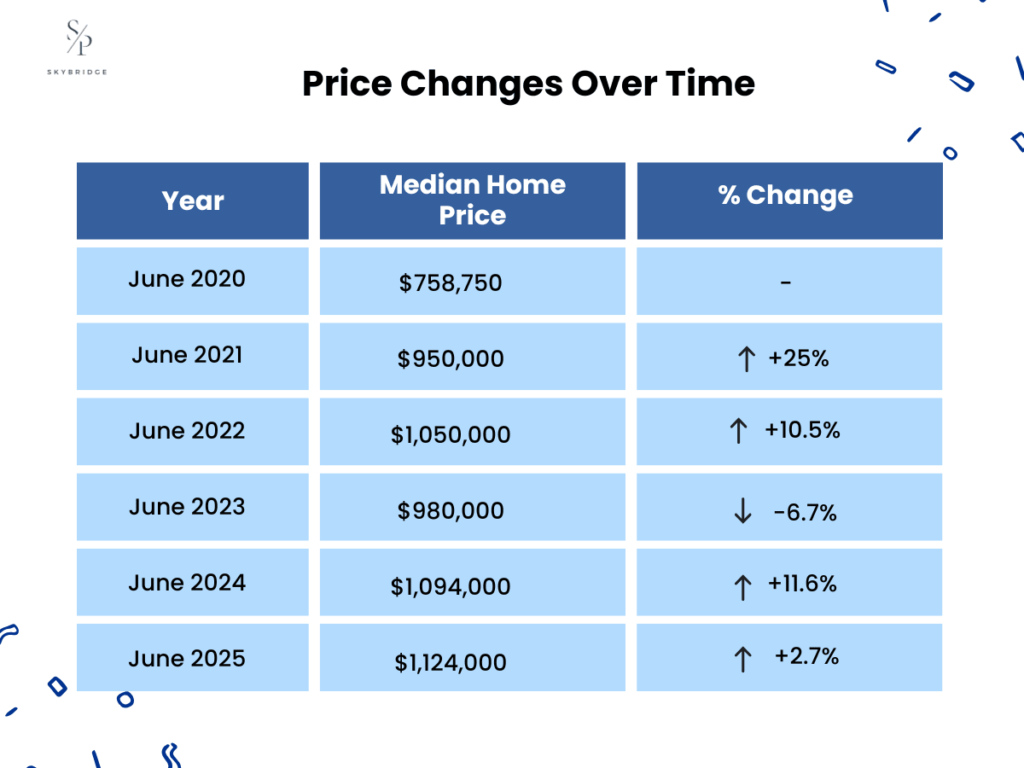

Price Changes Over Time

Over the last five years, the median home price in Los Angeles has seen a steady increase, with notable fluctuations in some years. Below is a year-over-year breakdown of the median home prices:

- June 2020: $758,750

- June 2021: $950,000 (up by 25%)

- June 2022: $1,050,000 (up by 10.5%)

- June 2023: $980,000 (slight decrease of 6.7%)

- June 2024: $1,094,000 (rebound of 11.6%)

- June 2025: $1,124,000 (up by 2.7%)

The 2023 dip in prices likely reflects a short-term market slowdown, possibly due to higher interest rates or economic uncertainty, but the market has rebounded, showing steady growth through 2025.

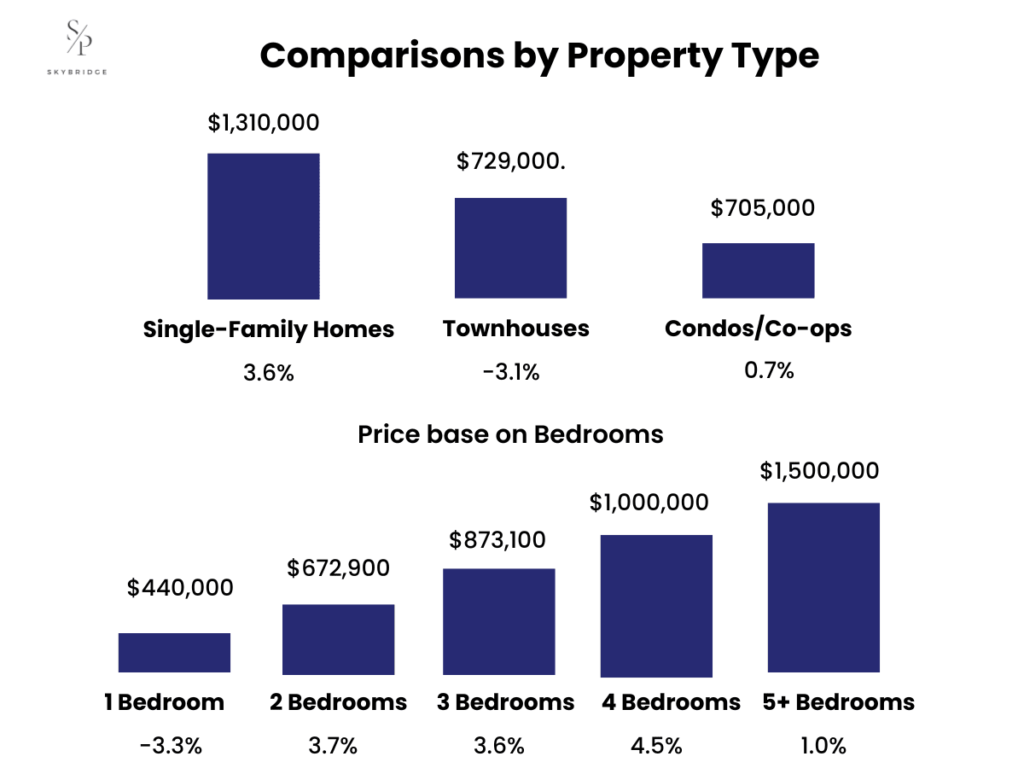

Comparisons by Property Type

Los Angeles housing prices vary significantly across different property types, with single-family homes, townhouses, and condos all experiencing distinct price shifts. Here’s a breakdown of how these categories compare in June 2025:

- Single-Family Homes: Average price of $1,310,000, a 3.6% increase year-over-year.

- Townhouses: Price dropped by 3.1%, now at $729,000.

- Condos/Co-ops: Increased by 0.7%, now at $705,000.

Additionally, prices for homes based on the number of bedrooms have shown specific trends:

- 1 Bedroom: Decreased by 3.3%, now priced at $440,000.

- 2 Bedrooms: Increased by 3.7%, now priced at $672,900.

- 3 Bedrooms: Increased by 3.6%, now priced at $873,100.

- 4 Bedrooms: Stable at $1,000,000, showing a 4.5% increase year-over-year.

- 5+ Bedrooms: Remained at $1,500,000, showing a slight 1.0% increase.

This breakdown illustrates how different property types and sizes are performing, with larger homes and single-family homes continuing to appreciate, while townhouses are experiencing a slight decline.

Investment Opportunities in LA Real Estate

Los Angeles offers strong investment potential in both residential and commercial properties, especially in neighborhoods like Inglewood, Downtown LA, and Hollywood, driven by major infrastructure projects, including the Metro Rail expansion and the SoFi Stadium. With rising demand for both long-term and short-term rentals, areas like Venice Beach and West Hollywood present profitable opportunities. Multifamily units and commercial spaces are also seeing high returns, making LA a prime location for investors seeking growth in diverse property markets.

High ROI Areas in Los Angeles

Some of the highest ROI areas in Los Angeles are undergoing rapid transformation, driven by major infrastructure projects, new developments, and strong demand for housing. Key areas to watch include:

- Inglewood: With ongoing developments like the SoFi Stadium and the Metro Rail expansion, property values have surged by 5% in the past year, selling for a median price of $751K. Inglewood presents significant growth potential for investors, especially in multi-family units, with the area’s revitalization attracting both buyers and renters.

- Downtown LA: The average home value in Downtown LA, CA, is $588,953, offering investors opportunities in a growing, revitalized area. The transformation of commercial spaces into residential properties, combined with rising demand for luxury condos, provides strong ROI potential, particularly as the area continues to attract businesses and residents.

- Hollywood: It remains one of the most sought-after areas, with a median list price of $900,000 and $680 per square foot. Its prime location near major attractions and entertainment hubs makes it an attractive market for both luxury and affordable properties, with increasing tourism further driving demand for both long-term and short-term rentals.

Real Estate Investment Strategies

For investors looking to capitalize on the Los Angeles real estate market in 2025, several investment strategies offer high returns based on current trends and local market conditions. Key strategies include:

- Buy and Hold: Long-term rental properties in neighborhoods like Downtown LA, Koreatown, and Inglewood remain solid investments, with stable demand and rising rents, providing steady cash flow and appreciation over time.

- Flipping: The renovation and resale of distressed properties is a viable strategy in areas like Inglewood and East LA, where new developments and gentrification are driving price increases. Investors can purchase homes at lower prices, renovate them, and sell for significant profits.

- Short-Term Rentals: The growing demand for vacation and temporary housing in high-tourism areas like Venice Beach, West Hollywood, and Beverly Hills offers investors strong returns. Despite regulatory challenges, properties in these areas continue to see high occupancy rates and premium rental prices.

Each strategy has its advantages, with buy and hold offering long-term stability, flipping yielding quicker profits, and short-term rentals providing high returns from tourism-driven demand.

Housing Affordability and Market Challenges

Housing affordability in Los Angeles has become a major issue, with the median home price reaching $970,592 in June 2025. Rising home prices and rent costs, now averaging $2,866 per month, are outpacing wage growth, making it difficult for first-time homebuyers and middle-income families to enter the market. With a 20.8% increase in rent, averaging $2,866 per month, renters are facing significant challenges in securing affordable housing across the region.

Affordability Issues

Affordability in Los Angeles is becoming increasingly unattainable for many residents. The median home price in Los Angeles has risen sharply to $970,592 in June 2025, according to Zillow, while the average rent has climbed to $2,866 per month, reflecting a 20.8% increase year-over-year, according to the Legislative Analyst’s Office. As wages have not kept pace with these rising costs, many first-time homebuyers and middle-income families are being priced out of desirable neighborhoods. Areas undergoing gentrification, like Highland Park and Echo Park, are seeing significant price increases, exacerbating affordability issues. The growing disparity between income levels and housing costs continues to be one of the most pressing challenges for Angelenos.

Economic Impact

The affordability crisis in Los Angeles has significant economic consequences, particularly for the workforce. Rising home prices, which reached a median of $970,592 in June 2025, and the average rent of $2,866 per month, are making it increasingly difficult for workers in key industries, such as healthcare and tech, to live near their jobs. This forces many to commute longer distances, leading to increased traffic congestion and higher transportation costs.

Moreover, businesses are struggling to attract and retain employees, with 41% of employers in Los Angeles reporting hiring challenges due to the high cost of living, according to the LA Business Journal. The housing market’s reliance on investors has inflated home prices further, reducing the ability for many to become homeowners, limiting their ability to build equity, and stifling local economic growth.

Government Policies Affecting Housing

Government policies in Los Angeles, including rent control and zoning restrictions, are central to the city’s ongoing housing crisis. Rent control laws (AB 1482) have limited rent increases to 3% annually or CPI (whichever is lower) for residential rental properties with 5 or more units, which has slowed new construction and discouraged property owners from upgrading their units. Zoning laws also restrict new housing development, with 74% of land in LA zoned for single-family homes, per a UC Berkeley study.

While efforts such as Measure JJJ and the LA Housing Element 2021-2029 aim to increase affordable housing, their implementation has been slow and faced significant opposition. Experts argue that easing zoning restrictions and investing more in affordable housing projects are crucial steps to addressing the growing demand for housing in the city.

Los Angeles Housing Market Outlook for 2025 and Beyond

The Los Angeles housing market is projected to see moderate growth in 2025, with J.P. Morgan Research forecasting a 3% rise in house prices overall, with the median home price around $970,592 in June. Despite a 1.6% increase in apartment supply, with about 19,400 new units expected, the affordability crisis will persist, especially for first-time homebuyers. Looking ahead to February 2026, the market is expected to experience a modest increase of 0.4%, indicating a generally stable but slow-growing market as economic conditions, government policies, and emerging trends shape the future of housing in Los Angeles.

Future Trends

As the Los Angeles housing market continues to evolve in 2025 and beyond, several key trends are expected to influence home prices and buyer behavior:

- Sustainability and Eco-friendly Homes: With rising environmental awareness, there is an increasing demand for energy-efficient and sustainable homes. Buyers are now prioritizing green features like solar panels and energy-efficient appliances.

- Remote Work and Suburban Growth: The shift toward remote work is driving demand for suburban homes, with areas like Inglewood and the San Fernando Valley seeing price growth as people seek more space and affordability outside the urban core.

- Smart Home Technology: The integration of smart home devices such as security systems, thermostats, and lighting is becoming more common. Homes equipped with these technologies are gaining popularity, particularly among tech-savvy buyers.

- Gentrification and Revitalization: Neighborhoods like Downtown LA, Highland Park, and Echo Park will continue to see rising property values due to ongoing gentrification, with new businesses and public infrastructure investments driving development.

Impact of Interest Rates

Interest rates will continue to have a significant impact on the Los Angeles housing market in 2025 and beyond, especially on buyers’ purchasing power. As mortgage rates rise, they may affect affordability and demand:

- Higher Borrowing Costs: With interest rates around 6-7%, mortgage payments have increased, potentially deterring first-time homebuyers and limiting the purchasing power of many buyers.

- Slower Price Growth: Higher rates could slow the rapid price increases seen in previous years, leading to more moderate growth in home values, particularly in areas with less demand.

- Investment Shifts: Investors may turn to properties that offer better rental yields, such as multi-family homes, as the cost of borrowing rises and purchasing single-family homes becomes less attractive.

- Market Stabilization: While the rise in rates may reduce the volume of transactions, it could also lead to a more stable market, with fewer buyers driving up prices artificially.

How Can Los Angeles Property Management Services Enhance Your Real Estate Investment?

Property management services in Los Angeles can significantly enhance real estate investments by maximizing rental income, reducing vacancy rates, and ensuring property maintenance. With professional management, investors can streamline operations and ensure their properties are consistently occupied and well-maintained, leading to higher returns and less hassle.

Key benefits of property management in Los Angeles include:

- Rent Optimization: Property managers adjust rental rates based on market conditions to ensure properties are competitively priced, increasing rental income.

- Tenant Screening: Professional managers conduct thorough background checks, securing reliable tenants who will pay on time and care for the property.

- Maintenance and Repairs: Quick resolution of maintenance issues prevents vacancies and keeps properties in top condition, protecting long-term value.

- Legal Compliance: Property management services ensure that properties are compliant with local laws, avoiding legal issues related to rent control and tenant rights.

- Marketing and Leasing: Property managers market properties effectively and handle leasing agreements, minimizing vacancy periods and attracting high-quality tenants.

- Financial Reporting: Property managers provide detailed financial reports, giving investors a clear view of their investment’s performance and helping them make informed decisions.

For investors looking to streamline operations and ensure profitability, Skybridge Property Group offers expert property management services in Los Angeles. Our comprehensive offerings, including tenant screening, rent optimization, and property maintenance, help investors protect and grow their investments. By handling the day-to-day operations, Skybridge Property Group allows investors to focus on expanding their portfolios while ensuring their properties are managed efficiently.