Tenant screening is the process landlords use to evaluate prospective renters before offering a lease. It involves gathering and verifying information about an applicant’s background, finances, and rental history to assess whether they are likely to meet the terms of the lease and maintain the property responsibly. In California, this process must follow strict Fair Housing guidelines, ensuring all applicants are treated equally and evaluated with the same criteria.

A tenant screening checklist is a structured framework that keeps this process thorough and consistent. For homeowners and property managers in Southern California, it serves as a safeguard, organizing each step from credit and background checks to income verification and rental history review. By standardizing the evaluation process it minimizes the risk of overlooking important details that could later lead to payment delays, property damage, or legal disputes.

For homeowners, using a well-designed checklist means protecting both the property’s value and the stability of rental income. It ensures decisions are based on verified facts, not assumptions, while complying with California’s screening fee limits and disclosure rules. The result is greater confidence in selecting tenants who will respect the property, pay on time, and contribute to a positive rental experience.

What is a Tenant Screening Checklist?

A tenant screening checklist is a detailed framework landlords use to evaluate potential tenants before finalizing a lease. It outlines the sequence of steps and specific criteria to be checked, such as identity verification, income confirmation, credit review, and rental history, ensuring the process remains structured and compliant with applicable laws. In California, where rental screening practices are regulated under both state and federal guidelines, the checklist serves as a standardized method to assess applicants fairly and consistently.

By clearly defining what information must be gathered and how it should be reviewed, the checklist streamlines the screening process and reduces the likelihood of procedural errors. It acts as both a procedural guide and a compliance reference, helping landlords in Southern California maintain legal alignment with Fair Housing requirements and the state’s screening fee limits.

Why is the Tenant Screening Checklist Important?

A tenant screening checklist is vital because it creates a uniform system for evaluating all applicants, reducing the risk of financial loss, property damage, and legal disputes. It ensures landlords make informed decisions based on verified information rather than assumptions. In California’s tightly regulated rental environment, it also provides a clear record of compliance, which can be critical in the event of a dispute or audit.

Here are some key reasons why the tenant screening checklist is important.

- Significant risk reduction – By requiring documented checks on income, credit, and rental history, the checklist helps identify tenants who are more likely to pay on time and care for the property, reducing costly turnover and repairs.

- Consistency in decision-making – Applying the same process to every applicant not only ensures fairness but also protects against potential discrimination claims, which is especially critical under California’s Fair Housing laws.

- Legal protection – Maintaining records from a checklist can serve as evidence of proper screening practices in the event of disputes, audits, or legal challenges.

- Operational efficiency – A well-structured checklist speeds up the selection process by organizing information in a logical, easy-to-review format, saving landlords both time and resources.

- Peace of mind – With every step documented, landlords can lease their property with confidence, knowing their decision is based on verified facts rather than assumptions.

What is the Step-by-Step Process for Conducting Tenant Screening?

Tenant screening is not a single action but a series of structured steps designed to ensure informed, fair tenant selection and property protection. For landlords in Southern California, each stage must be carried out in line with state laws, including California’s Fair Housing requirements and annual screening fee limits.

1. Define Your Tenant Criteria

Establishing clear tenant criteria is the foundation for every screening decision. These standards typically include income thresholds, credit score ranges, rental history expectations, and job stability. In California, applying these equally to all applicants is a legal requirement under Fair Housing laws, making proper documentation vital.

In Southern California, many landlords set income at three times the monthly rent with proven, timely payments. By locking in these standards early, you create a consistent evaluation framework and avoid bias. Once the criteria are set, the next logical step is to identify applicants who meet them through pre-screening.

2. Pre-screen Applicants

Pre-screening puts your tenant criteria into action. This early filter can be done through short phone calls, email forms, or online questionnaires to confirm income, rental history, and move-in timelines. In California, it’s also a good time to explain screening fees and get consent for background checks.

By filtering at this stage, landlords save time and avoid processing applications from unqualified tenants. Pre-screening naturally leads into the formal application phase, where more detailed information is collected to begin the full evaluation process.

3. Collect Rental Applications

The rental application formalizes a tenant’s interest and provides the foundation for deeper checks. It captures personal information, employment history, rental background, and the applicant’s written consent for screenings, which California law requires before pulling credit or background reports.

Thoroughly reviewing each application for accuracy prevents delays later in the process. With complete applications in hand, the next step is to conduct background checks that reveal potential risks not visible from paperwork alone.

4. Conduct Background Checks

Background checks uncover potential risks such as criminal convictions, eviction records, and civil judgments. California landlords must use compliant services, follow state restrictions on which criminal records can be considered, and issue required notices if taking adverse action based on findings.

Multiple reputable sources should be consulted for accuracy, and all findings documented. This step ensures landlords have complete, fact-based information before committing to a lease, reducing the likelihood of future conflicts and protecting both property and community safety.

5. Verify Employment and Income

Verifying employment and income confirms that a tenant can meet monthly rent obligations. California landlords typically request recent pay stubs, bank statements, W-2 forms, or tax returns for self-employed applicants. Direct contact with employers adds further confirmation.

The industry standard in Southern California is to require income at least three times the rent. Completing this step reduces the risk of late payments or defaults, ensuring financial stability throughout the tenancy and supporting consistent cash flow for property owners.

6. Verify Rental History

Rental history verification provides insight into an applicant’s reliability and lease compliance. Contacting previous landlords can confirm whether rent was paid on time, the property was maintained, and all lease terms were followed.

Asking specific, factual questions is essential to avoid bias and ensure accuracy. In the competitive Southern California market, choosing tenants with a proven record of responsibility helps protect property value and supports long-term stability.

7. Make a Decision and Communicate

After gathering all information, landlords should evaluate the applicant against predefined criteria. Consistent application of these standards ensures fairness and compliance with California’s Fair Housing laws. All decisions should be documented for transparency and legal protection.

Communication must be prompt and professional. If an applicant is denied due to credit or background results, California law requires a formal adverse action notice. Timely, respectful communication maintains trust and professionalism in the rental process.

8. Maintain Consistency

Consistency in screening prevents bias and protects against discrimination claims. Landlords should use the same checklist, criteria, and documentation process for every applicant, regardless of personal familiarity or referral source.

This approach creates a predictable, legally defensible system that works across diverse rental markets like Los Angeles, Riverside, and San Bernardino. Consistency not only strengthens compliance but also builds a professional reputation among prospective tenants.

9. Comply with Fair Housing Laws

Compliance with Fair Housing laws is mandatory for all California landlords. These laws prohibit discrimination based on race, color, national origin, religion, sex, familial status, disability, sexual orientation, gender identity, and source of income.

To comply, landlords must apply criteria equally, avoid prohibited questions, and ensure advertisements are free from bias. Maintaining detailed records provides strong protection in the event of disputes or audits, supporting both ethical and legal rental practices.

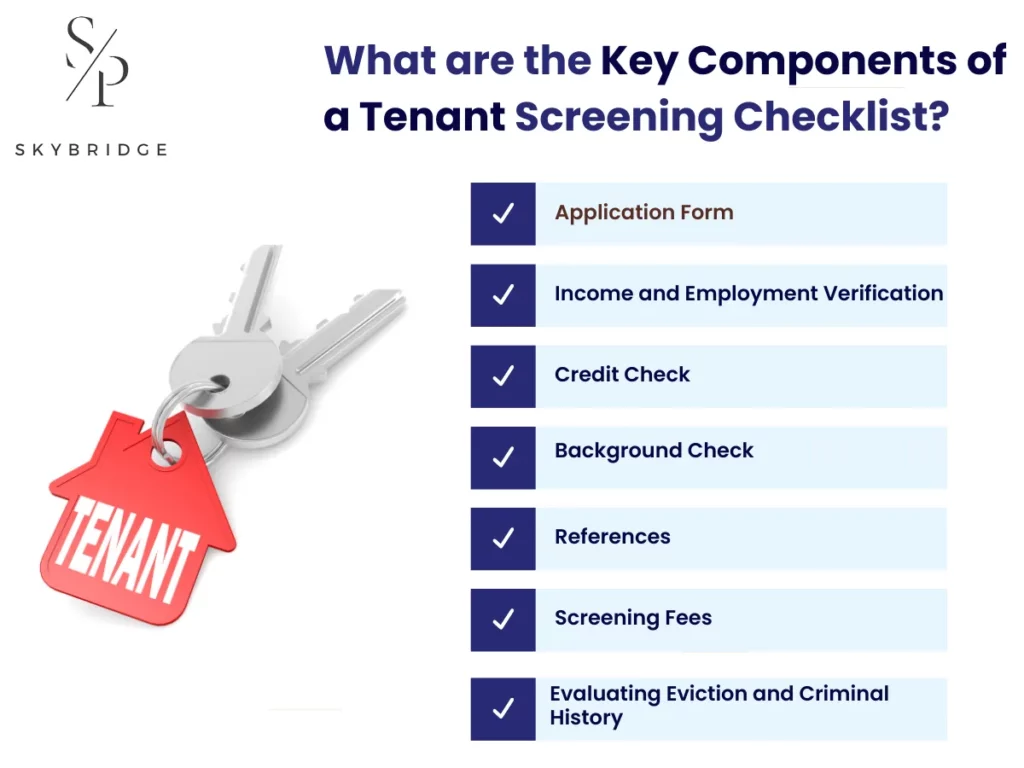

What are the Key Components of a Tenant Screening Checklist?

A tenant screening checklist contains the essential steps and documents needed to evaluate a rental applicant thoroughly. These components guide landlords through collecting, verifying, and assessing information to make fair, consistent leasing decisions. In California, following these elements closely not only improves tenant quality but also ensures compliance with rental laws and screening regulations.

Application Form

Before any screening can begin, landlords need a detailed application form to capture the applicant’s personal, rental, and employment history. This form serves as the base record for all future checks. In California, it must also include signed consent to run credit and background reports, making it both a legal and practical requirement. Incomplete or false forms often signal reliability issues and should be addressed before proceeding further.

- Request the applicant’s full legal name and accurate contact details.

- Collect detailed employment history and current income information.

- Record rental history with landlord contact information.

- Obtain signed authorization for credit and background checks.

Income and Employment Verification

Once the application is in hand, it’s time to confirm the applicant’s ability to pay rent. This means verifying both the stability and amount of income against your set requirements. California landlords often require income at least three times the monthly rent. Verification is done through financial documentation and direct employer contact. For self-employed tenants, alternative proof, like tax filings or business statements, may be necessary to confirm consistent income.

- Review recent pay stubs or W-2 forms for accuracy.

- Request bank statements showing regular deposits.

- Contact the employer to confirm job status and length of employment.

- Ask self-employed applicants for tax returns or business invoices.

Credit Check

To evaluate financial responsibility, a credit check offers insight into how an applicant manages debts and payments. The report includes credit score, payment history, and any public records like bankruptcies. In California, landlords often set a minimum score as part of their checklist, but should weigh credit findings alongside other screening data. This approach ensures that a low score isn’t the sole reason for denial unless it directly relates to payment reliability.

- Pull a credit report from a reputable service.

- Examine payment history for late or missed payments.

- Check for high debt levels or collections.

- Compare findings with your minimum score criteria.

Background Check (Including Criminal and Eviction History)

Beyond finances, landlords must assess potential risks to property and community safety. Background checks identify criminal records, eviction history, and civil judgments. California law limits the use of certain criminal records in housing decisions, so landlords must apply these results within legal guidelines. This step is not about automatic rejection but about identifying patterns that may impact tenancy.

- Use a compliant background check provider.

- Review allowed criminal records relevant to tenancy.

- Check eviction records for patterns or recent cases.

- Document findings and follow proper adverse action procedures.

Rental History

Past rental performance often predicts future tenant behavior. Rental history checks reveal payment reliability, property care, and lease compliance. Speaking directly with previous landlords provides first-hand insight. In California, landlords should keep questions factual and consistent to ensure fairness and avoid bias.

- Contact past landlords to verify payment timeliness.

- Ask about property care and adherence to rules.

- Confirm if there were any lease violations.

- Record whether the landlord would rent to the tenant again.

References

References add a personal dimension to the screening process by offering third-party perspectives on reliability and conduct. These can include employers, professional contacts, or former landlords. While references should not replace objective checks, they can confirm impressions formed during the application review.

- Request at least two references from different sources.

- Call each reference to confirm their relationship with the applicant.

- Ask about punctuality, communication, and overall reliability.

- Note whether they would recommend the tenant for a lease.

Screening Fees

Screening fees help offset the costs of running reports and verifications. In California, the maximum allowable fee is adjusted annually ($59.67 in 2024) and must be disclosed before collection. Fees can discourage non-serious applicants while covering administrative expenses, but they must always comply with legal limits.

- Disclose the screening fee amount before processing applications.

- Ensure the fee is within California’s legal limit for the year.

- Use collected fees only for screening purposes.

- Provide a receipt or proof of fee use upon request.

Evaluating Eviction and Criminal History

Evaluating eviction and criminal history allows landlords to assess potential risks fairly. Focus on severity, frequency, and recency, while considering whether the issue is relevant to tenancy. California’s Fair Housing rules require uniform evaluation for all applicants, avoiding arbitrary or discriminatory rejections.

- Compare findings to pre-set evaluation standards.

- Weigh older or resolved cases with context.

- Apply the same review process to every applicant.

- Document the reasoning behind acceptance or denial.

What are the Best Practices for Performing Tenant Screening?

Tenant screening best practices create a process that is both effective and legally compliant. Applying consistent evaluation standards reduces bias, improves the quality of approved tenants, and strengthens legal defensibility. These practices include using documented criteria for all applicants, complying with Fair Housing laws, keeping thorough records, and verifying all data through reliable sources. By following them, landlords in California protect themselves from legal risks while ensuring a fair, efficient, and ethical rental process.

Consistency in Screening

One of the quickest ways to undermine a screening process is to apply it differently from one applicant to the next. Inconsistent practices can create bias, make it harder to defend decisions, and damage a landlord’s credibility. In California, inconsistency can also raise Fair Housing concerns, as all applicants must be treated according to the same legal standards.

Establishing a standardized checklist is the best defense against inconsistency. This includes asking the same qualifying questions, requesting the same documents, and verifying all information using identical methods. Consistent records protect landlords during disputes and streamline the entire screening process.

Fair Housing Compliance

Laws that govern rental practices are not just guidelines; they are enforceable obligations. Fair Housing compliance ensures all applicants are evaluated without prejudice, protecting them from discrimination based on federally and state-recognized protected classes. For California landlords, the list extends to categories like source of income and gender identity.

Practical compliance involves removing bias at every stage of screening. This means crafting advertisements with inclusive language, eliminating prohibited questions from applications, and maintaining thorough documentation for each decision. Doing so not only avoids legal challenges but fosters an ethical rental environment.

Screening Every Tenant

Exceptions in screening may seem harmless, but can create significant legal and operational problems. Skipping the process for a referred applicant, friend, or family member introduces bias and undermines fairness. For California landlords, such exceptions can directly conflict with Fair Housing requirements.

The solution is to commit to screening every applicant using the exact same process. By relying on predefined criteria, landlords remove personal judgment from the equation. This approach builds trust with tenants, reduces disputes, and ensures every decision can be backed by documented evidence.

Secure Qualified Tenants With Our Tenant Screening Checklist

A ready-to-use tenant screening checklist simplifies the leasing process and improves the quality of tenant selection. By following a structured, step-by-step framework, landlords can evaluate applicants more thoroughly, ensuring they choose tenants who pay rent on time, maintain the property, and comply with lease terms. Local California property management companies handle tenant screening as a complete, end-to-end process. They manage everything from advertising the vacancy and reviewing applications to verifying income, conducting background checks, and confirming rental history. Each stage is carried out with consistency and in compliance with state and federal housing laws.