Housing tenure is the legal arrangement that determines who has the right to occupy a housing unit, either through ownership or rental. This choice has a profound impact on an individual’s financial security, housing stability, and long-term well-being. It shapes decisions around mobility, security, and wealth accumulation.

For society, housing tenure influences neighborhood stability, community integration, and the overall functioning of housing policies that protect both tenants and homeowners. The main types of housing tenure include homeownership, rental housing, cooperative housing, public housing, and land trusts, each with unique legal and financial characteristics.

The decision to rent or buy is influenced by factors such as financial capacity, job security, and personal preferences. While homeownership builds equity and provides long-term stability, renting offers flexibility but no wealth-building opportunities.

Housing tenure also affects mental health, access to services, and community involvement, influencing social cohesion and economic development. Understanding how these elements work together helps individuals make informed housing decisions that align with their financial situation and life goals.

Why is Housing Tenure Important?

Housing tenure is important to determine financial security, housing stability, and long-term outcomes for individuals and communities. For individuals, the type of housing tenure, specifically ownership, shapes life decisions related to finances, mobility, and security. Whereas for society, housing tenure influences neighborhood stability, community integration, and how housing policy protects tenants and owners.

- Provides Security and Stability

Secure housing tenure reduces the risk of eviction and displacement, providing long-term stability. Homeownership offers residential security, while stable rental agreements ensure continuity for tenants and families.

- Ensures Financial Security and Wealth Accumulation

Housing tenure plays a central role in financial security by shaping how households manage payments, debt, and long-term assets. Homeownership helps build equity over time, contributing to wealth accumulation, while renting remains a recurring expense. Housing tenure affects whether housing serves as a financial asset or an ongoing cost.

- Impacts Physical and Mental Health

Secure housing through housing tenure reduces stress associated with eviction risk, unstable leases, or frequent relocation. Homeownership and long-term housing tenure provide a sense of control and predictability, which supports mental well-being. Stable housing conditions allow families to maintain healthier living environments and consistent access to care.

- Provides Access to Services and Infrastructure

Stable housing arrangements often determine proximity to essential services like high-quality schools and healthcare. Long-term housing arrangements help households remain connected to local infrastructure and community resources. Stable housing tenure supports continuity in education and healthcare by limiting disruptive moves. Reliable access to services contributes directly to the quality of life and economic participation.

- Promotes Community and Social Integration

Homeowners often remain in the same area for longer, which helps build stronger social ties and encourages greater involvement in local organizations. This long-term presence fosters a sense of shared responsibility for neighborhood well-being, contributing to the social stability that supports vibrant, safe communities.

- Supports Policy and Legal Frameworks

Housing tenure is closely tied to U.S. housing law and policy, including fair housing protections, property law, and housing finance rules governed by federal, state, and local authorities. From ownership rights to tenant safeguards, different housing tenure types provide different levels of legal protection. These legal distinctions shape how housing policy protects households and regulates the housing market.

What Are the Different Types of Housing Tenure?

The different types of housing tenure are owner-occupied housing, rental housing, cooperative housing, public housing, and land trust tenure. Each of these housing tenure types carries distinct legal rights, financial obligations, and lifestyle implications that shape housing stability and personal outcomes. Therefore, understanding how these housing tenure types differ helps individuals evaluate cost, security, and long-term suitability based on their financial situation and housing goals.

Owner-Occupied Housing Tenure

Owner-occupied housing tenure is a living arrangement in which an individual or family owns the house or apartment they occupy. This type of housing tenure generally lasts for 11-12 years. In the U.S., this is the most common form of housing tenure, with the U.S. Department of Housing and Urban Development reporting that around 66% of households are owner-occupied.

This housing tenure supports financial stability by allowing owners to build home equity through mortgage payments and long-term property ownership. Owner-occupiers also benefit from housing-related tax provisions, such as mortgage interest and property tax deductions, which can reduce overall housing costs. In addition, ownership provides greater control over the housing unit and protection from lease termination or rent increases.

Rental Housing Tenure

In rental housing tenure, a household, whether a private owner, organization, or public authority, rents a property from a landlord, with ownership remaining with the landlord. This includes private rentals, subsidized housing, and employer-provided housing, all governed by a lease agreement that defines the tenant’s rights, responsibilities, and rental period. The duration of rental tenure varies by age, with younger renters moving more frequently and older renters staying longer in one place.

Rental housing offers flexibility for households that anticipate relocation due to work, education, or changing circumstances. Under this housing tenure, tenants generally avoid responsibilities for major repairs, property taxes, and long-term maintenance, since these obligations remain with the landlord. In exchange, renters make regular rent payments, comply with lease terms, and do not build equity through property ownership.

Cooperative Housing (Co-ops)

Cooperative housing, or co-ops, is a housing tenure model that combines elements of homeownership with collective ownership and community governance. In this arrangement, residents do not own their individual housing units outright, instead, they own shares in a cooperative organization that manages property. This collective ownership allows for shared financial responsibilities and decision-making, creating a sense of community.

Under co-op tenure, residents govern the property through an elected board, which makes key decisions on building maintenance, finances, and policies. While co-ops often offer affordability and stability, they may come with stricter rules and approval processes compared to other housing types. Co-ops are ideal for those seeking long-term stability, affordability, and the opportunity to be actively involved in a community-oriented living environment.

Public Housing

Managed by local Public Housing Agencies (PHAs) with federal funding from HUD, public housing is a housing tenure in which government-owned or government-funded housing units provide affordable rental housing for low-income individuals and families. This housing tenure type plays a central role in addressing housing affordability by offering access to safe housing for households that cannot afford market-rate rental housing. This includes low-income families, seniors, and people with disabilities.

Eligibility for public housing is based on household income relative to the local area median income, along with family status and citizenship or eligible immigration status. Applicants apply through their local PHA and may face waiting lists due to high demand. Rent is generally calculated as a portion of household income, which helps lower housing costs and allows residents to allocate resources toward essentials such as food, healthcare, and childcare.

Land Trusts

Land trust housing tenure, often implemented through Community Land Trusts (CLTs), is a model designed to preserve long-term affordable housing through community ownership of land. In this housing tenure model, a nonprofit organization owns the land while an individual or family owns the house built on it. This approach removes land from real estate speculation, lowering housing costs for low- to moderate-income households.

Compared to other housing tenure types, this housing tenure operates through long-term, renewable ground leases, typically lasting 99 years, which ensures long-term affordability. Homeowners purchase the housing unit but lease the land for a modest fee, while remaining responsible for mortgage payments, property taxes, and upkeep. In land trust tenure, resale prices are restricted to maintain affordability for future buyers, allowing homeowners to build limited equity.

What Are the Federal Laws Governing Housing Tenure?

Housing tenure in the United States is governed by a layered legal framework, including the Fair Housing Act (FHA), the Civil Rights Act, the Americans with Disabilities Act (ADA), the Fair Credit Reporting Act (FCRA), and the Housing Act of 1937. All of these federal laws form the core legal structure governing housing tenure, ensuring that both tenants and homeowners receive baseline protections across the U.S. housing system.

8 Major Federal Laws & Regulations Governing Housing Tenure:

- Fair Housing Act (FHA): Prohibits discrimination in housing-related activities, including renting, selling, lending, and advertising, based on protected characteristics such as race, color, religion, sex, disability, familial status, and national origin.

- Americans with Disabilities Act (ADA): Ensure accessibility and prohibit discrimination against individuals with disabilities in housing and community development, requiring reasonable accommodations.

- Fair Credit Reporting Act (FCRA): Regulates how landlords and housing providers use consumer credit reports and background checks when screening tenants, ensuring accuracy and fairness in tenant evaluation.

- Civil Rights Act of 1964 (Title VI): Prohibits discrimination in programs receiving federal funding, including some housing and community development programs.

- Rehabilitation Act of 1973 (Section 504): Protects qualified individuals with disabilities from discrimination in HUD-assisted housing and other federally funded housing programs.

- Housing Act of 1937: Established the federal public housing system and created a foundation for long-term government involvement in providing affordable housing for low-income households.

- HUD’s Office of Fair Housing and Equal Opportunity (FHEO): Oversees compliance with federal fair housing laws, investigates complaints, and supports enforcement actions related to housing discrimination.

- Department of Justice (DOJ): Enforces federal housing laws through litigation, particularly in cases involving systemic discrimination or violations of civil rights.

What Are the Key Aspects of Legal and Regulatory Frameworks in Housing Tenure?

The key aspects of legal and regulatory frameworks in housing tenure include the definition of rights, responsibilities, and protections that apply to homeowners, renters, and landlords. These frameworks operate at the federal, state, and local levels and directly influence housing stability, access, affordability, and market behavior. By setting standards for ownership, renting, development, and occupancy, housing laws shape how housing tenure functions and how well it protects individuals and communities.

- Defining Rights and Responsibilities

Legal frameworks clearly establish what tenants, homeowners, and landlords are entitled to and responsible for under housing tenure. Tenants have the right to habitable living conditions and proper notice before eviction, while landlords must maintain properties and follow lease and safety requirements. Homeowners hold responsibility for property upkeep and compliance with zoning and building codes.

- Ensuring Security of Tenure

Security of tenure refers to legal protection against arbitrary eviction or displacement. Housing laws regulate eviction procedures for renters and protect homeowners through property and foreclosure rules. These protections ensure occupants can remain in their housing unit as long as legal obligations are met, supporting long-term housing stability for individuals and families.

- Protecting Against Discrimination

Housing tenure laws prohibit discrimination in renting, selling, financing, and advertising housing. Federal protections, including those under the Fair Housing Act, ensure equal access to housing regardless of race, disability, familial status, or other protected characteristics. Anti-discrimination enforcement helps expand housing access and prevents exclusionary practices.

- Regulating the Market and Development

Legal frameworks regulate housing markets through zoning laws, land-use rules, and development standards, while guiding where and how housing can be built. This also limits unsafe or overcrowded development, and curbs practices such as speculation or price manipulation. Market regulation supports orderly growth and long-term housing affordability.

- Formalization of Property Rights

Property rights are formalized through legal documentation such as deeds, titles, and recorded ownership records. Clear documentation establishes lawful ownership, prevents disputes, and allows property to be sold, transferred, or financed securely. Formalized property rights are essential for stable real estate markets and legal certainty.

- Affordability and Access

Housing laws address affordability and access through mechanisms such as subsidies, income-based rent limits, and housing assistance programs. These measures aim to ensure that housing tenure options remain available to households across income levels. Continued legal support for affordability is critical to reducing housing insecurity and expanding access to stable housing.

How Does Housing Tenure Impact Individuals and Society?

Housing tenure affects both individuals and society by shaping financial stability, mental health, access to opportunity, and social inclusion. Whether people own or rent a housing unit influences personal outcomes such as wealth, health, and autonomy, while also shaping broader patterns of community cohesion, economic development, and inequality.

Impact of Housing Tenure on Individuals:

- Wealth Accumulation

Housing tenure, particularly homeownership, contributes to wealth accumulation by allowing households to build equity over time. While renters pay for the use of a property with no financial return, homeowners build an asset that appreciates over time. This long-term investment creates a wealth gap, where the median homeowner’s net worth vastly exceeds that of the median renter.

- Health and Well-being

Stable housing tenure is associated with better physical and mental health outcomes because it reduces stress linked to eviction risk, frequent moves, and housing uncertainty. Long-term housing security, especially through homeownership, also lowers chronic stress and anxiety tied to displacement or sudden rent increases. This stability supports overall family well-being.

- Autonomy and Control

Owning a house grants individuals full control over their living environment. This personal empowerment allows for renovations, personalization, and a lifestyle free from landlord-imposed restrictions. With this level of control, individuals significantly increase life satisfaction and a sense of belonging.

- Labor Market Outcomes

Housing tenure influences labor market outcomes by shaping stability and access to employment. Secure housing allows individuals to remain near job centers and pursue career progression without frequent relocation. Stable tenure supports steady employment and job retention.

Impact of Housing Tenure on Society

- Community Stability and Civic Engagement

Communities with higher levels of stable housing tenure often experience stronger social cohesion, as long-term residence encourages sustained relationships and civic participation. This also results in collective investment in neighborhood well-being, contributing to deeper social ties and shared community responsibility.

- Economic Development

Secure housing tenure contributes to economic development by encouraging long-term investment and improving property values. Stable housing supports local economies through job creation, consumer spending, and tax revenue. Economic vitality and housing stability reinforce each other.

- Social Inequality

Housing tenure plays a key role in social inequality by shaping access to wealth and stability. Disparities in homeownership and affordable housing access contribute to unequal financial outcomes across populations. Policies that expand access to secure housing tenure help reduce inequality and promote equitable opportunity.

How Has Housing Tenure Evolved Over Time?

The evolution of housing tenure in the U.S. reflects a shift from an urban rental system to one centered on homeownership. In the early 20th century, high down payments and short-term mortgage structures kept ownership out of reach for many households, leaving the homeownership rate largely unchanged at 46% between 1890 and 1930. The Great Depression then exposed weaknesses in housing finance, prompting federal intervention in the 1930s that introduced long-term, insured mortgages and expanded access to ownership.

The most significant shift occurred after World War II, when post-war economic growth, federal mortgage support, and veteran-focused housing benefits accelerated suburban development. By 1960, homeownership surpassed 60%, establishing ownership as the dominant housing tenure.

Today, housing tenure is shifting again as affordability pressures and changing preferences reshape housing choices. Rising property prices and higher interest rates have increased reliance on rental housing and alternative shared-equity models such as Community Land Trusts. This shift reflects ongoing efforts to balance wealth-building opportunities with access to stable, affordable housing.

How Does the Time Frame Affect Your Housing Tenure?

The time frame or duration of a housing situation directly affects financial planning, housing stability, flexibility, personal attachment, and housing outcomes. Short-term and long-term housing tenure options involve different trade-offs between mobility, security, and financial return. Shorter stays often align with renting due to ease of relocation, while longer time horizons make homeownership or extended leases more practical.

Short-Term Housing Tenure

Short-term housing tenure refers to rental arrangements typically lasting less than one year, such as month-to-month leases or short-term rental agreements. This housing tenure type offers flexibility and allows individuals to relocate easily in response to job changes, education, or temporary living needs. Short-term housing generally requires lower upfront commitment but provides limited security and no opportunity for long-term investment. While it supports mobility, short-term tenure is less suitable for households seeking permanence or wealth accumulation.

Long-Term Housing Tenure

Long-term housing tenure includes homeownership or extended lease arrangements that last beyond one year. This housing tenure type provides greater financial stability by supporting equity growth, predictable housing costs, and long-term planning. Long-term housing tenure also allows residents to make permanent changes to their housing unit and develop stronger ties to their community. For individuals seeking permanence, financial security, and community integration, long-term housing tenure is typically the more stable option.

What Are the Challenges of Housing Tenure?

Housing tenure presents several challenges, including affordability crisis, stability, and equitable access to housing. These challenges impact both renters and homeowners and are shaped by market conditions, policy limitations, and structural inequalities. Addressing them requires coordinated policy action, stronger protections, and long-term planning to ensure stable housing access for all households.

- Housing Affordability Crisis

The housing affordability crisis occurs when housing costs rise faster than wages, making rent and homeownership increasingly difficult to afford. This gap restricts access to stable housing, especially in high-demand urban areas.

- Racial and Ethnic Inequities in Housing

Racial and ethnic inequities persist through discriminatory practices such as redlining and unequal lending. These barriers reduce access to homeownership and reinforce long-term wealth disparities.

- Limited Federal Support for Housing

Federal housing assistance does not meet the current demand for affordable housing. Insufficient funding results in long waitlists and limited access for low-income households.

- Housing-Related Financial Burdens

Many families are house burdened in the US, spending over 30% of their gross income on housing costs (Source: congress.gov). These high payments, combined with rising utility and maintenance expenses, leave little to no room for emergency savings or retirement.

- Housing Tenure Insecurity

Renters face extreme instability due to short-term leases and a lack of just cause eviction protections. This insecurity leads to frequent forced moves, which disrupt child education and break local community ties.

- Housing Conditions and Quality Issues

Substandard living conditions, including mold, lead paint, and failing HVAC systems, disproportionately affect low-income renters. These quality issues pose direct threats to respiratory health and overall physical safety.

- Financial Strain from Housing Costs

High housing costs reduce the ability to pay for essentials such as healthcare, education, and savings. This strain increases long-term economic instability for households.

- Complexities of Housing Tenure Types

Different housing tenure types involve varying legal, financial, and maintenance responsibilities. Lack of understanding can lead to poor housing decisions and instability.

- Climate Vulnerability and Housing Risk

Climate-related risks such as floods and wildfires threaten housing stability in coastal, wildfire-prone, and flood-prone regions, increasing displacement and repair risks for both renters and homeowners.

What Are the Solutions to Housing Tenure?

Solutions to housing tenure challenges require a multifaceted approach focused on improving affordability, enhancing housing security, and increasing access to stable housing. Governments, communities, and private actors all play vital roles through targeted programs, regulatory reforms, and investment strategies that support renters, homeowners, and underserved populations.

- Affordable Housing Development

The most direct solution is increasing the physical supply of housing through government-funded construction and zoning reforms. By allowing for higher-density projects and utilizing land banking where the government holds land specifically for social use, cities can lower the housing tenure issue.

- Rent Control and Stabilization

Rent stabilization laws set caps on annual price increases, providing renters with the predictability needed for long-term residency. When balanced with housing supply growth, these policies help protect tenants while maintaining investment incentives.

- Homeownership Assistance Programs

Homeownership assistance programs, such as PMAY and the HOME program, provide down payment grants and low-interest mortgages to first-time and low-income buyers. Expanding these programs helps close ownership gaps in underserved communities.

- Shared Equity Housing

In shared equity models, such as Community Land Trusts (CLTs), the homeowner and a nonprofit or government share the equity. This reduces purchase costs and ensures long-term affordability by keeping housing prices below market rates.

- Flexible Tenure Models

Flexible housing tenure options, such as lease-to-own or short-term ownership, offer mobility for those in transitional life stages. These models provide a balance between flexibility and long-term stability.

- Rent-to-Own Programs

Rent-to-own programs allow tenants to apply part of their rent toward purchasing the home. This provides a path to ownership for households that may not qualify for traditional home loans.

- Cooperative Housing

Co-ops offer a sense of community where residents collectively own and manage the property. This model reduces individual costs through economies of scale and gives residents a direct vote in long-term community stability and shared responsibility.

- Social Housing and Public Housing

Social and public housing provide income-based rental options for low-income households. Continued investment is necessary to preserve existing units and meet growing demand.

- Incentives for Private Sector Involvement

Private-sector incentives, such as tax credits and public–private partnerships (PPPs), encourage investment in affordable housing. These incentives help scale development and increase housing supply.

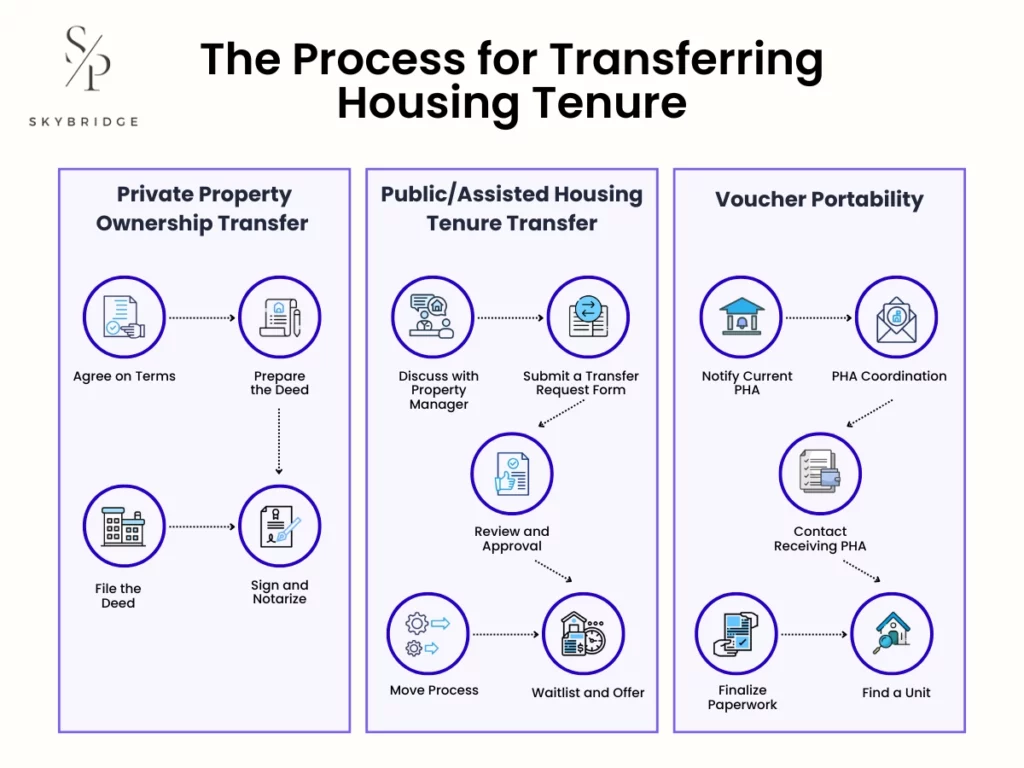

What Is the Process for Transferring Housing Tenure?

The process for transferring housing tenure depends entirely on the type of housing involved, whether it is private ownership, public/assisted housing, or voucher portability. For private ownership, the process for transferring housing tenure generally involves deed transfer, which requires legal documentation, agreement on terms, and proper filing. Public housing transfers may involve coordination with property managers or Public Housing Authorities (PHAs) to determine eligibility, available units, and lease terms. For voucher portability, tenants must work with both the sending and receiving PHAs to ensure a smooth transition.

Private Property Ownership Transfer (Deed Transfer)

- Agree on Terms

Both parties must first reach a clear agreement on the sale price, rental rates, lease duration, and any repairs. A mutual understanding at this stage helps avoid disputes during the housing tenure transfer process.

- Prepare the Deed

A legal document known as the deed must be prepared with correct property details, buyer and seller information, and any legal notices required. Accurate deed preparation is vital to avoid future legal issues.

- Sign and Notarize

To make the transfer legally binding, the grantor must sign the deed, typically in the presence of a notary public. This step provides legal authenticity and protects both parties by verifying the identity of the signer.

- File the Deed

After signing, the deed must be filed with the local authorities, such as a county recorder or property office. This step officially transfers ownership and protects property rights.

Public/Assisted Housing Tenure Transfer (Unit Transfer or Voucher Portability)

- Discuss with Property Manager

Before transferring public housing, tenants should discuss eligibility, lease terms, and available units with the property manager. This step ensures clarity and avoids misunderstandings during the housing tenure transfer process.

- Submit a Transfer Request Form

The tenant must submit a form with the necessary details, including new unit preferences and reasons for transfer. An accurate submission helps move the process forward.

- Review and Approval

The property manager reviews the request, checking eligibility, unit availability, and compliance with lease terms. Once approved, the housing tenure transfer moves to the next step.

- Waitlist and Offer

Approved tenants are often placed on a waitlist. Once a suitable unit becomes available, a formal offer is made, contingent upon the tenant’s continued eligibility.

- Move Process

The final stage involves the logistics of relocation, including scheduling the move, packing, and the formal handover of keys for the old and new units.

Voucher Portability (Relocating to Another City/State)

- Notify Current PHA

Tenants must inform their current Public Housing Authority (PHA) of their intent to transfer, initiating the process for portability. This is the mandatory first step to ensure your benefits are not interrupted.

- PHA Coordination

The sending and receiving PHAs coordinate to facilitate the transfer, exchanging documentation and eligibility information. During this phase, effective communication between these agencies is vital for a smooth transition.

- Contact Receiving PHA

Once your file is sent, tenants must contact the receiving PHA to confirm eligibility and provide required documentation, such as income verification. They will assess their local standards and unit availability to confirm you can move forward.

- Find a Unit

Tenants should identify a suitable unit within the receiving PHA’s available properties. Factors like size, location, and affordability play a critical role in the selection process.

- Finalize Paperwork

After finding a unit, tenants must sign new lease agreements and confirm income declarations. This final step ensures that the housing tenure transfer is legally complete.

How Can You Choose the Right Housing Tenure?

Choosing the right housing tenure is essential, as it depends on your financial situation, family needs, and lifestyle preferences. Whether you choose to rent or own, evaluating personal and financial factors that align with your long-term housing goals is critical. The decision will influence your financial stability, mobility, and overall well-being, making it important to consider all these elements before making a choice.

- Financial Situation

Your housing tenure choice is determined by your financial standing, including liquidity and debt. Homeownership requires a significant upfront investment, including a 10-20% down payment and closing costs, while renting primarily requires a security deposit. Also, consider your Debt-to-Income (DTI) ratio, as lenders generally prefer a DTI below 36% when approving a mortgage.

- Stability vs. Flexibility

Homeownership offers long-term stability, while renting provides flexibility to move with ease. Renters enjoy the ability to relocate without a long-term commitment, but lack the stability of homeownership. When choosing, consider your lifestyle needs and job stability to determine whether flexibility or stability is more important for your situation.

- Long-Term Goals

If your goal is wealth accumulation, homeownership acts as a form of forced savings through equity building. Whereas, if you prioritize short-term cash flow or plan to move within 3 years, renting allows you to invest your capital elsewhere, like the stock market or a business.

- Maintenance

Homeownership comes with the responsibility for property maintenance, from repairs to upkeep, whereas renters rely on landlords for maintenance and repairs. Potential homeowners should factor in the time, costs, and effort involved in maintaining a property when deciding whether to buy or rent.

- Market Conditions

Market conditions, such as interest rates and home prices, affect housing tenure decisions. High home prices or interest rates might make renting a more attractive option, while lower rates and prices could make owning more feasible. It is important to consider current market conditions when deciding between renting and buying.

- Personal Preferences

Beyond math, your desire for autonomy and control matters. Homeowners have the freedom to renovate, landscape, and customize their space, while renters must operate within the constraints of a lease agreement that may restrict everything from wall colors to pet ownership.

- Local Laws and Incentives

Local laws and incentives, such as rent control, tax credits for first-time buyers, or local housing subsidies, can impact the decision to rent or own. Researching these factors can help reduce housing costs and encourage homeownership where applicable. Understanding local policies may provide a financial advantage when choosing housing tenure.

What Are the Current Homeownership Rates in U.S. States?

Homeownership rates in the U.S. currently hover around 65% to 65.3%, according to data from the U.S. Census Bureau, but these rates vary significantly across states. States like West Virginia and Mississippi have some of the highest homeownership rates, while New York and California consistently rank among the lowest. These homeownership rate fluctuations are driven by factors such as economic conditions, demographic trends, and state-level housing policies, all of which impact affordability, housing availability, and local job markets.

Highest Homeownership Rates:

- West Virginia: 79.1%

- Mississippi: 75.8%

- Delaware: 75.1%

- Maine: 73.8%

Lowest Homeownership Rates:

- New York: 52.7%

- California: 55.3%

- Nevada: 61.5%

- Oregon: 63.0%

Understanding homeownership rates in specific states can help individuals make informed decisions about relocation or investment, as these rates reflect local housing market conditions, economic opportunities, and long-term affordability.

What Factors Affect Homeownership Rates by State?

Homeownership rates by state are affected by economic conditions, income levels, local housing policies, property taxes, housing market availability, and cultural preferences toward renting versus owning. Understanding how these elements interact helps explain why homeownership rates fluctuate significantly from state to state.

- Economic Conditions

A state’s overall economic vitality directly dictates its housing market health. Factors such as median household income and the availability of mortgage credit are paramount. Generally, stronger economies with higher average incomes and healthy housing markets tend to support higher homeownership rates.

- State-specific Laws and Incentives

State-specific laws and incentives like tax credits for first-time homebuyers, property tax exemptions, and affordable housing programs can greatly impact homeownership rates. States offering these incentives typically experience higher homeownership rates, as they make it more financially accessible.

- Job Opportunities

High job availability, particularly in high-wage sectors, provides the stable income necessary to qualify for 30-year mortgages. States with diverse industrial bases often see higher ownership rates because residents feel confident in their long-term ability to service debt.

- Cultural Factors

In some regions, there is a strong preference for homeownership as a symbol of financial success and stability, while in others, renting may be prioritized for its flexibility. These cultural trends influence how people view renting versus owning, impacting homeownership rates in different states.

- Cost of Living

Higher living costs, especially in urban areas, can make homeownership less affordable. States with lower living costs tend to have higher homeownership rates, as more individuals can afford to buy property without being burdened by expensive rents or high property prices.

When Should You Rent vs. Buy a Home?

Renting offers flexibility, while buying a home is typically better suited for long-term stability and wealth accumulation. Each option has its pros and cons, and the best choice depends on your current life situation and future goals. It is also influenced by factors like financial stability, job security, and personal preferences.

When Should You Rent?

Renting is often the better choice if you are in a transitional phase, need short-term housing, or prefer flexibility. Renting requires a lower initial investment, as tenants typically pay only a security deposit, unlike the large down payments needed for homeownership. It is ideal for those with uncertain job security, frequent relocations, or limited savings for a down payment. However, while renting provides flexibility, it does not build long-term wealth or equity.

When Should You Buy?

Buying a home is a better option when you need long-term housing and are financially ready for the commitment. Homeownership allows you to build equity over time through mortgage payments, which renters do not accumulate. Additionally, homeowners can benefit from tax advantages, including property tax deductions and mortgage interest deductions. Buying a home can be a solid long-term investment, particularly if you are financially stable and plan to stay in one location for several years.