The difference between lease and rent lies in the terms, duration, and flexibility of the agreement. A lease is a long-term contract, typically lasting one year or more, providing tenants with stability, fixed rent payments, and clear responsibilities. Leases offer benefits like predictable monthly costs, access to amenities, and lower upfront investment compared to buying. However, they come with drawbacks such as a lack of equity, restrictions on personalizing the space, and less flexibility if tenants need to move before the lease ends.

Whereas renting generally involves shorter-term agreements, often with month-to-month flexibility, making it easier for tenants to relocate. Renting requires lower upfront costs and fewer restrictions. However, it lacks the stability of leases, with rent potentially increasing over time and less security regarding the renewal of the rental agreement. Ultimately, choosing between leasing and renting depends on whether you value stability or flexibility. Consulting with a local property management company can help clarify the best option based on your unique circumstances.

What is a Lease?

A lease is a legal contractual agreement between a property owner (lessor) and a tenant (lessee) for the temporary use of a property, such as an apartment or house, for a set period in exchange for regular rental payments. These terms typically include the rental amount, the duration of the lease, and the responsibilities of both the tenant and the landlord.

Leases are commonly associated with longer-term agreements, typically lasting one year or more, and are a standard practice in residential, commercial, and industrial real estate. By defining the rights and obligations of both parties, leases help to prevent misunderstandings and ensure a smooth rental process.

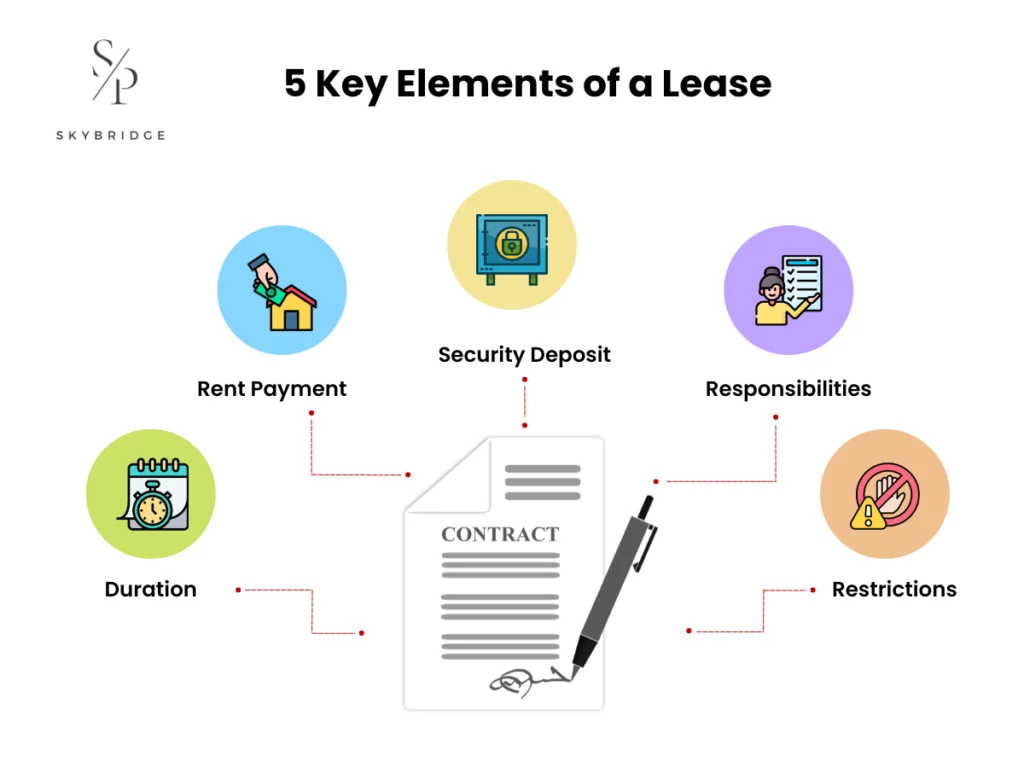

5 Key Elements of a Lease

- Duration: A lease specifies a fixed term during which the tenant is authorized to occupy the property. The duration can vary, with one-year leases being the most common, though they may range from several months to several years, depending on the agreement.

- Rent Payment: The lease outlines the agreed-upon rent amount and payment schedule. This usually involves monthly payments, but could also include specifics on late fees, penalties, and acceptable payment methods like bank transfer and online payment.

- Security Deposit: Typically, a lease requires the tenant to pay a security deposit at the beginning of the lease. This deposit protects the landlord in case of property damage or unpaid rent. If the property is well-maintained and the terms are followed, the deposit is usually refundable when the lease ends.

- Responsibilities: Leases clearly state the responsibilities of both the tenant and the landlord. Tenants are generally required to maintain the property in good condition, while landlords are responsible for major repairs and upkeep. Specific maintenance tasks and obligations are often detailed within the agreement.

- Restrictions: Leases often include specific rules or restrictions regarding the use of the property. These may include limitations on pets, alterations to the property like painting or installing fixtures, or subletting. Violating these terms can result in penalties or early termination of the lease.

Common Types of Leases

- Residential Lease: This lease agreement typically covers the rent amount, lease term, and responsibilities for both parties. Residential leases are generally straightforward and designed to protect the tenant’s right to live in the property.

- Commercial Lease: Used for business premises, such as office spaces or retail locations. Commercial leases tend to be more complex, with negotiations covering rent, utilities, maintenance responsibilities, and terms related to business activities conducted on the property.

- Fixed-Term Lease: This lease type defines a specific start and end date. The tenant is obligated to stay for the entire duration of the lease term, with penalties or fees for early termination.

- Renewable Lease: A lease with an automatic renewal clause, meaning the lease renews for another term unless either party notifies the other of their intention to terminate. This provides convenience and security for tenants who wish to remain in the property long-term.

What Are the Pros of Leasing an Apartment?

Leasing an apartment offers benefits such as flexibility, lower costs, access to amenities, and predictable monthly payments. Tenants also enjoy hassle-free living, with repairs handled by the landlord and the option to move easily at the end of the lease. Leasing also requires less upfront investment compared to buying a home. Many rental properties include amenities like pools or gyms, and fixed rent ensures stable monthly expenses, making budgeting more straightforward.

- No Maintenance Headaches

- Flexibility & Mobility

- Lower Upfront Costs

- Access to Amenities

- Predictable Monthly Costs

What Are the Cons of Leasing an Apartment?

The cons of leasing an apartment include a lack of equity, potential rent hikes, restrictions on customization, and less stability compared to homeownership. Renting means you are not building long-term investment in the property, and rent can increase at the end of the lease term. Additionally, leasing an apartment may also limit personalizations and leave you with less security if the landlord decides not to renew or sells the property.

- Lack of Equity and Ownership

- Restrictions & Limited Customization

- Lack of Stability

- Fewer Space & Storage Options

What is Rent?

Rent is the payment made by a tenant to a property owner (landlord) for the use of their property, typically on a monthly basis. Unlike a lease, which involves a fixed-term agreement, rent is generally associated with more flexible, short-term arrangements. A rental agreement specifies the terms under which the property is rented, including the rent amount, payment due dates, duration of the rental period, and the responsibilities of both the tenant and landlord.

The tenant agrees to pay the specified amount in exchange for the right to live or operate a business in the property, and the landlord is responsible for maintaining the property in habitable condition. It is important to understand the rental agreement fully before committing, as it outlines the financial obligations and terms for both parties.

What Are the Pros of Renting an Apartment?

Renting an apartment offers several benefits, including the flexibility to move easily, lower upfront costs with no large down payments, and the convenience of not having to worry about maintenance. These advantages make renting an ideal choice for tenants seeking short-term housing solutions.

- Month-to-Month Flexibility

- Easier to Relocate Quickly

- Minimal Commitment

- Faster Approval Process

- No Long-Term Financial Obligation

What Are the Cons of Renting an Apartment?

Renting an apartment has some drawbacks, including the lack of equity, as rent payments do not contribute to property ownership. There is also the potential for rent increases at the end of the lease, along with restrictions on personalizing the space. Additionally, renting offers less stability, as the landlord may choose not to renew the lease or decide to sell the property.

- Rent May Change Frequently

- Less Security of Tenure

- Higher Cost Over Time

- Limited Customisation or Personalisation

Leasing vs Renting: What is the Smarter Choice for You?

The main differences between leasing and renting a property involve duration, financial commitment, and flexibility. Leasing a property typically requires a longer-term commitment, often for a year or more, offering tenants more stability and predictable costs. Renting, however, usually involves shorter-term agreements, providing greater flexibility for those who need to relocate frequently or are unsure about long-term plans.

Regarding financial commitment, leases generally offer fixed monthly rent for the entire term, whereas rental prices can fluctuate, making renting less predictable. Flexibility is another key difference as leasing involves a more rigid commitment, while renting can allow tenants to move with less hassle when their lease term is up.

Ultimately, the decision between leasing and renting depends on your personal circumstances. If you prioritize stability and predictable costs, leasing may be the better choice. However, if you need more flexibility and lower upfront costs, renting could better suit your needs.

- Duration

- Flexibility

- Cost Predictability

- Legal Obligations

- Renewal and Termination Terms

- Suitability for Tenants and Owners

Get Lease and Rent Clarity Through Local Property Management Expertise

Understanding the differences between leases and rents is crucial for making an informed decision when renting or leasing a property, as it can affect every aspect of your life, from mental to monetary stress. Local property management expertise can provide the clarity you need to navigate these decisions confidently. Property managers offer invaluable knowledge of the local rental market, helping both tenants and landlords understand the nuances of lease agreements, rental terms, and regulations.

Local property management professionals can guide you through the specifics of lease agreements, explaining key terms and ensuring you fully understand your responsibilities and rights. They can also assist in navigating local laws and regulations that may affect rental agreements, providing peace of mind and helping avoid potential legal issues.

Consulting with a local property management expert can help you make more informed decisions, ensuring that your lease or rental agreement aligns with your unique needs and circumstances. A professional property management company can offer tailored advice to ensure you fully understand all aspects of your rental or lease agreement before committing to any.