A property lease refers to the legal arrangement in which a tenant rents a property from a landlord for a specified period in exchange for regular rent payments. Essentially, it means that the tenant is granted the right to use and occupy the property for a defined time, typically with agreed-upon terms regarding rent, duration, and responsibilities. With nearly 31% of U.S. households renting their homes, property leasing has become a common and practical housing choice for millions of residents (Source: U.S. Census Bureau).

Unlike a simple rental agreement, a property lease often offers more stability, as it locks in the terms for the entire lease period. This blog provides comprehensive information about property leases and lease agreements, covering everything from the basic definitions to key components like rent amounts, lease duration, and the rights and responsibilities of both the tenant and landlord.

How Does a Property Lease Work?

A property lease works by highlighting clear terms and obligations for both the tenant and landlord. It outlines the specifics of the rental arrangement, including the rent amount and the responsibilities of both parties. The lease agreement is designed to ensure that both parties are aligned on key aspects such as payment schedules, property maintenance, and rules for property use.

- Tenant Obligations

The tenant is responsible for paying rent on time, maintaining the property in good condition, and adhering to any rules outlined in the lease. This may include restrictions on pets, noise levels, and alterations to the property. Tenants are also responsible for ensuring the property remains in habitable condition, notifying the landlord of necessary repairs, and complying with any local laws or regulations.

- Landlord Obligations

The landlord has the responsibility to maintain the property, ensure its habitability, and address major repairs. They must also provide a safe living environment and ensure that the property complies with building codes and other legal requirements. The landlord typically covers larger property expenses such as structural maintenance, while the tenant handles minor repairs or day-to-day upkeep.

- Payment Schedule

The lease will specify when rent payments are due (usually monthly) and the acceptable payment methods. This section will also outline any penalties for late payments, including late fees or additional charges. Both parties must understand the payment due dates to avoid confusion and maintain a smooth financial relationship.

- Lease Renewal and Termination

At the end of the lease term, the lease may be renewed based on mutual agreement. If the tenant wishes to renew the lease, they should notify the landlord within the required time frame, which is typically 30 to 60 days before the lease ends. On the other hand, if either party wishes to terminate the lease early, they must follow the termination clauses outlined in the agreement. This may include providing notice (e.g., 30 days) and paying any penalties or fees for early termination.

What’s the Difference Between a Rent and Lease Agreement?

When it comes to rent agreements and lease agreements, the primary difference lies in their duration and flexibility. Rent agreements are typically short-term and flexible, often on a month to month lease. This allows either the tenant or landlord to terminate the agreement with proper notice (usually 30 days).

In contrast, lease agreements are generally for a fixed term, such as one year, and lock in the terms of the rental arrangement for the entire duration. Neither party can alter or terminate the lease without cause before the end of the term, providing stability for both the tenant and landlord.

| Feature | Rental Agreement | Lease Agreement |

| Duration | Short-term (month to month) | Long-term (fixed term, e.g., one year) |

| Flexibility | Lower for both | High for both tenant and landlord |

| Termination | Can be terminated with proper notice by either party | Cannot be terminated before the end of the term unless specified conditions are met |

| Use Case | Ideal for temporary living or uncertain arrangements | Ideal for tenants seeking stability or landlords wanting a consistent tenant |

What is a Property Lease Agreement?

A property lease agreement is a legal contract between a tenant (lessee) and a landlord (lessor) that outlines the terms and conditions under which a tenant can occupy a property for a defined period in exchange for regular rent payments. Unlike a simple rental agreement, a property lease agreement provides stability by locking in the terms, including the rental amount, lease term, and the rights and responsibilities of both parties, for the full duration.

This agreement serves as the foundation of the landlord and tenant relationship, ensuring that both parties understand their obligations, including maintenance responsibilities, late fee structures, and rules for property use. Whether it is a single-family home in Pasadena or a commercial property in Long Beach, the property lease agreement ensures both the tenant and landlord are clear on their duties.

What Are the Essential Components of a Property Lease Agreement?

A property lease agreement includes key components such as rent amount, lease term, security deposit, maintenance responsibilities, and rules for property use that outline the terms of the rental arrangement. These essential elements ensure clarity and protection for both the tenant and landlord.

- Parties Involved (Landlord, Tenant, Co-signers): The lease agreement lists the landlord, the tenant, and any co-signers, each with specific responsibilities. The tenant is responsible for paying rent and maintaining the property, while the landlord ensures the property is habitable. Co-signers, if applicable, are legally responsible for the lease obligations if the tenant defaults on payments.

- Property Description and Address: The lease will specify the full address and detailed description of the property, including its type, such as a house, apartment, or commercial space. This section ensures both tenant and landlord are aligned on the property’s location and features. Agreement on these details is crucial for avoiding future misunderstandings.

- Lease Term and Duration: A lease term clearly states the start and end dates of the rental period. It may be a fixed-term lease, lasting for a set period (e.g., one year), or a more flexible month-to-month lease. This section provides clarity for both parties about the lease duration and outlines the required notice period for renewal or termination.

- Rent Amount and Payment Terms: The rent amount and payment schedule are specified, including the frequency of payments (e.g., monthly) and acceptable methods (e.g., bank transfer, check). The agreement will also highlight any penalties for late payments. Clear terms here prevent misunderstandings and ensure the tenant meets their financial obligations.

- Security Deposit Requirements: A security deposit is required to protect the landlord against property damage or unpaid rent. The lease outlines the deposit amount, conditions for withholding or returning it, and the refund process. Both parties must understand these terms to ensure the return process is straightforward after the lease ends.

- Late Fees and Penalties: Late fees are outlined in the lease, specifying the amount charged for overdue rent. It also sets a timeline for when these fees will apply. This section ensures the tenant understands the consequences of late payments and provides clarity on the penalties for repeated delays.

- Maintenance and Repair Responsibilities: Responsibilities for maintenance and repairs are clearly defined, with the tenant typically handling minor repairs and upkeep, and the landlord managing major repairs (e.g., plumbing issues). Specifying these duties helps prevent disputes and ensures both parties know their responsibilities.

- Rules and Restrictions: This section outlines any rules or restrictions on the property, such as pet policies, noise limits, or guidelines for property alterations. Adhering to these rules helps maintain the property’s condition and ensures the tenant respects the rights of neighbors and other tenants. Violation of these terms could result in penalties or lease termination.

- Entry and Access Rights: The lease defines the landlord’s right to access the property, whether for routine repairs, inspections, or in emergencies. It also specifies the notice period required before entry, ensuring the tenant’s privacy is respected. Understanding these terms helps both parties know when and how access is permitted.

- Termination Clauses: Termination clauses outline the process for ending the lease early, including required notice periods and penalties. This section clarifies the steps involved if either party wants to break the lease before the term ends, ensuring transparency about the responsibilities and any associated costs.

What Are the Types of Property Leases?

Residential and commercial property leases are two different types of property leases, each with its own characteristics and structures designed to meet the specific needs of tenants and landlords. Understanding the differences between these lease types is essential as it determines the tenant’s responsibilities, the landlord’s obligations, and the overall rental experience.

Residential Property Lease Types

There are three main types of residential leases, fixed-term leases, month-to-month leases, and lease-to-own. Each type has its own characteristics, offering tenants and landlords different levels of flexibility and commitment.

Fixed-Term Lease

A fixed-term lease is a lease agreement with a set duration, typically lasting for 12 months. During this term, the rent amount remains fixed, and both the tenant and landlord are bound by the agreed-upon terms. At the end of the term, the lease may be renewed or terminated, depending on the agreement. This lease type provides stability and predictability for both parties. Tenants pay a fixed amount for the duration, and landlords enjoy consistent rental income. However, the downside is the lack of flexibility; neither party can easily end the lease before the term ends without consequences.

Month-to-Month Lease

A month-to-month lease offers flexibility, with no fixed end date. Either the tenant or landlord can terminate the lease with proper notice, usually 30 days. Rent can also be adjusted at the end of each month. This lease type is ideal for those who need flexibility, such as tenants who are unsure of their future plans. However, the downside is the lack of long-term stability, as either party can choose to end the lease with minimal notice, which can be unsettling for tenants.

Lease-to-Own (Lease Option)

A lease-to-own agreement offers tenants the option to purchase the property at the end of the lease. A portion of the monthly rent paid can be credited toward the purchase price. At the end of the lease, the tenant has the right (but not the obligation) to buy the property. This type of lease benefits tenants who eventually want to own a home but may not have the funds for a down payment. However, it can also tie the tenant to the property, even if their circumstances change.

Commercial Property Lease Types

Common types of commercial leases include gross leases, net leases, triple net leases, percentage leases, modified gross leases, and ground leases. Commercial leases differ significantly from residential leases, offering various structures that outline the tenant’s financial responsibilities and the landlord’s obligations.

Gross Lease (Full Service Lease)

In a gross lease, the landlord covers most property expenses, including taxes, insurance, and maintenance, while the tenant pays a fixed rent. This arrangement is ideal for tenants who want predictability in their expenses. The main advantage for tenants is the simplicity of a fixed monthly rent without worrying about additional property costs. However, gross leases typically come with higher base rents to cover these additional costs, making them less flexible for tenants who want more control over their expenses.

Net Lease

A net lease is a lease in which the tenant is responsible for additional property expenses beyond rent. These expenses typically include insurance, taxes, and maintenance costs. The specific expenses covered by the tenant are clearly defined in the lease agreement. This type of lease is more financially beneficial for landlords, as tenants contribute to property maintenance and operational costs. However, it places additional financial responsibility on the tenant, making it a less predictable rental arrangement.

Double Net Lease (NN)

In a double net lease (NN), the tenant is responsible for paying property taxes and insurance, in addition to the base rent. The landlord typically covers structural repairs and maintenance. This lease is commonly used in commercial settings and provides landlords with more predictable income by transferring some of the costs to the tenant. However, it increases the tenant’s financial burden and can lead to higher operational costs for their business.

Triple Net Lease (NNN)

A triple net lease (NNN) places the responsibility for all property expenses, taxes, insurance, and maintenance on the tenant. In addition to rent, the tenant must cover all costs associated with operating the property, which can significantly raise their financial obligations. This lease type is beneficial to landlords as it ensures consistent income without worrying about property expenses. However, the tenant assumes full responsibility for property upkeep, which can be both an advantage and a disadvantage depending on the specific needs of the business.

Percentage Lease

A percentage lease requires the tenant to pay a base rent plus a percentage of their business’s sales. This lease type is commonly used in retail settings, where sales performance fluctuates. The tenant’s rent is partially tied to their business success, making it more adaptable to the tenant’s financial situation. For landlords, a percentage lease can be highly profitable, especially in high-traffic retail areas. However, it may not offer predictable rent revenue if the tenant’s sales decline. It benefits tenants by potentially lowering their base rent, but they must also share a portion of their earnings.

Ground Lease

A ground lease is an agreement where the tenant rents land from the landlord and is responsible for developing or maintaining the property. These leases are typically long-term, often lasting 50 years or more, and are ideal for large-scale developments or projects that require significant investment. The tenant can use the land for construction or property development, while the landlord retains ownership of the land itself. This lease provides the tenant with a long-term commitment, making it ideal for commercial developments that require significant upfront investment.

What Are the Legal Rights and Responsibilities of Tenants and Landlords in a Property Lease?

Tenants are entitled to a safe and habitable living environment, privacy, and protection from discrimination, while landlords are responsible for maintaining the property, ensuring habitability, and handling repairs. Both parties must understand their legal rights and responsibilities to prevent conflicts and maintain a positive rental experience.

For Tenant

- Right to Habitable Property: Tenants have the right to a safe and livable space, and the landlord is responsible for ensuring the property meets health and safety standards. If significant issues arise, such as plumbing problems or unsafe conditions, tenants can request repairs or take legal action if the property is deemed uninhabitable.

- Privacy Rights: Every tenant has the right to privacy within their rental property. Landlords must give advance notice before entering the property, except in emergencies. This right ensures tenants can enjoy their homes without unnecessary interruptions from the landlord.

- Protection from Discrimination: All tenants are protected from discrimination under the Fair Housing Act, covering categories like race, gender, religion, or disability. If a tenant feels they are treated unfairly based on these factors, they have the right to file complaints and seek legal recourse.

- Right to Repairs: If repairs are needed for the property to remain habitable, tenants have the right to request timely repairs. The landlord must address any serious issues promptly. If repairs are delayed, tenants may be allowed to withhold rent or take further legal action.

- Security Deposit Rights: Tenants are entitled to the return of their security deposit, minus any deductions for damages or unpaid rent. Landlords must return the deposit within the legally required timeframe, ensuring it is handled according to state laws.

- Protection from Retaliation: Tenants are safeguarded from retaliation by their landlord for asserting their rights, such as requesting repairs or reporting health and safety violations. Any form of eviction or penalty for these actions is illegal, and tenants can pursue legal action if retaliation occurs.

For Landlord

- Right to Timely Rent Payment: Landlords are entitled to receive rent payments on time, as specified in the lease. Late fees and penalties for overdue rent will be clearly outlined in the lease agreement. Tenants are expected to adhere to these deadlines to avoid additional charges.

- Right to Access Property: The landlord has the right to access the rental property for essential repairs, inspections, or maintenance. Proper notice (typically 24-48 hours) must be provided, except in emergencies, to respect the tenant’s privacy while ensuring the property remains in good condition.

- Right to Evict for Cause: If a tenant violates the terms of the lease, such as failing to pay rent or causing significant damage, the landlord has the right to evict the tenant. The process requires legal notice and must comply with local laws, ensuring both parties’ rights are upheld.

- Right to Screen Tenants: Before renting the property, landlords have the right to screen tenants through background and credit checks. This process ensures that potential tenants meet the criteria for rental eligibility and that the landlord can make an informed decision based on legal and financial factors.

- Property Damage Recovery: If a tenant causes damage beyond normal wear and tear, the landlord can use the security deposit to cover the repair costs. Should the damage exceed the deposit, the tenant may be required to pay the remaining amount. This ensures the property remains in good condition.

What Are the Benefits of Leasing a Property?

Leasing a property offers significant advantages for both landlords and tenants, as tenants benefit from lower upfront costs, flexibility in moving, and no responsibility for major property maintenance. For landlords, leasing provides a steady income stream, long-term stability with reliable tenants, and the ability to maintain control over property management without the burden of repairs.

For Tenants

- Increase Flexibility and Mobility: A lease provides the freedom to move without being tied down to long-term commitments. Tenants can easily relocate with short-term agreements or month-to-month leases, offering the flexibility to change living arrangements whenever needed. This is perfect for those with changing circumstances or for those exploring different neighborhoods without the permanence of homeownership.

- Reduce Upfront Costs: Renting a property significantly reduces upfront costs compared to purchasing a home. Tenants do not have to worry about hefty down payments, closing costs, or property taxes. This makes leasing a more affordable option, especially for those looking to conserve their capital or who prefer to allocate their funds elsewhere.

- Eliminate Maintenance Burden: As a tenant, you are free from the burden of property maintenance. While landlords are responsible for major repairs, such as plumbing or roof issues, tenants can rest easy knowing they will not face unexpected repair costs. This peace of mind allows tenants to focus on enjoying their home without worrying about upkeep.

- Flexible Lease Terms: Tenants benefit from flexible lease terms that can be tailored to their needs. Whether it is a short-term lease or the option to renew at the end of the term, leasing offers the ability to adapt to changing personal circumstances. This flexibility is perfect for those who may need to adjust their living situation on short notice.

- Ensure Predictable Housing Costs: Renting a property ensures predictable housing costs, especially with fixed rent. Tenants do not have to worry about fluctuating housing expenses, unlike homeownership, where property taxes or housing market shifts may affect costs. This stability allows tenants to budget more effectively and avoid any unexpected financial burdens.

- Access to Amenities: Renting often gives tenants access to premium amenities such as gyms, swimming pools, and common areas that may otherwise be out of reach. These perks, often included in the lease, enhance the living experience without the added responsibility or cost of ownership.

- Avoid Property Tax Burden: One of the major advantages of leasing is the freedom from property tax responsibilities. Tenants do not have to worry about the unpredictability of property tax hikes since landlords cover this cost. This helps tenants avoid additional financial strain and keeps housing costs predictable.

For Landlords

- Generate Steady Income Stream: Owning a rental property offers landlords a steady and reliable income through monthly rent payments. This consistent cash flow provides financial security, making it easier for landlords to plan for expenses, investments, or other property-related needs.

- Property Appreciation: Over time, a property’s value may increase due to housing market trends or improvements in the area. This property appreciation can significantly boost a landlord’s investment, providing a solid return on investment should they decide to sell the property in the future.

- Receive Tax Advantages: Property owners can take advantage of tax deductions, such as for mortgage interest, depreciation, and other property-related expenses. These benefits reduce taxable income, improving cash flow and making property ownership even more financially rewarding.

- Build Assets Over Time: Investing in property allows landlords to build assets over time. As they make mortgage payments and the property’s value appreciates, they accumulate equity. This increasing equity can be leveraged for future investments, providing a solid foundation for long-term wealth.

- Professional Property Management: With property management services, landlords can outsource essential tasks like tenant screening, maintenance, and rent collection. These services ensure smooth operations and reduce the landlord’s involvement in day-to-day management, making property ownership less stressful and time-consuming.

- Build Equity: As the property’s value increases and mortgage payments are made, landlords gradually build equity. This equity grows over time, providing a valuable asset that can contribute to future investments or be used as collateral for further financial opportunities.

What Are Common Mistakes to Avoid in Property Leasing?

Common mistakes to avoid in property leasing include skipping inspections, overlooking terms, and failing to review key clauses related to repairs, renewals, or payment obligations. Both tenants and landlords face issues when essential details are missed. Tenants often rush into agreements without understanding total costs or restrictions, while landlords may rely on generic documents or overlook screening steps. These oversights create preventable disputes and financial risks.

For Tenants

- Not Reading the Lease Agreement Thoroughly

- Failing to Understand Total Costs

- Skipping Property Inspection

- Not Documenting Property Condition

- Ignoring Location and Neighborhood Research

- Ignoring Lease Restrictions (Pets, Guests, Parking)

- Not Planning for Future Needs

- Failing to Get Renters Insurance

- Poor Communication with Landlord

For Landlords

- Inadequate Tenant Screening

- Using Generic or Illegal Lease Templates

- Setting Incorrect Rental Prices

- Failing to Maintain the Property

- Ignoring Local Tenancy Laws

- Not Documenting Everything

- Discrimination in Tenant Selection

- Improper Security Deposit Handling

- Not Having Emergency Procedures

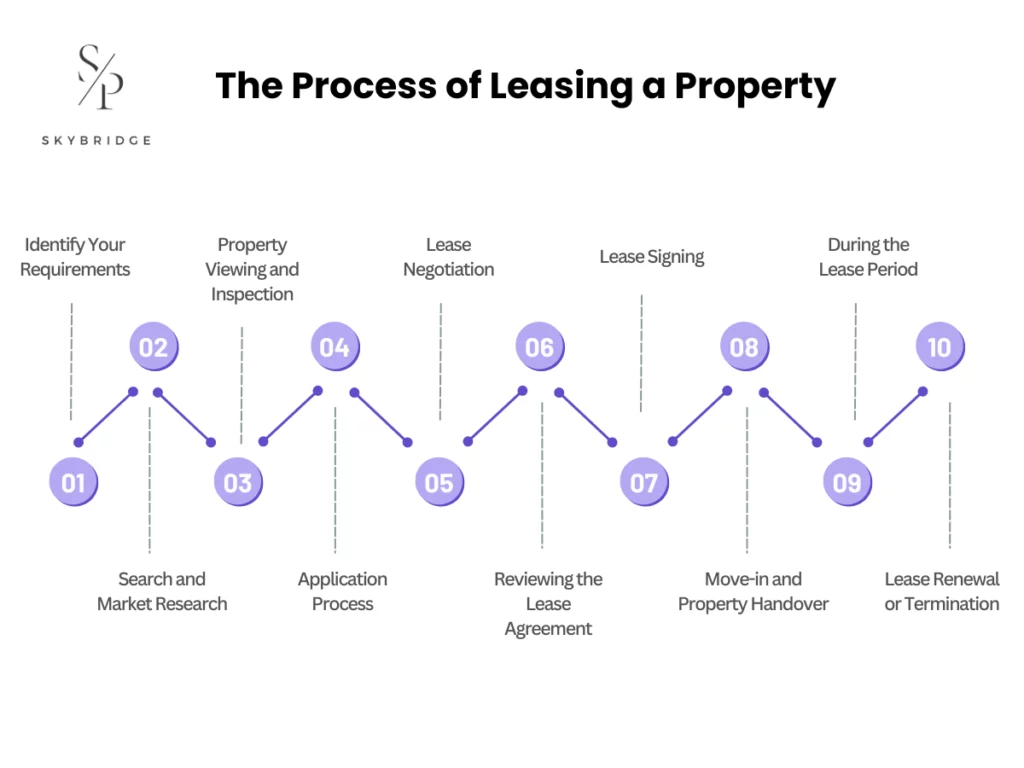

What is the Process of Leasing a Property?

The property leasing process includes searching, viewing, applying, and signing, giving tenants a clear path from identifying needs to securing a home. It begins with defining requirements, followed by market research, property inspections, and completing the application. After this, both parties negotiate terms, review the lease agreement, and finalize signatures. Each step plays a direct role in ensuring a smooth leasing experience and reducing potential issues during the lease period.

Step 1 – Identify Your Requirements

Requirements are the tenant’s needs for property features and location, including budget, preferred area, and property size. Identify essential features such as the number of bedrooms or needed amenities. Clear requirements make the search easy and avoid unsuitable options.

Step 2 – Search and Market Research

Search and research are the processes of exploring available properties through online listings, market trends, and comparisons. Review availability in your target neighborhoods and compare prices to set realistic expectations. Use this information to refine property choices.

Step 3 – Property Viewing and Inspection

Property viewing is the process of inspecting a property before renting. Visit the property to assess its condition, check for damage, and evaluate amenities. Identify potential repairs and confirm that the space meets your needs before proceeding.

Step 4 – Application Process

The application process is the steps to apply for renting a property, including submitting documents and paying fees. Complete the application form, provide proof of income and references, and prepare for verification. Meeting all requirements supports a smooth approval.

Step 5 – Lease Negotiation

Lease negotiation involves discussing and agreeing on lease terms such as rent, duration, and specific clauses. Review important points, address unclear items, and confirm conditions that align with your needs. Finalize mutually acceptable terms before moving forward.

Step 6 – Reviewing the Lease Agreement

A lease agreement is a legally binding contract, so review it carefully. Read clauses related to rent, deposits, maintenance, and your rights. Ask for clarification on anything unclear to ensure full understanding before signing.

Step 7 – Lease Signing

Lease signing is the final step in committing to a rental agreement. Once terms are agreed upon, sign the lease and obtain a signed copy. Note the start date and any documented conditions for future reference.

Step 8 – Move-in and Property Handover

The move-in process is the tenant’s final step to occupy the rental property. Coordinate the move-in date, complete a walk-through with the landlord, and document the property’s condition. Sign the inventory list to confirm the initial state.

Step 9 – During the Lease Period

The lease period is the duration the tenant is renting the property, requiring consistent adherence to terms. Pay rent on time, maintain the space, and submit maintenance requests promptly to support a smooth tenancy.

Step 10 – Lease Renewal or Termination

Lease renewal is extending the lease term or ending it based on future plans. Review renewal terms, provide proper notice if leaving, and follow the required procedures. Finalize your decision according to the timeline outlined in the lease.

How Can You Successfully Negotiate a Property Lease?

Lease negotiation involves discussing rent, terms, and clauses to reach an agreement that supports both sides. Start by identifying your priorities, such as rent amount, lease duration, and any special clauses you want included or adjusted. Present your terms clearly and explain why they are reasonable, focusing on solutions that work for both tenant and landlord. Stay flexible where possible and finalize conditions that meet your needs while maintaining a cooperative approach throughout the conversation.

Do Your Research and Preparation

Understanding the rental landscape gives you a stronger voice in any negotiation. Look into local market trends, compare similar properties, and review typical lease conditions for the area. Knowing what others are paying helps you justify requests and avoid accepting terms that fall outside the normal range.

Identify What Is Negotiable

Not every part of a lease is fixed, and recognizing which terms can be adjusted makes the process smoother. Rent amount, lease duration, common area maintenance responsibilities, and renewal conditions are often open for discussion. Deciding your priorities early allows you to negotiate confidently and with purpose.

Timing Your Negotiation

The moment you choose to negotiate can significantly affect the outcome. Approaching the landlord before they select another applicant or during slower rental periods often increases your leverage. Market conditions and timing work together, so use both to secure terms that better match your goals.

Use Negotiation Tactics that Work

Approaching the conversation with a solid strategy improves your chances of reaching favorable terms. Present reasonable requests supported by comparable market data, explain why your proposal makes sense, and stay flexible with secondary terms. A cooperative tone and clear reasoning help both sides find common ground.

Know When to Walk Away

Even with preparation, some agreements may not serve your interests. Set clear limits on rent, responsibilities, and conditions before negotiating, and be ready to walk away if the lease does not meet those boundaries. Recognizing when to step back ensures you commit only to a lease that supports your long-term needs.

What Should You Review Before Signing a Property Lease?

Before signing a property lease agreement, start by carefully checking the lease terms, including rent terms, lease duration, payment schedules, and renewal options. Review maintenance obligations, repair responsibilities, and any penalties tied to late payments or early termination. Pay attention to rules, restrictions, and conditions that affect how you use the property. Make sure every clause is clear, and request clarification on anything that seems uncertain or incomplete.

The Complete Pre-signing Checklist

A detailed checklist helps you avoid missing important information before you commit to a lease. Review essential items such as rent amount, payment deadlines, lease duration, and deposit requirements. Include notes on property condition, inspection results, and any agreed-upon repairs. Confirm maintenance responsibilities, utility obligations, and rules that affect day-to-day living. Go through the list carefully and ensure every item is fully understood before signing.

Understanding Escalation Clauses

Escalation clauses outline how and when rent will increase during the lease term. Review these clauses to understand the timing, frequency, and method used to calculate increases. Some leases tie adjustments to inflation or market indexes, while others apply a fixed percentage annually. Clarify how these increases change your long-term costs so you can plan your budget with accuracy.

Automatic Renewal Terms

Some leases include an automatic renewal clause that extends the agreement if no notice is given. Identify whether this applies to your lease and understand the required notification period for ending or adjusting the agreement. Review how renewal terms differ from the initial lease and ensure you know when and how to opt out if you do not intend to stay.

Penalty and Fee Structures

Penalty and fee structures can significantly affect your total cost if overlooked. Review charges related to late rent payments, early termination, returned payments, or damage beyond normal wear. Ensure each fee is clearly defined and reasonable. Understanding these terms early helps avoid unexpected financial consequences during the tenancy.

Dispute Resolution Procedures

Every lease should explain how conflicts between the tenant and the landlord will be handled. Check whether the agreement specifies mediation, arbitration, or another method of resolution before legal action becomes necessary. Understand the steps required if a dispute occurs and confirm the process aligns with local tenancy laws. Knowing your options ensures you are prepared if issues arise.

Getting Professional Review

According to Fannie Mae’s research, 64% of renters say they know little or nothing about their rights, making professional review especially valuable. A knowledgeable lawyer or property manager can identify terms that may be unclear or unfavorable and help you understand the legal implications behind each clause. They can point out sections that require adjustment, confirm the lease complies with local laws, and ensure you are fully aware of your responsibilities. This added level of guidance helps prevent misunderstandings and protects you from costly issues later.

How Can You Break a Property Lease?

Breaking a property lease, also known as terminating the lease agreement early, may be permitted without penalty when state or federal law provides a valid justification, but it must be supported by proper documentation and written notice. Tenants may legally end a lease early in situations such as uninhabitable living conditions, landlord harassment, repeated privacy violations, or when protections apply for domestic violence, stalking, or sexual assault. Active-duty military members may also terminate under the Servicemembers Civil Relief Act, and a lease may be void if it contains illegal terms or applies to a dwelling that cannot legally be rented. Understanding these legal pathways helps prevent disputes and ensures the termination follows the correct process.

For breaking property lease reasons that do not qualify as legally protected, such as relocating for work, buying a home, or personal changes, tenants usually remain responsible for paying rent in full unless another agreement is reached. Reviewing the lease for an early termination clause is a useful starting point, as it may outline fees or conditions for ending the contract. When no clause exists, tenants often negotiate with the landlord, request a lease buyout, or help locate a qualified replacement tenant to limit financial liability. Written notice should always be provided, and failing to follow required steps can lead to lost deposits, ongoing rent charges, damage to credit or rental history, or legal claims for unpaid amounts.

Buying vs. Leasing: Which Option is Best for You?

Deciding between buying and leasing comes down to how long you plan to stay, your financial readiness, and the lifestyle you prefer. Buying is generally more advantageous for individuals expecting to remain in one place for 3 to 7 years or longer, as this time frame allows you to recoup upfront costs and build equity. Ownership also provides long-term stability, potential appreciation, and full control over the property. However, it requires a sizable down payment, ongoing maintenance, property taxes, and financial responsibility for unexpected repairs.

Leasing is often the better choice for those who expect shorter stays, anticipate life changes, or prefer to avoid long-term commitments. It offers lower upfront costs, predictable monthly payments, and minimal maintenance responsibilities, making it ideal for renters who prioritize flexibility. If relocating for work, adjusting to new circumstances, or keeping financial obligations light is important, leasing provides more adaptability than ownership. Ultimately, the best option depends on your specific needs, priorities, and long-term goals.

Choosing the Right Property Lease Type for Your Needs

Selecting the right lease type depends on your specific needs, how you plan to use the property, and the level of flexibility you require. Start by considering whether the property will serve residential or commercial purposes, as each category offers different lease structures. Fixed-term leases work well for tenants seeking stability and predictable costs, while month-to-month leases suit those who need flexibility or anticipate changes in the near future. Commercial tenants may need to evaluate additional factors, such as responsibility for taxes, insurance, and maintenance under gross, net, or triple-net lease options.

Carefully weigh the lease duration, financial commitments, and the amount of control you want over the space. If you expect short-term needs, frequent relocations, or uncertainty in plans, a flexible lease may be the better fit. For long-term goals, predictable expenses, or business stability, a structured lease provides greater consistency. Evaluating these factors ensures you choose a property lease type that aligns with your lifestyle, operational needs, and overall objectives.