The three main types of tenancy are ownership-based tenancies, lease-based residential tenancies, and special-purpose or regulated tenancies. Each type governs legal rights, obligations, and inheritance outcomes by defining how property is owned or occupied, how responsibilities are divided between parties, and how those rights are transferred or terminated over time.

In real estate practice, tenancy operates as the legal framework that connects a person occupying a property with its actual title holder or owner. Their relationship forms the legal foundation of rental agreements and property law, describing how property can be occupied, what each party is responsible for, and how renewals, disputes, or terminations are handled within a housing arrangement.

As different types of tenancy serve different legal and practical needs, tenants must choose the right structure based on their ownership goals, occupancy requirements, and long-term plans. This article defines each tenancy type in detail, explains their differences, and clarifies when one form of tenancy may apply over another in real estate ownership and residential housing.

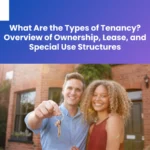

What Are the Ownership-Based Types of Tenancy?

Real estate can be legally owned in different ways, and each ownership structure serves different people and entities based on their needs and objectives. These arrangements determine who controls the property, how ownership interests are transferred, and what happens to the property upon death. Selecting the right tenancy depends on the number of owners, their relationship, liability considerations, and long-term planning goals.

Five ownership-based tenancy types are:

- Joint Tenancy

- Tenancy in Common

- Tenancy by the Entirety

- Tenancy in Severalty

- Community Property

Joint Tenancy: Equal Ownership and Survivorship Rights

Under joint tenancy, two or more co-owners can own one property together under a single title with the same interests and rights. Each owner holds an undivided share of the entire property rather than a defined physical portion. Its defining feature is the right of survivorship, meaning that when one joint tenant dies, their ownership interest transfers automatically to the surviving joint tenant or tenants. The deceased owner’s share does not pass through probate, which distributes property through a will or estate. As ownership interests are equal and unified, an individual tenant cannot freely transfer their share without breaking the joint tenancy structure.

This form of ownership is governed by four legal requirements known as the unities, which must exist at the time the joint tenancy is created.

- Unity of Interest: Each joint tenant owns an equal and undivided share of the property. Two co-owners each receive 50%, four co-owners receive 25% each, and so on.

- Unity of Time: All joint tenants must acquire their ownership interest at the same moment, meaning no owner can be added later without changing the tenancy structure.

- Unity of Title: All joint tenants must receive their ownership interest through the same legal document, such as a single deed or will, rather than separate transfers.

- Unity of Possession: Every tenant has an equal right to possess and use the entire property, with no individual owner having exclusive rights to any specific area.

Tenancy in Common: Unequal Shares and Transferable Interests

When two or more co-owners hold ownership of a single property with unequal shares or ownership interests, it is called tenancy in common. Unlike joint tenancy, ownership shares do not need to be equal, and each tenant in common can sell, transfer, or bequeath their interest independently. There is no right of survivorship under this structure, so when a co-owner dies, their share becomes part of their estate rather than passing automatically to the surviving owners. This type of tenancy is common in investment scenarios, such as when multiple investors purchase unequal shares of a property and want individual control over their ownership interests.

Key characteristics of tenancy in common include:

- Unequal Shares: Co-owners may hold different ownership percentages, such as 75-25 or 40-35-25, based on their financial contributions or other agreements.

- Shared Use: All tenants have the right to occupy and use the entire property, regardless of the size of their ownership share.

- Flexibility: Each tenant may sell, transfer, or mortgage their ownership interest independently without requiring consent from the other co-owners.

- No Right of Survivorship: When a tenant in common dies, their ownership interest passes to their beneficiaries rather than transferring automatically to the surviving co-owners.

- Probate: When a co-owner passes away, their share becomes part of their estate and is transferred through probate according to a will or estate plan.

Tenancy by the Entirety: Marital Co-Ownership with Legal Protections

Tenancy by entirety (TBE) is an ownership-based tenancy for married couples, where both spouses own a property together as a single legal unit. Each spouse has an equal and undivided interest in the entire property, and neither can sell, transfer, or encumber the property without their partner’s consent. This tenancy type also includes survivorship rights, so when one spouse dies, the surviving spouse automatically becomes the sole owner without a probate.

Below are the major characteristics of tenancy by entirety:

- Unities: Tenancy by the entirety requires the unities of time, title, interest, and possession, along with the unity of marriage, meaning a couple must acquire the property at the same time under the same deed while being legally married.

- Right of Survivorship: Upon the death of one spouse, the surviving one receives full ownership automatically without estate distribution proceedings.

- Debt Protection: Creditors of only one spouse cannot force the sale of property held as tenants by the entirety. For example, if one spouse incurs personal business debt, the marital home remains protected from that creditor. However, it is not protected against joint debts.

- Divorce Proceedings: After a divorce, tenancy by the entirety typically converts into a tenancy in common, with each former spouse holding a separate ownership interest.

- State Recognition: This is recognized in Alaska, Arkansas, Delaware, D.C., Florida, Hawaii, Illinois, Indiana, Kentucky, Maryland, Massachusetts, Michigan, Mississippi, Missouri, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Vermont, Virginia, and Wyoming.

Tenancy in Severalty: Sole Ownership and Control

Ownership in sevaralty, or tenancy in severalty, means a single individual or legal entity holds full and exclusive ownership of a property, with the right to sell, rent, lease, mortgage, transfer, or use the property as they choose. The owner or owning party (often a corporation) holds property title in their own name and does not share ownership rights with any other person, which distinguishes this structure from shared or co-ownership arrangements. The term “severalty” itself refers to ownership that is separate and individual, rather than joint or common.

This form of tenancy gives the owner complete control and responsibilities over the property, including legal liability for debts, taxes, and obligations associated with the property. From an estate planning standpoint, tenancy in severalty is more independent and straightforward than joint ownership because the property passes according to the sole owner’s will or estate plan, without being affected by survivorship rules or shared ownership. However, in cases of a legal entity owning a property, its transfer requires an authorized corporate officer to sign the deed in accordance with the board resolution authority, which may be more complex.

Community Property: Shared Ownership with Spousal Rights

Community property is an ownership-based tenancy for married couples or domestic partners (in California, Nevada, and Washington only), where assets and debts acquired during the marriage are owned equally by both spouses. Property obtained during the marital period belongs equally to both spouses, regardless of which spouse earned the income or whose name appears on the title. This creates equal spousal rights in real estate, wages, investments, and liabilities tied to the marriage, while property owned before the marriage or received individually as a gift or inheritance is excluded.

This ownership provides a significant tax benefit, with the entire property value adjusted to its fair market value at the time of a spouse’s death, which reduces or eliminates capital gains tax if the property is later sold. However, it also carries a risk of the entire asset being exposed to debts incurred by either spouse. Moreover, neither spouse may sell or transfer their share without the other’s consent.

Community property states:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

- Alaska (community property through an agreement or a community property trust)

- Florida ( citizens and non-citizens can opt in under state law)

- Tennessee (residents and non-residents can opt in through a trust)

- Kentucky (residents and non-residents can opt in through a trust)

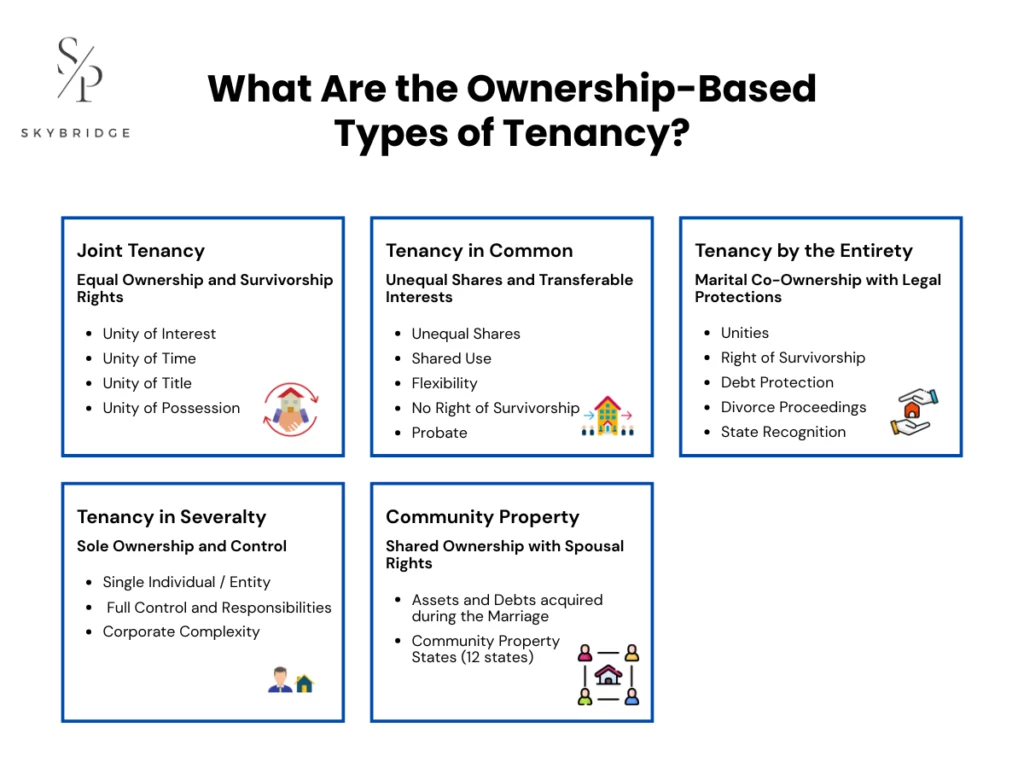

What Are the Main Leasehold Tenancy Types in Residential Rental Agreements?

Residential rental agreements provide property owners with legal methods to allow occupancy without transferring ownership, based on specific rules for duration, renewal, and termination rights. These are designed to serve different housing needs, ranging from long-term stability to short-term flexibility, while setting clear expectations for rent, notice periods, and legal responsibilities. The structure selected affects how easily a tenancy can end, how rent may change, and what protections apply to both tenants and property owners.

Fixed-Term Tenancy: Contracts with Defined Duration

Under a fixed-term tenancy, a rental agreement is established for a specific period, starting at a fixed starting and ending date (example: Jan-01-2026 to Dec-31-2026). These contracts commonly last for six months or twelve months, and the tenancy cannot end early unless both parties agree or a break clause allows early termination. During this period, both the tenant and the landlord are legally bound to the agreed terms, which include a fixed rent amount, occupancy rights, and use conditions. Breaking a fixed-term tenancy early may result in financial liability, such as continued rent obligations or penalties, unless state law or specific lease terms allow early termination.

As the end date approaches, either party may give notice within the period required by local law or the lease agreement, often 30 days before expiration. If the tenancy ends early, legal grounds or mutual consent must apply. After the fixed term expires, the parties may either renew the arrangement by signing a new fixed-term lease or convert automatically to a month-to-month tenancy if no new agreement is made and neither party gives termination notice.

Periodic Tenancy: Month-to-Month Renewing Occupancy

A periodic tenancy means the agreement automatically renews for specific rental periods, like a month-to-month basis, without a fixed date for termination. The tenancy renews automatically at the end of each rental period unless either the tenant or the landlord provides proper notice to terminate or change the arrangement type. Rent is usually paid at regular intervals, and the tenancy continues as long as neither party ends the arrangement with a proper notice.

Most tenants pay monthly, although semi-annual and annual payments are also common. This tenancy arrangement offers flexibility for both property owner and renter, making it common in long-term rentals where fixed commitments are not desired. Tenants can relocate with shorter notice, while landlords can adjust terms such as rent or staying period with legally required notice. If an owner wishes to terminate the tenancy, an advance notice of 30 days is required by law, though longer notice periods may apply for long-term occupants.

Tenancy at Will: Flexible and Unstructured Arrangements

When a tenant occupies a property with the owner’s permission but without a fixed end date or formal written agreement, this situation is considered a tenancy at will. It often arises from verbal arrangements, such as when a landlord allows occupancy and accepts rent without setting defined lease terms. Although informal, this arrangement still comes with certain legal rights and obligations for both parties.

Tenancy at will offers flexibility but limited stability, since either the tenant or the owner may end the arrangement without definite cause by giving the notice required under state law, often around 30 days or even sooner. Common examples include a tenant remaining after a lease expires or a friend or family member staying indefinitely while paying rent. Since notice rules and tenant protections vary by state, these informal arrangements stay within legal gray areas, making it important for both parties to understand local laws and set basic expectations early on.

Tenancy at Sufferance: Holdover Without Consent

A tenancy at sufferance occurs when a tenant stays in a property without the owner’s consent, even after their legal right to stay has ended, such as when a lease expires without renewal. The tenant originally entered the property lawfully, but once the term ends, continued occupancy without consent makes the tenant a holdover and does not guarantee any ongoing occupancy rights

During this period, the property owner may require the tenant to pay rent for each month they occupy the property, choose to renew or formalize the tenancy, or file for eviction. If eviction is pursued, the tenant must receive a court summons and attend a hearing, as physical removal cannot occur without a court order. The owner may also sue for damages incurred during the holdover period, including unpaid rent or property damage, in accordance with local landlord-tenant law.

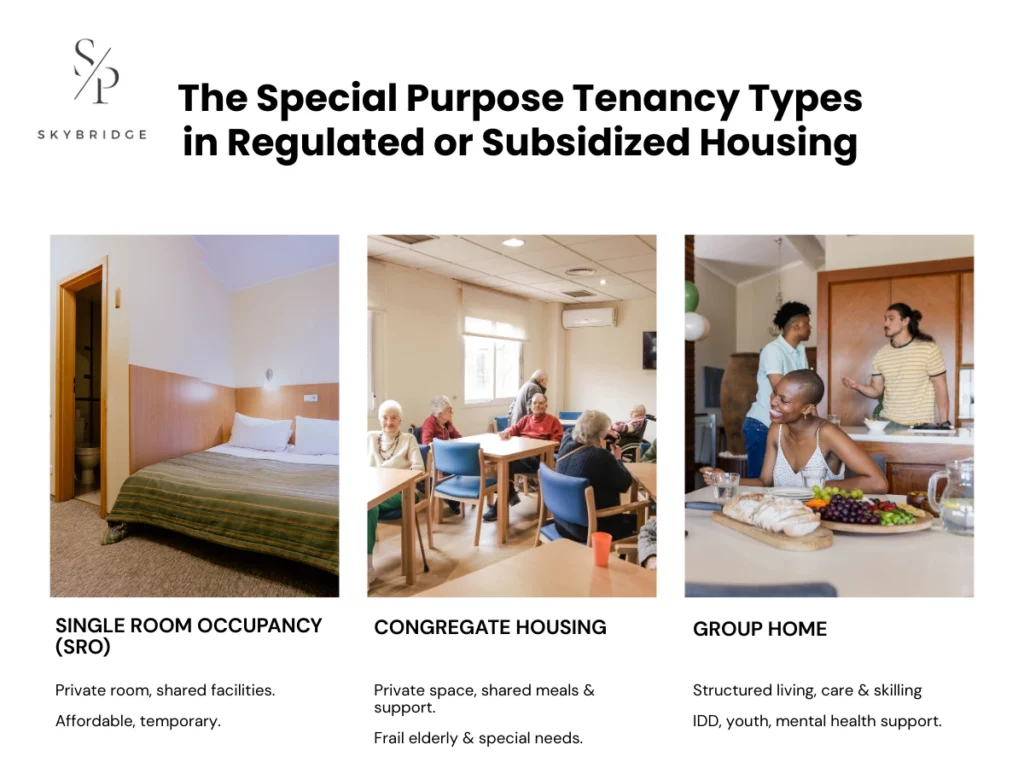

What Are the Special Purpose Tenancy Types in Regulated or Subsidized Housing?

Special-purpose housing, such as single room occupancy (SRO) units, congregate housing, and group homes, serves people with financial, physical, and mental health needs that require additional living support beyond the standard rental arrangements. These tenancies operate under strict regulatory and funding frameworks that shape eligibility, occupancy rights, and the services provided to residents.

Single Room Occupancy (SRO)

In a single room occupancy, a tenant rents one private room within a building while sharing kitchens, bathrooms, and other common facilities with other residents. These rooms are typically designed to be occupied by an individual, as they typically measure between 100 and 150 square feet only. SRO units are subject to occupancy limits established by local zoning codes and state housing laws, which usually allow two people at most to live in one room.

This type of housing is commonly used by elderly individuals, students, people with special needs, low-income residents, or displaced tenants who need temporary, affordable, and stable lodging rather than a full apartment. Legal requirements for SROs vary by jurisdiction, with regulated properties required to meet specific safety, sanitation, and habitability rules, while zoning allowances and tenant protections differ across cities and states. Many U.S. municipalities include SROs within transitional or subsidized housing programs that provide low-cost private rooms within a shared living layout.

Congregate Housing

The congregate housing arrangement provides private living spaces combined with shared meals and supportive services for frail elderly residents and special needs individuals who live in federally subsidized housing. The housing model is designed to help residents remain independent while receiving assistance with daily activities in a non-institutional setting, rather than in a nursing facility.

Many congregate housing programs operate under the federal Congregate Housing Services Program (CHSP), administered by the U.S. Department of Housing and Urban Development (HUD) in coordination with state-level housing authorities. These programs provide at least one daily group meal and additional services like housekeeping, transportation, or personal care. Eligibility is determined through professional assessment, and funding is shared between HUD, housing sponsors like public housing authorities or nonprofits, and participating residents, who contribute a portion of the program cost based on their income. Waiting lists are common for this housing due to limited funding and high demand.

Group Home

A group home refers to a structured housing with ongoing supervision and care for people with intellectual or developmental disabilities (IDD), youth in foster care, youth offenders, and those receiving substance abuse or mental health support. These homes provide structured housing combined with supervision and care that prepares individuals to live independently and safely integrate into community life, rather than remaining isolated in institutions.

The housing model focuses on skill development and independence through daily living support, nursing and therapeutic services, vocational training for employment, and social skills development for community interaction. These shared, regulated residents are designed to mirror everyday living while providing guidance, supervision, and accountability. The quality, structure, and services of group homes vary widely depending on the provider and population served, with state licensing and zoning laws governing supervision levels, occupancy limits, and program standards.

How Do Tenancy Agreements Differ from Leases in Legal Structure and Terms?

A tenancy agreement usually applies to short-term or rolling arrangements, while a lease binds the parties for a fixed term. As both of them govern rental occupancy but differ in duration, formality, and enforceability, people often confuse the two. The sections below help clear the confusion by explaining these differences, followed by occupancy and termination rights, along with defining renewal terms, binding periods, and use agreements.

Tenancy Agreement vs Lease: What’s the Difference?

A tenancy agreement is a short-term contract that usually operates on a month-to-month basis, while a lease is a long-term contract that commonly runs for at least one year. The key differences between the two come down to duration, formality, and how easily the occupancy terms can be changed or terminated. Both create legally enforceable relationships, but they are structured to serve different occupancy needs.

Key differences between a tenancy agreement and a lease include:

- Duration: Tenancy agreements usually renew monthly, while leases bind the parties for a fixed long-term period (usually at least one year).

- Formality: Leases are formal written contracts with defined start and end dates, whereas tenancy agreements are simpler or implied informally through verbal agreements in many cases.

- Flexibility: Tenancy agreements allow changes or termination with proper notice, while making changes during a lease’s binding term is highly complicated, unless both parties agree.

- Termination: Ending a tenancy agreement requires a statutory notice of around 30 days, while early lease termination requires legal grounds, specific contractual clauses, or mutual understanding.

Occupancy Rights and Termination Clauses in Agreements

Occupancy rights refer to a tenant’s legal authority to reside in a property and use its facilities during the tenancy or lease term. These rights include the right to reside without interference, the right to basic habitability standards, and the right to privacy that prevents unlawful entry by the property owner. The scope of occupancy rights depends on the type of agreement, with leases providing stronger and more predictable protections due to their fixed duration, while tenancy agreements offer more flexible but less stable occupancy. For example, a tenant under a 1-year lease cannot be asked to vacate early without legal grounds, while a month-to-month tenant may be required to leave after a 30-day notice.

Termination clauses specify how and when either party may lawfully end the agreement. In tenancy agreements, termination requires a statutory notice of around 30 days, unless local law specifies a longer period. Leases, by contrast, limit termination during the term and require specific legal grounds, such as breach of contract or an agreed-upon early termination clause. These provisions determine eviction procedures, notice requirements, and the conditions under which occupancy rights end, making them a crucial part of rental agreements.

Renewal Terms, Binding Periods, and Use Agreements

Renewal terms, binding periods, and use agreements determine how long a tenancy lasts, when it can end, and how occupancy rights continue or change over time. These provisions explain whether a rental arrangement continues automatically, how long the parties remain legally bound, and how additional occupants may use the property without modifying the main contract.

- Renewal Terms: These explain what happens when a tenancy reaches its end, including whether it must be renewed or continues automatically. In many cases, a fixed-term tenancy converts into a rolling or month-to-month tenancy if no notice is given on time.

- Binding Period: This refers to the period of tenancy during which neither party can terminate the agreement on their own. Fixed-term leases have a defined binding period, like a one-year lease, while periodic tenancies reset the binding obligation at the end of each rental cycle, which is usually on a month-to-month basis.

- Use Agreements: These are legally binding arrangements that set specific rules for how a property or part of it may be used by the tenants, helping to prevent future disputes. They may specify the maximum number of occupants, shared space access, rent, utilities, maintenance and repair responsibilities, pets, parking, and termination terms.

FAQs About Tenancy Types

What is the most common type of tenancy?

According to the Office of Policy Development and Research (PD&R), about 66% of housing units are owner-occupied, making ownership-based tenancy the most common overall. For rental housing, the most common tenancy type is month-to-month (periodic) tenancy, as noted by the California Department of Real Estate.

Can tenancy types affect inheritance or taxes?

Yes, tenancy types directly affect inheritance and taxes by controlling how property transfers at death. Joint tenancy and tenancy by entirety (TBE) bypass inheritance because ownership passes automatically to the survivor, while community property with survivorship also avoids probate and reduces or eliminates capital gains tax. Tenancy in common and tenancy in severalty pass through the owner’s estate, often requiring probate and offering fewer tax benefits.

Which tenancy is best for married couples?

Tenancy by entirety (TBE) and community property are the best tenancy types for a married couple. These provide equal ownership and survivorship rights, with TBE also protecting the asset from individual creditors. The most suitable option depends on marital goals, debt considerations, and whether the state recognizes these ownership structures.

Do tenants in common need equal shares?

No, tenants in common do not need equal ownership shares. Each co-owner may own a different percentage of the property, but they all have equal rights to use the entire property as their own. The ownership percentages should be clearly stated in the deed to avoid disputes over control, income, or inheritance.

What happens when a joint tenant dies?

When a joint tenant dies, their share of the property transfers to the surviving joint tenant or tenants automatically through the right of survivorship. The property does not pass through probate, and the deceased joint owner’s heirs do not inherit that share.