If your rental application is denied, understand the reason for the denial, whether it is due to poor credit history, past evictions, or incomplete information on your rental application. Knowing the exact reason for the rental application denial helps you determine the best course of action, whether that involves addressing errors, improving your credit or financial situation, or considering alternative housing options.

For example, if poor credit is the issue, you might work on improving your credit score or offer a co-signer. If it is due to past evictions or a criminal background, consider providing references or offering a larger deposit. In the case of errors in the screening report, contacting the agency to dispute the incorrect information is crucial. This guide presents denials of rental applications based on different scenarios along with what to do in each situation, ensuring you are prepared for any rental challenges that may arise.

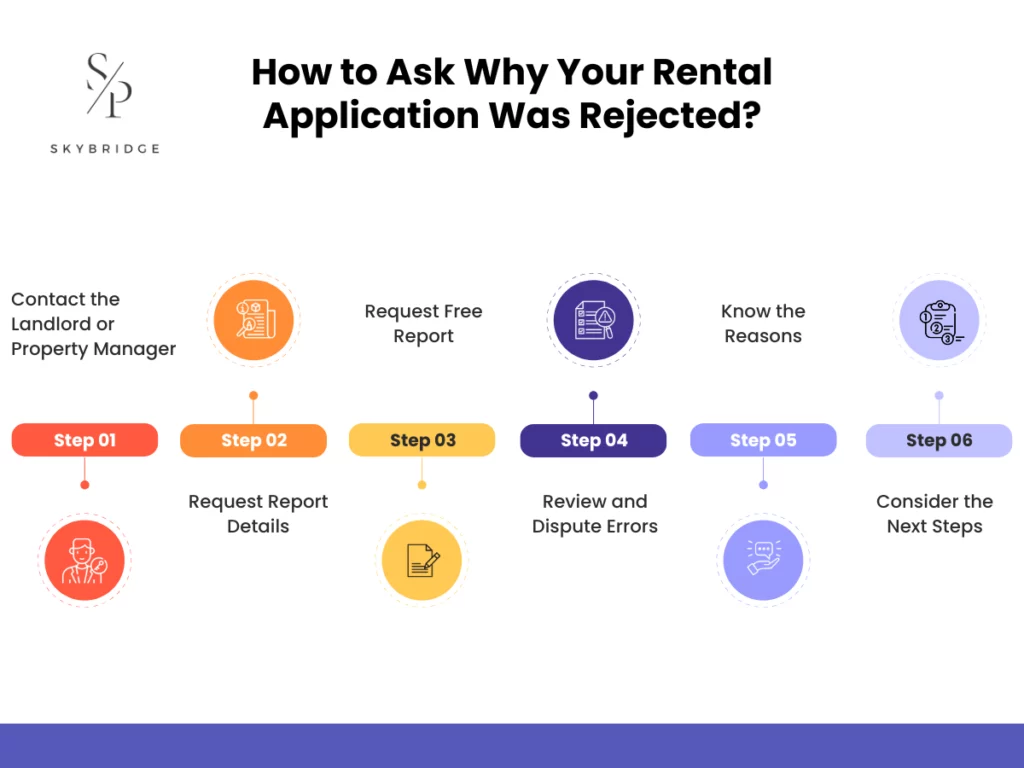

How to Ask Why Your Rental Application Was Rejected?

To ask why your rental application was rejected, reach out to the landlord or property manager politely to request the specific reason for the denial. If a tenant screening company was involved in the decision, you have the legal right to know if a background check influenced the outcome. You can then request a free copy of your screening report to check for errors and dispute any inaccuracies with the reporting company.

Here are the steps you can take to ask about your rental application rejection:

- Contact the Landlord or Property Manager:

Politely reach out to the landlord or property manager via phone or email to inquire about the denial. While they are not always obligated to provide a detailed explanation, especially if the rejection was not based on a consumer report, a respectful inquiry can often lead to valuable insights.

- Request Report Details:

If a tenant screening report, background check, or credit report was used in the decision-making process, the landlord is required to provide you with the name, address, and phone number of the reporting company. This is especially important if you paid an application fee, as you are entitled to this information by law.

- Request Free Report:

Under the Fair Credit Reporting Act (FCRA), landlords are required to provide a free copy of the tenant screening report within 60 days of the denial. This allows you to verify the accuracy of the information used in the screening process.

- Review and Dispute Errors:

Once you receive your tenant screening report, carefully review it for any errors, such as mistaken identity, inaccurate credit history, or incorrect criminal records. If you find any discrepancies, you have the right to dispute these inaccuracies within 30 days (or 45 days in certain cases) with the screening company. The company is legally obligated to investigate the issue and correct any errors in the data.

- Know the Reasons:

Common reasons for rental application rejections include poor credit history, insufficient income, or negative rental history. Knowing the specific reasons for your denial will allow you to address these issues and improve your chances for future applications.

- Consider the Next Steps:

Based on the information you gather, decide your next steps. If errors were found in the screening report, dispute them and consider reapplying. If the denial reasons are valid, work on improving those factors, such as credit score, income, or rental history.

Note: The Fair Housing Act prohibits housing discrimination based on race, color, national origin, religion, sex, national origin, familial status, or disability. If you believe your application was rejected due to any of these protected factors, you have the right to file a complaint according to federal law with the U.S. Department of Housing and Urban Development (HUD).

What to Do If Your Rental Application Was Denied Due to Poor Credit History?

If your rental application was denied due to poor credit history, request an adverse action notice from the landlord, which provides the reason for the denial in writing. Check your current credit score, as a score below 600 is typically considered “Poor” on the FICO scale (300-579). Many landlords prefer tenants with a “Fair” score (580-669) or “Good” score (670+), as these indicate stronger payment reliability. If your credit score is below 620, you may need to offer a co-signer, a larger deposit, or proof of income to reassure the landlord.

Once you have a clear understanding of your current credit score and the exact reasons for the rental application denial, obtain a copy of your credit report from a reputable agency to check for mistakes or inaccuracies. Credit issues like late payments, high debt, or errors in the report can be disputed with the credit bureau. To strengthen your credit score, consider paying down high-interest debts, particularly credit cards, and providing pay stubs (or other proof of income). Offering a larger deposit, securing a co-signer, or showing high income (3x rent) can also demonstrate your financial responsibility to the landlord. In the long term, focus on improving your credit score by paying bills on time, reducing your debt, and keeping your credit utilization low before reapplying rental application.

How to Get Approved for an Apartment with Bad Credit?

Getting approved for an apartment with bad credit is possible by taking proactive steps such as offering a larger security deposit or prepaying rent, securing a co-signer or guarantor with good credit, and providing strong references from previous landlords or employers. While a credit score of 600 or higher is often ideal for renting, many renters with lower scores can still qualify for an apartment with this method.

In addition, you should work on improving your financial situation by paying off outstanding debts and reducing your overall debt-to-income ratio. Keep in mind that credit history is just one factor landlords evaluate. By being transparent about your credit issues and showing that you are taking steps to improve, such as paying bills on time, you can significantly increase your chances of getting approved for an apartment with bad credit. These actions help demonstrate to landlords that you are committed to fulfilling your financial obligations despite your credit history.

What to Do If Your Rental Application Was Denied Because of a Criminal Background Check?

If your rental application was denied due to a criminal background check, obtain a copy of the screening report from the landlord or the screening company. Carefully review the report for any mistakes or outdated information related to criminal history. If you spot any discrepancies, you have the right to dispute them with the screening company. Additionally, you can consider writing a letter to the landlord explaining your situation. If you feel that your rights were violated, you can file a complaint with the Department of Housing and Urban Development (HUD) or the Consumer Financial Protection Bureau (CFPB).

Here is a step-by-step process you can follow:

- Request the Screening Report: The landlord is obligated to provide you with the name, address, and contact information of the background screening company used for your application. You are entitled to request a free copy of the report within 60 days of the denial.

- Dispute Errors: Once you have the report, thoroughly review it for inaccuracies, such as mistaken identity or outdated records, like expunged criminal charges. If you find any errors, you have the right to dispute them directly with the screening company. They must investigate the issue and correct any inaccuracies within 30 days.

- Write an Appeal Letter: If there are extenuating circumstances related to your criminal background, consider writing an appeal letter to the landlord. In your letter, explain your situation, provide any relevant context, and outline why you would be a responsible tenant. This could include providing evidence of rehabilitation or other mitigating factors.

Note: If you suspect you have faced discrimination in the housing process, you can file a complaint with the federal Department of Housing and Urban Development (HUD). HUD will investigate the issue and take appropriate action if discrimination is found.

What to Do If Your Rental Application Was Denied Due to Past Evictions?

If your rental application was denied due to past evictions, check if the eviction is officially recorded and how recent it is. An eviction record can significantly affect your chances of getting approved, but understanding its impact is important. Landlords typically place a high weight on eviction history, especially if it is recent, as it may indicate potential risks for non-payment or poor tenant behavior.

If the eviction is legitimate, you may still have options. You can provide references from previous landlords, explain the circumstances surrounding the eviction, or offer a larger security deposit to reassure the landlord. If the eviction is older and you have maintained a positive rental history since then, highlighting this can help demonstrate that the situation has been resolved.

In some cases, such as long-standing evictions or resolved disputes, temporary or second-chance housing options may be available. Additionally, consider working on rebuilding your rental credibility and presenting a co-signer, which can strengthen your rental application for future rentals.

What to Do When Your Rental Application Is Denied Because of a Screening Report Mistake?

In case your rental application is denied because of a screening report mistake, request a copy of your tenant screening report, carefully review it for any errors, and then submit a formal dispute with the landlord or screening company. This step is crucial as it allows you to identify inaccuracies, such as outdated evictions, incorrect criminal records, or misreported financial information, which may have influenced the decision.

If you find mistakes like errors in your name or incorrect personal details, dispute them directly with the screening agency. By federal law, the agency is required to investigate and resolve the issue within 30 days. If they fail to do so, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC).

After the errors are corrected, follow up with the landlord by providing them with the updated version of your report and reapply with the corrected documentation. Taking these steps can significantly improve your chances of approval.

What to Do If Your Rental Application Was Rejected for Incomplete or False Information?

If your rental application was rejected due to incomplete or false information, request a detailed explanation from the landlord or property manager. The Fair Credit Reporting Act (FCRA) requires landlords to provide an “adverse action notice” if the denial was based on a credit or tenant screening report. This notice should include contact information for the reporting agency and the specific reason for the rejection. Once you have the explanation, determine if the issue was due to an error on your part or inaccurate information in the screening report.

In case the denial was due to inaccuracies, dispute the errors directly with the reporting agency, which has 30 to 45 days to investigate and correct the issue. If the problem was due to unintentional omissions or outdated details, like old job information, write an appeal letter to the landlord explaining the situation. Be clear, professional, and offer solutions such as a higher security deposit or a co-signer to reassure the landlord. Offering these concessions can help strengthen your case and improve your chances of rental approval.

What to Do If Your Rental Application Was Denied Due to Insufficient Income?

If your rental application was denied due to insufficient income, consider options like finding a guarantor, getting roommates, offering a larger deposit, showing savings, or securing recommendations from previous landlords. Many landlords require proof of steady income, typically 2.5 to 3 times the rent, to ensure tenants can comfortably afford the payments.

To strengthen your rental application, consider offering a co-signer with a stronger financial profile or presenting multiple sources of income, such as gig work or freelance income, as part of your total income. Additionally, check your screening report for errors that may have contributed to the denial. To improve your rental chances in the future, focus on building a stronger financial profile by paying down debt, increasing your income, and maintaining consistent, verifiable employment.

What to Do If Your Rental Application Was Denied Due to Poor Rental History?

When your rental application is denied due to poor rental history, it is important to take immediate action, starting by requesting feedback from the landlord or property manager. Understanding the specific reasons for the denial, such as late payments, lease violations, or landlord complaints, will help you address any issues that impacted your application.

Common problems like past late payments, denied rental, or prior lease violations can affect your approval chances. To strengthen your future applications, consider securing reference letters from previous landlords or offering a larger deposit to reassure the landlord. Additionally, take actions to rebuild trust, such as maintaining a consistent rent payment history and ensuring transparent communication with future landlords. These steps will show your commitment to being a reliable tenant.

What to Do If Your Rental Application Was Denied Due to Unfair or Illegal Reasons?

If you believe your rental application was denied for an unfair or illegal reason, request the reason for the denial in writing from the landlord. Next, obtain a copy of your tenant screening report and carefully review it for any errors that may have contributed to the rejection. If you find inaccuracies, dispute them directly with the screening company to have them corrected.

Additionally, if the denial was based on discrimination due to protected characteristics, such as race, religion, disability, or familial status, you have the right to file a complaint with the Department of Housing and Urban Development (HUD) or the Consumer Financial Protection Bureau (CFPB). Keep thorough documentation of all interactions with the landlord and any communications that may support your case. If you believe your rights have been violated, consider consulting a lawyer or filing a lawsuit. The Fair Housing Act protects you from discrimination, and legal action can help address and resolve unlawful rental denials.

How to Appeal a Rental Application Denial?

To appeal a rental application denial, start by requesting the rejection letter and carefully reviewing the reasons for the denial. Understanding the specific factors that led to the rental rejection will help you determine the next steps. Then, gather supporting documents, such as references, proof of income, or evidence of recent credit improvements, to strengthen your case.

Once you have a clear understanding of the denial, write a polite and professional appeal letter to the landlord or property manager. In your letter, address the reasons for the rejection and provide any relevant supporting documents. Clarify any misunderstandings or highlight factors that may have been overlooked, such as extenuating circumstances or updates to your financial situation. To further reassure the landlord, consider offering compromises like a larger security deposit or a co-signer. By approaching the situation respectfully and demonstrating your commitment to meeting rental requirements, you can increase the likelihood of having the denial reconsidered.

What Are the Alternative Housing Options After a Rental Application Denial?

Although being denied for a rental application can be discouraging, there are several alternative housing options, including getting a co-signer, looking for private landlords, and subletting. These alternative options can help you secure accommodation while you work on strengthening your application for future rentals.

- Second-Chance Apartments: Some landlords specialize in second-chance rentals, which are properties that offer more flexibility to tenants with prior denials. These properties may be more lenient with screening criteria like credit history or past evictions.

- Sharing with Roommates: Sharing a rental with a roommate can be a great option if your rental application was denied due to insufficient income or poor rental history. A co-tenant with a stronger financial background can help meet the landlord’s requirements and increase your chances of approval.

- Subletting Property: Subletting an apartment or house is another alternative. If a tenant already has a lease, you may be able to sublet the property, allowing you to secure housing while temporarily bypassing the application process.

- Look for Short-Term Rentals: If you need immediate housing, short-term rentals from local property management companies or private landlords can provide flexibility while you work to improve your long-term rental prospects.

- Rent from a Private Landlord: Renting directly from a private landlord can sometimes offer more flexibility compared to large property management companies, which may have stricter requirements. A private landlord may be more willing to overlook past issues or negotiate terms that work for you.

- Offer a Larger Security Deposit: If you are unable to meet income requirements or have a questionable rental history, offering a larger security deposit can reassure the landlord that you are financially responsible and provide extra security against any risks.

Avoid Future Denials – Choose a Local Property Management Expert

Partnering with a local property management expert can make all the difference in avoiding future rental application denials, offering a crucial local rental support strategy. These professionals understand the local market and can connect you with listings that fit your financial profile and rental history. By working with someone who knows the ins and outs of the area rental market, you will have a much better chance of finding a place that is a good match for you.

Local property managers do more than just show you listings, they guide you through the entire rental process. From knowing if your rental application is denied to helping with document preparation for your next rental application, they provide invaluable support. Their expertise also helps address any challenges with your rental history or credit, making your application more appealing to landlords. By choosing a trusted, experienced local property management expert, you ensure personalized, hands-on assistance that boosts your chances of securing your next rental.