Most landlords prefer a credit score between 620 and 700 when approving rental applications. This range shows financial reliability and responsible credit behavior, giving property managers confidence that rent will be paid on time.

If your credit score falls below 600, you may still qualify, but the conditions are usually stricter. Many property management companies may require a higher security deposit, a co-signer, or proof of stable income. These additional measures help balance the landlord’s risk when working with applicants who have limited or less favorable credit histories.

Maintaining a score above 650 offers clear advantages. It not only improves your chances of approval but can also lead to better lease terms, such as lower deposits or more flexible payment arrangements. Understanding these score ranges helps renters prepare stronger rental applications and approach the process with confidence.

What Credit Score Do Landlords Look For?

When applying for a rental property, landlords generally expect a credit score of at least 600. This score signals basic financial responsibility and helps them gauge whether rent will be paid consistently. A higher score, closer to 700 or above, improves approval odds and may qualify renters for lower deposits or better lease conditions. Since credit expectations differ among property management companies, understanding how each range is interpreted can help renters assess where they stand.

| Credit Score Range | Category | Landlord Interpretation | Possible Requirements |

| 750 and above | Excellent | Highly reliable tenant | May receive better rent offers |

| 700–749 | Good | Financially stable and low risk | Easy approval |

| 650–699 | Fair/Acceptable | Slightly higher risk, but usually approved | May require a moderate deposit |

| 600–649 | Below Average | Some risk observed | A higher deposit or a co-signer may be needed |

| Below 600 | Poor | High risk; approval less likely | Co-signer or proof of income required |

These credit score categories give landlords a clearer view of tenant reliability while helping renters plan their next steps. Even if your score is near 600, maintaining a steady income and a positive rental history can strengthen your application. Reviewing credit reports for errors and demonstrating consistent payment history can also help meet most credit requirements over time.

Why Your Credit Score Matters When Renting?

Your credit score matters when renting because it directly affects your approval chances, the amount of security deposit, and the lease terms a landlord offers. A score above 650 signals financial reliability and often leads to smoother approval. Landlords use it to judge payment consistency, while scores below 600 may require a co-signer or a higher deposit.

Indicates Financial Responsibility

A credit score indicates financial responsibility because it reflects how well a person manages credit, debt, and timely payments. Landlords view it as a measure of how dependable a tenant is when it comes to paying rent and handling ongoing financial obligations. A consistent record of paying credit cards, loans, and bills on time shows that an applicant can be trusted to make rent payments without issues.

For example, renters with a credit score above 700 usually have a strong payment history and low debt balances, while those below 600 may have late payments or higher credit usage. This distinction helps landlords predict how reliably a tenant will meet monthly rent. Building good credit habits and focusing on improving your credit score over time helps demonstrate accountability and increases rental approval chances.

Assesses Tenant Risk

Landlords use a credit score to assess tenant risk, helping them decide how likely an applicant is to make consistent rent payments. A lower score often signals missed payments, high debt, or unstable financial behavior, while a higher score indicates reliability and lower financial risk.

When reviewing applications, landlords check credit reports to identify red flags such as unpaid accounts or frequent late payments. For example, a renter with a score above 700 is usually seen as dependable, while someone near 600 may be asked for a co-signer or a higher security deposit to offset potential risk. By analyzing credit history, landlords can reduce the chances of rent defaults and ensure more predictable income flow from tenants.

Affects Approval Chances

Your credit score directly affects your approval chances when applying for a rental property. Landlords often use it as a quick filter to decide whether an applicant meets their financial standards. A score above 650 usually leads to faster approval, while one below 600 may trigger additional screening steps.

In competitive rental markets, a strong credit score can help applicants stand out and secure preferred units. Those with lower scores might still qualify, but they may need a co-signer, a larger deposit, or extra proof of income. Property managers rely on these credit insights to balance financial risk and maintain consistent rent collection. Having a solid credit profile not only speeds up approval but can also improve overall lease terms and rental opportunities.

Impacts Lease Terms

Your credit score impacts lease terms by influencing how flexible or strict a landlord can be with rental conditions. Tenants with a higher credit score, typically above 700, are viewed as lower risk and often receive better lease offers, such as reduced security deposits, longer lease durations, or more favorable payment options.

In contrast, renters with scores near 600 may face tighter conditions. Landlords might require larger deposits, shorter leases, or monthly rent paid earlier in the billing cycle. These measures help protect property owners from potential late or missed payments.

By maintaining consistent payment history and responsible credit management, tenants can strengthen their profiles and negotiate lease terms with more confidence. Over time, improving your credit score not only helps with approval but also provides leverage in securing more flexible and affordable housing agreements.

Predicts Payment Reliability

A credit score predicts payment reliability by showing how consistently someone pays bills and manages debt. Landlords use this score to estimate whether rent will be paid on time each month. A score above 700 usually reflects steady payment history and dependable financial behavior.

When reviewing credit reports, landlords look for missed or late payments, which can signal risk. Tenants with consistent on-time payments are seen as more reliable and are often offered better lease terms. Keeping credit accounts current and reducing debt helps strengthen rental applications and builds trust with future landlords.

How Credit Score Requirements Vary by Region?

Credit score requirements vary by region because housing demand, cost of living, and local economic conditions influence what landlords expect. In cities, landlords often expect scores above 700, while rural areas may accept around 600–650. Higher living costs and competitive rental markets raise standards, whereas less demand in smaller towns allows greater flexibility.

Credit Score Standards in Cities

In large metropolitan areas such as Los Angeles, San Francisco, and New York, landlords typically expect a credit score between 700 and 750 due to high competition and strong demand for rentals. A higher score indicates financial reliability, helping applicants stand out among many qualified tenants. Urban landlords often rely heavily on credit reports because city properties carry higher rent values and turnover risks. Renters with scores below 650 are not always disqualified but may need a co-signer, a larger deposit, or strong income verification to secure approval. In cities where housing costs are rising, a solid credit profile can be just as important as proof of income.

Flexible Requirements in Rural Areas

In rural or less competitive rental markets, landlords often accept credit scores between 600 and 650, as tenant demand is lower and property turnover can take longer. Flexibility allows them to fill vacancies faster while still assessing a renter’s overall reliability. Instead of focusing only on the score, rural landlords often weigh income stability, rental history, and references more heavily. Applicants with lower scores can often qualify by showing consistent payment history or providing a larger security deposit to offset potential risk.

Economic Influence on Credit Scores

Economic conditions strongly affect what credit score landlords expect from renters. In stronger economies, higher income and housing demand push requirements up, while weaker markets encourage flexibility to keep properties occupied.

How the economy shapes credit score expectations:

- High job growth areas: Landlords prefer scores above 700 to minimize risk.

- Stable mid-income regions: Scores between 650–700 are usually acceptable.

- Economically slow areas: Scores around 600 may still qualify if income is steady.

- Cities with high cost-of-living: Require stronger credit and lower debt-to-income ratios.

Housing Demand and Credit Expectations

High housing demand often leads to stricter credit score expectations because landlords can choose from a larger pool of applicants. In cities where rental competition is strong, such as Los Angeles or New York, scores above 700 are typically required to secure approval quickly.

In contrast, areas with lower demand or more available units allow for greater flexibility. Landlords may accept applicants with scores near 600, especially if they can show steady income or a solid rental history. When demand drops, the emphasis shifts from credit score strength to overall tenant reliability.

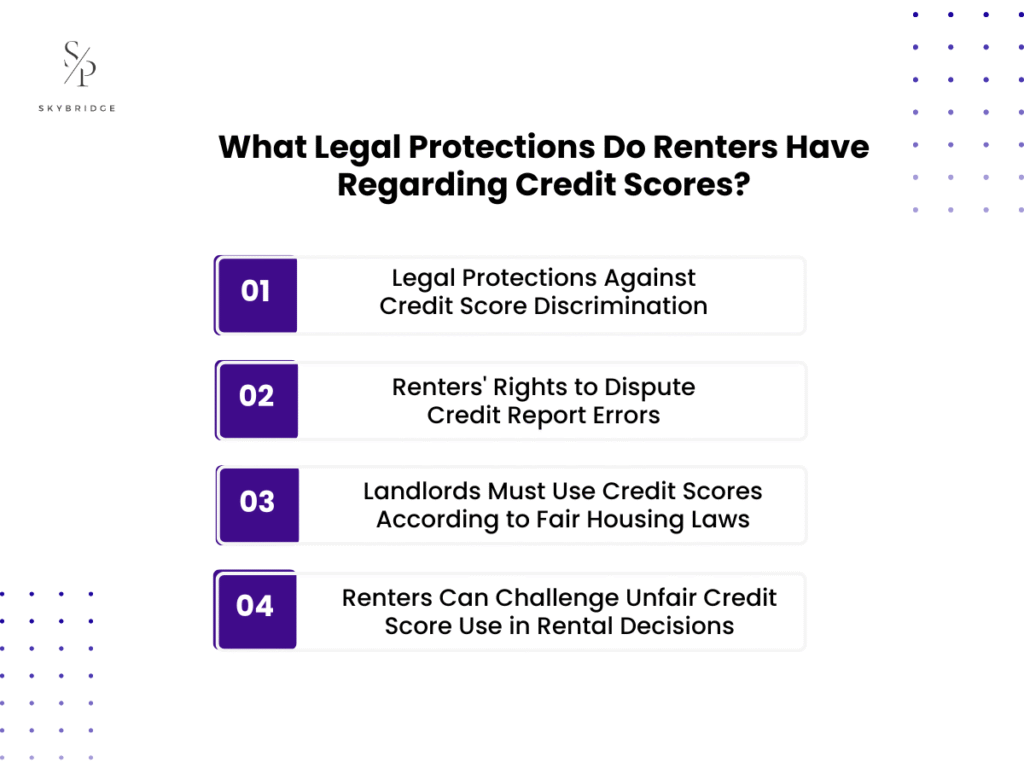

What Legal Protections Do Renters Have Regarding Credit Scores?

Renters are legally protected from unfair or discriminatory credit practices under federal laws such as the Fair Housing Act (FHA), the Fair Credit Reporting Act (FCRA), and the Equal Credit Opportunity Act (ECOA). These laws ensure that landlords use credit information fairly, apply consistent standards to all applicants, and allow renters to dispute inaccurate data. Together, they help prevent bias in rental decisions and give tenants a legal pathway to correct or challenge improper credit use.

- Legal Protections Against Credit Score Discrimination

The Fair Housing Act prohibits landlords from using credit scores to discriminate against applicants based on protected characteristics such as race, religion, gender, family status, or disability. All applicants must be judged using the same objective criteria.

- Renters’ Rights to Dispute Credit Report Errors

Under the Fair Credit Reporting Act, renters have the right to review and dispute incorrect credit report information. If an error is found, credit bureaus must investigate and respond within 30 days, ensuring renters are not unfairly denied housing.

- Landlords Must Use Credit Scores According to Fair Housing Laws

Landlords may include credit checks in their screening process, but must do so uniformly. Selective or inconsistent use of credit scores may violate Fair Housing Laws, especially if it disproportionately impacts certain protected groups.

- Renters Can Challenge Unfair Credit Score Use in Rental Decisions

Landlords may include credit checks in their screening process, but must do so uniformly. Selective or inconsistent use of credit scores may violate Fair Housing Laws, especially if it disproportionately impacts certain protected groups.

How to Improve Your Credit and Strengthen Your Rental Application?

Improving your credit score is one of the most effective ways to increase your rental approval chances, reduce your security deposit, and qualify for better lease terms. A higher score shows landlords that you manage debt responsibly and make consistent payments, which helps build confidence in your financial reliability.

Steps to strengthen your credit and rental profile:

- Pay bills and credit cards on time: Consistent on-time payments have the biggest positive impact on your credit score.

- Reduce credit card balances: Lower utilization rates show that you can manage available credit wisely.

- Check your credit reports regularly: Review all three major credit bureaus to spot and correct any errors promptly.

- Limit new credit applications: Too many inquiries in a short time can temporarily lower your score.

- Show stable income and rental history: Verified earnings and strong rental records can balance a mid-range credit score.

Choosing the right property management company can greatly improve your chances of rental approval, even with an average credit score. Reputable firms often evaluate applicants as a whole, considering factors like rental history, income stability, and consistent payment behavior. Renters who show financial progress and maintain open communication are more likely to be viewed as responsible and trustworthy tenants, increasing their chances of securing housing while rebuilding credit.