In California, tenant screening is essential for landlords to ensure that potential tenants meet the financial and behavioral requirements for renting. For example, a landlord in Los Angeles preparing to lease an apartment must assess whether an applicant can afford rent and care for the property. Without proper screening, landlords risk renting to individuals who may cause financial or legal issues.

California’s tenant screening process is regulated by laws that protect both parties. The Fair Credit Reporting Act (FCRA) mandates written consent before conducting credit or background checks, while California laws, such as AB 1482 and AB 2493, regulate rent increases and cap screening fees. Additionally, local ordinances, such as the Fair Chance Ordinance, restrict the use of criminal background checks, promoting fairness and non-discrimination.

To stay compliant, landlords in California should use consistent criteria for all applicants, disclose fees upfront, and inform applicants of decisions based on screening results. This approach helps protect properties and ensures a fair, legal process for all potential tenants.

What is Tenant Screening?

Tenant screening is the process landlords use to evaluate rental applicants before granting a lease agreement. Its primary purpose is to determine whether an applicant meets the necessary financial, legal, and behavioral requirements to be a responsible tenant. Key criteria typically evaluated include credit score, background checks, income verification, rental history, and references.

Landlords may use third-party services or conduct in-house checks to gather this information. It is crucial that tenant screening is done fairly, legally, and in compliance with local, state, and federal regulations, such as the Fair Credit Reporting Act (FCRA). This ensures the process is non-discriminatory and helps landlords make informed decisions.

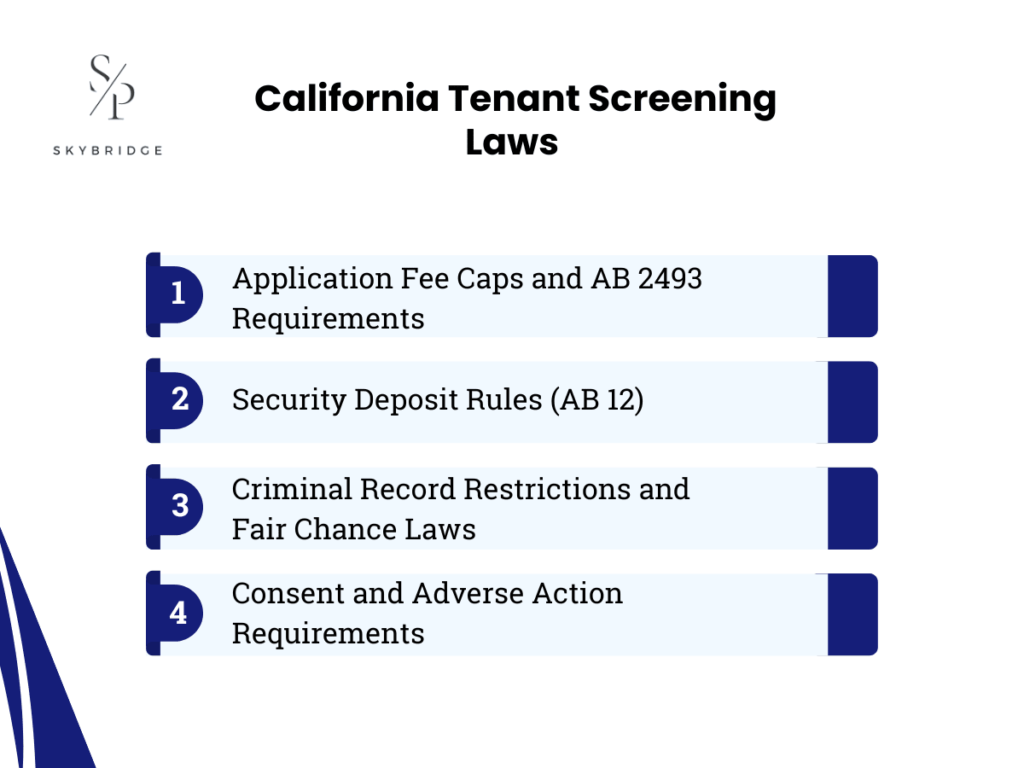

Understanding California Tenant Screening Laws

California tenant screening laws, including the Fair Credit Reporting Act (FCRA), AB 1482, AB 2493, and the local Fair Chance Ordinance, set strict guidelines for how landlords can evaluate rental applicants. These laws ensure fair, non-discriminatory practices and protect both landlords and tenants from legal risks. Landlords must comply with these regulations to avoid penalties and maintain a lawful screening process.

Application Fee Caps and AB 2493 Requirements

Since January 1, 2025, California’s AB 2493 has imposed new limits on rental application screening fees. The maximum allowable fee is $62.02, adjusted annually based on the Consumer Price Index (CPI). If the fee is charged, landlords must provide the applicant with their credit report within 7 days. Additionally, landlords cannot charge a screening fee if no rental units are available or expected to be available.

Key requirements under AB 2493 include:

- The maximum screening fee is set to $62.02 (CPI-adjusted).

- Landlords must provide the applicant’s credit report within 7 days.

- No fees can be charged if no units are available or expected soon.

- Refunds must be issued within 7 days if the applicant is not selected, or within 30 days of application.

- Avoid discriminatory questions related to protected characteristics. For example, asking about an applicant’s marital status, religion, or disability status would be considered discriminatory under the Fair Housing Act.

- Non-compliance may lead to civil penalties, lawsuits, or investigations.

Security Deposit Rules (AB 12)

Under California’s AB 12, effective July 1, 2024, landlords can collect the security deposits to a maximum of one month’s rent for most rental properties. Housing providers who collected more than this before the effective date are not required to refund the excess, but cannot charge additional deposits, such as pet or key deposits, if the total exceeds one month’s rent. The law also permits advance rent payments for leases of six months or longer, with a maximum of six months’ rent.

Key rules under AB 12 include:

- One month’s rent maximum deposit limit starting July 1, 2024

- No additional deposits allowed if the total exceeds one month’s rent

- Advance rent payments of up to six months are allowed for leases of six months or more

- The small owner exemption applies to landlords with two or fewer properties and no more than four units

- Non-compliance can lead to penalties under California Civil Code §1950.5

Criminal Record Restrictions and Fair Chance Laws

California’s Fair Chance Law, also known as the Second Chance Law, restricts how landlords use criminal history in tenant screening. Landlords cannot ask about criminal convictions until a conditional offer has been made. This law also requires sequential screening, meaning criminal background checks must only occur after the applicant meets other qualifications. In Los Angeles, the Fair Chance Housing Ordinance prohibits landlords from inquiring about criminal history during the initial application phase, further strengthening protections against discrimination.

Key provisions of the Fair Chance Laws include:

- Criminal history can only be asked about after a conditional offer.

- Criminal records are reviewed only after meeting other qualifications.

- Los Angeles prohibits asking about criminal history initially.

- Arrests without convictions, expunged records, and juvenile records cannot be considered.

- Non-compliance may result in discrimination claims and legal penalties.

Consent and Adverse Action Requirements

Following the Fair Credit Reporting Act (FCRA), landlords must obtain written consent before conducting credit or background checks. If an applicant is denied or subject to additional conditions, such as requiring a co-signer, a higher deposit, or higher rent, the landlord must issue an Adverse Action Notice. This notice must be provided when any unfavorable decision is made based on the screening results.

Key components of consent and adverse action notice include:

- Reason for the action taken (e.g., denial or additional conditions)

- Credit reporting agency used and contact information

- Name of the credit reporting agency (CRA) used and its contact details

- Right to dispute inaccurate information with the CRA

- Right to a free credit report within 60 days

- A statement that the CRA did not make the final decision

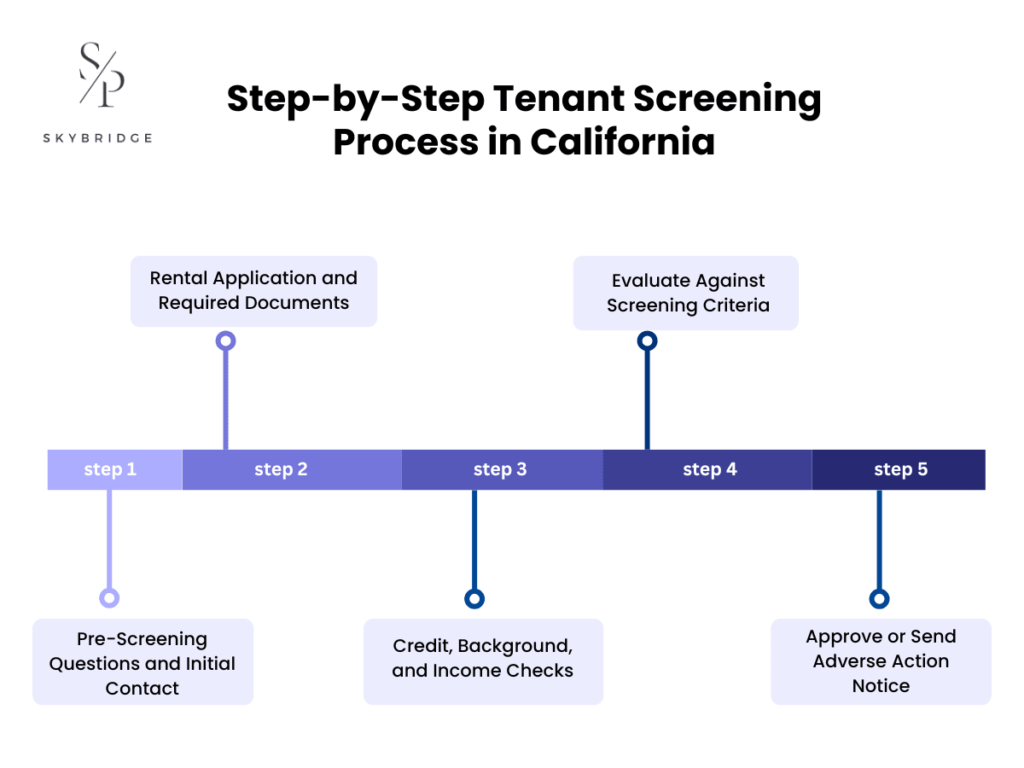

Step-by-Step Tenant Screening Process in California

Tenant screening in California involves checking an applicant’s qualifications through pre-screening, submitting a rental application, conducting background checks, verifying income, and making a decision. Following these steps helps ensure compliance with California laws and fair treatment of all applicants.

1. Pre-Screening Questions and Initial Contact

Pre-screening questions help landlords quickly assess whether an applicant meets the basic qualifications for a rental property, saving time and ensuring only qualified candidates move forward in the process. These questions typically address income, rental history, pets, and past evictions. By asking early, landlords can avoid unnecessary applications and focus on those who meet the key criteria.

Common pre-screening questions include:

- Are you able to pay the rent on time each month?

- Do you have any pets? (if applicable)

- Have you ever been evicted?

- What is your current employment situation?

- Can you provide references from previous landlords?

These questions allow landlords to efficiently filter applicants and move forward with the best candidates.

2. Rental Application and Required Documents

After pre-screening, landlords typically request a formal rental application, which includes essential personal information and documents needed to assess the applicant’s qualifications. This step is crucial for verifying income, rental history, and identity before making a decision. Common documents requested include proof of income, a photo ID, and references from previous landlords or employers.

Common rental application documents include:

- Proof of income (e.g., pay stubs, bank statements)

- Photo ID (e.g., driver’s license, passport)

- Rental references (contact details of previous landlords or employers)

- Consent for background and credit checks

By collecting these documents, landlords ensure they have the necessary information to make an informed and legally compliant decision.

3. Credit, Background, and Income Checks

After receiving the rental application, landlords conduct credit, background, and income checks to assess an applicant’s financial stability and reliability. These checks help landlords determine if the applicant can afford the rent, has a clean criminal record, and has a history of responsible tenancy. It’s important that these checks comply with California and federal regulations, like the Fair Credit Reporting Act (FCRA).

Key checks performed during tenant screening include:

- Credit report: Assesses financial responsibility

- Background check: Reviews criminal history and past evictions

- Income verification: Confirms financial ability to pay rent

4. Evaluate Against Screening Criteria

Once the credit, background, and income checks are complete, landlords evaluate the applicant based on established screening criteria. This helps ensure that all applicants are assessed fairly and consistently. Common criteria include a minimum credit score, income-to-rent ratio, rental history, and any criminal background checks. Landlords typically set specific thresholds for these factors to help guide their decision-making process.

Common screening criteria include:

- Credit score: A minimum score for financial stability (e.g., 620 or higher)

- Income-to-rent ratio: Typically 2.5–3 times the rent amount

- Rental history: No prior evictions or lease violations

- Criminal background: Only relevant and recent convictions considered

5. Approve or Send Adverse Action Notice

After reviewing an applicant’s qualifications, landlords either approve the application or send an Adverse Action Notice if the application is denied or additional conditions are required. This notice must explain the reason for denial, provide the source of the credit report, and inform the applicant of their right to dispute the findings.

Key elements of the adverse action Notice include:

- Reason for denial or additional conditions

- Source of the credit report used

- Instructions on how to dispute inaccuracies with the credit agency

- A notice of the right to a free credit report within 60 days

Failure to issue a timely or complete notice can lead to legal consequences under the Fair Credit Reporting Act (FCRA).

Components of a Tenant Screening Report

A tenant screening report typically includes a credit report, criminal background check, eviction history, and income verification. These components help landlords assess financial stability, criminal background, rental behavior, and the ability to afford rent, ensuring informed and fair decisions.

Credit Report and Score

The credit report is a key component in tenant screening, allowing landlords to assess an applicant’s financial responsibility. It provides a detailed history of the applicant’s credit usage, including payment history, outstanding debts, and credit score. A credit score is used to gauge the applicant’s ability to pay rent on time. Typically, landlords look for a minimum credit score, such as 620 or higher, to ensure the applicant can meet their financial obligations.

Criminal Background Check

By running a criminal background check, landlords can assess an applicant’s safety and reliability as a tenant. It reviews an applicant’s criminal history, including felony convictions and other legal issues that could affect the tenancy. California law restricts the use of certain criminal records, such as sealed or expunged records and arrest-only records. Landlords are required to perform these checks in compliance with the Fair Chance Ordinance to avoid discrimination.

Eviction and Rental History

Reviewing eviction history is an essential step in tenant screening, as it reveals an applicant’s past behavior as a tenant. Landlords check whether the applicant has been evicted previously or had issues such as unpaid rent or lease violations. A solid rental history with positive references from past landlords indicates the applicant is likely to be a responsible tenant and a good fit for the property.

Employment and Income Verification

Verifying an applicant’s employment and income is crucial to ensure they can afford the rent. Landlords often request pay stubs, bank statements, or an employment letter to confirm the applicant’s income. Additionally, landlords typically require an income-to-rent ratio of 2.5 to 3 times the rent to ensure the applicant has sufficient financial stability. This step helps landlords avoid renting to tenants who may struggle to meet their financial obligations.

How to Run a Legal Credit Check in California?

To run a legal credit check in California, landlords must obtain written consent from the applicant and use authorized credit bureaus. The process must comply with the Fair Credit Reporting Act (FCRA), and the report should only be used for rental decisions. If the applicant is denied based on the credit check, an Adverse Action Notice must be provided, explaining the reason for denial.

Written Consent and Disclosure Requirements

In California, landlords must obtain written consent from applicants before conducting credit checks, under the Fair Credit Reporting Act (FCRA). This consent must inform the applicant that their credit report will be used solely for evaluating their rental application. Additionally, landlords must provide a disclosure regarding the applicant’s right to receive a copy of the report if adverse action is taken. Failing to comply with these requirements can result in penalties and legal consequences.

Using Credit Bureaus Legally

Landlords must use authorized credit bureaus like Experian, TransUnion, or Equifax when obtaining tenant credit reports. These bureaus are legally allowed to provide consumer reports under the Fair Credit Reporting Act (FCRA), ensuring compliance with tenant protection laws. Landlords must use the credit information only for rental decisions and cannot share it for other purposes. Failing to follow these guidelines can lead to lawsuits, penalties, and legal liability for landlords.

Credit Score Interpretation Guidelines

Californian landlords rely on credit scores to assess an applicant’s financial responsibility, with scores ranging from 300 to 850. A score of 620 or higher is commonly required, indicating a relatively low risk of missed payments. However, landlords should also consider other factors like income, rental history, and recent credit events. Using a comprehensive approach ensures that landlords make fair, well-rounded decisions without relying solely on the credit score.

Income and Employment Verification Standards

Income and employment verification is essential for confirming that tenants have a reliable income to cover rent. Landlords typically request pay stubs, bank statements, and employment verification letters to assess financial stability.

Proof of Income Documents

To verify an applicant’s ability to pay rent, landlords usually require proof of income. Common documents include pay stubs, bank statements, and tax returns for self-employed individuals. These documents allow landlords to assess whether the applicant’s income is stable and sufficient to meet the rent. Landlords typically look for applicants whose income is at least 2.5 to 3 times the monthly rent to ensure affordability.

Employment History Checks

To confirm an applicant’s job stability and ensure they have a reliable source of income, a thorough check of employment history is required. Landlords may ask for employment verification letters or contact the applicant’s employer directly. This step helps landlords assess whether the applicant’s employment is consistent and if they are financially capable of maintaining rent payments. Frequent job changes may raise concerns about income stability and could influence a landlord’s decision.

Calculating Income-to-Rent Ratio

The income-to-rent ratio is a key metric landlords use to evaluate whether an applicant can afford the rent. Typically, landlords require an applicant’s monthly income to be 2.5 to 3 times the rent amount. For example, if the rent is $2,000 per month, the tenant should earn at least $5,000 to $6,000 per month. This ratio helps landlords assess the applicant’s financial stability and reduces the risk of missed rent payments.

Criminal Background Screening: California Compliance

In California, criminal background screening is regulated to ensure fairness and prevent discrimination, with landlords prohibited from using sealed or expunged records, arrest-only records, and certain juvenile records in tenant evaluations. Landlords must also comply with the Fair Chance Ordinance, which restricts when and how criminal history can be considered, ensuring applicants are not unfairly rejected based on their past.

What Landlords Can Legally Check?

Landlords in California can legally review relevant convictions and certain felonies, but cannot consider sealed, expunged, arrest-only, or juvenile records. This ensures applicants are not unfairly excluded based on outdated or irrelevant criminal history.

Legally permissible checks include:

- Convictions relevant to tenant behavior or safety

- Violent felonies that may threaten tenants or property

- Drug trafficking offenses affecting rental safety

- Sex offender registry status when directly relevant

- Fraud or property damage convictions tied to lease obligations

- Financial crimes that may impact rent reliability

Fair Chance Ordinance Guidelines

Under the Fair Chance Ordinance, landlords cannot inquire about criminal history until after making a conditional offer. This protects applicants from automatic disqualification and ensures fair evaluation of their suitability for housing.

Key points under the Fair Chance Ordinance in California are:

- Ask about criminal history only after a conditional offer

- No automatic rejection based solely on past convictions

- Individual assessment of each applicant’s criminal history

- Consider rehabilitation and the time elapsed since offenses

- Compliance with Fair Housing laws to prevent discrimination

- Protection of protected classes under state and federal laws

When Can Criminal Records Be Considered?

Californian landlords can consider criminal records only when the offense is recent, relevant, and affects tenant or property safety. Records must be reviewed on a case-by-case basis, considering the applicant’s rehabilitation and the time elapsed since the conviction.

Criminal records in California can be considered if:

- The conviction is relevant to tenancy or safety

- There is evidence of rehabilitation or positive behavior change

- The offense poses a risk to other tenants or property

- The crime relates to lease terms or property use

- The record is recent enough to indicate potential concern

Operational Best Practices for Landlords

Landlords in California should follow structured best practices to ensure tenant screening is fair, consistent, and legally compliant. Using standardized criteria, documenting every step, staying updated on state and local laws, and responding properly to adverse actions helps reduce risks, avoid discrimination, and support informed rental decisions.

Red Flags to Watch for During Screening

While screening a potential tenant, landlords should be alert to red flags that may indicate financial or reliability risks. Identifying these early helps prevent probable problems during the interview without rejecting applicants.

Common red flags include:

- False or inconsistent information on the application

- Unverifiable income or pay stubs

- Recent evictions or lease violations

- Poor credit history with unresolved delinquencies

- Missing or unverifiable references

- History of late rent payments

Avoiding Discrimination in Screening Criteria

To avoid discrimination, landlords in California must ensure that tenant screening practices comply with federal, state, and local fair housing laws. Screening criteria should be neutral, applied consistently, and focused on financial and rental qualifications.

Key actions to prevent discrimination include:

- Apply the same criteria to all applicants

- Avoid questions based on race, gender, disability, religion, or family status

- Provide reasonable accommodations for tenants with disabilities

- Avoid policies that disproportionately impact protected classes

- Document all decisions for legal defensibility

Handling Rejected Applicants and Disclosures

When rejecting an applicant, California landlords must follow proper disclosure procedures to comply with legal requirements. Providing timely and accurate notices helps prevent disputes and ensures transparency.

Steps for handling rejected applicants include:

- Issue a written adverse action notice

- Include the specific reason for denial

- Disclose the source of the information (credit bureau or screening agency)

- Provide instructions for disputing inaccuracies

- Retain documentation of the decision and notice issued

Using Tenant Screening Services

Professional tenant screening services help landlords streamline the application process while ensuring compliance with legal requirements. These services provide access to credit reports, criminal background checks, and eviction histories quickly and accurately, reducing manual effort and minimizing errors.

Key benefits and considerations when using screening services include:

- Ensure the service is FCRA-compliant

- Access credit, criminal, and eviction reports in one platform

- Quick report turnaround, often same-day

- Integration with rental applications for efficiency

- Transparent cost structure for applicants and landlords

- Maintain responsibility for fair and legal use of the information

Recent Legal Changes in 2024–2025

Several new laws in California between 2024 and 2025 have impacted tenant screening, requiring landlords to update their procedures. These changes aim to increase fairness, transparency, and compliance with state regulations.

Key legal updates include:

- AB 2493: Caps the tenant screening fee at $62.02 in 2025, adjusted annually based on the Consumer Price Index (CPI)

- AB 12: Limits most security deposits to one month’s rent, with exemptions for small landlords and advance rent payments for leases of six months or more

- Fair Chance Ordinance updates: Criminal history can only be considered after a conditional offer, and blanket rejection policies are prohibited

- Adverse Action Notices: Landlords must issue timely notices, including the reason for denial, credit bureau details, and dispute instructions

Enhanced disclosure requirements: Landlords must provide clear documentation of fees, deposits, and tenant rights under state law

Get Professional Help with Tenant Screening in Southern California

Landlords in Southern California can benefit from professional tenant screening support, which simplifies the evaluation process and ensures compliance with complex state and local regulations. Many landlords achieve this by partnering with a property management company that specializes in tenant screening and rental compliance.Working with a property management company offers several advantages, including expert navigation of California-specific laws, access to FCRA-compliant screening platforms, time-saving screening packages, and assistance with adverse action notices, fee disclosures, and fair housing compliance. Leveraging professional support for tenant screening ensures landlords make informed, legally compliant decisions while saving time and reducing risk.