Landlords can check a tenant’s eviction history by collecting their full legal name, date of birth, and previous addresses, then searching local court databases or using third-party tenant screening services that include eviction reports. These steps help verify past rental behavior and flag any legal removals for non-payment, lease violations, or property damage.

Reliable screening often combines multiple methods. Public court records show official filings, while tenant background check providers offer broader insights like rental history, credit score, and eviction-related debt. Some credit reports may also list unpaid rent sent to collections. Using a combination of tools increases accuracy and reduces screening gaps.

All eviction checks must comply with federal regulations. Under the Fair Credit Reporting Act (FCRA), written tenant consent is required before running any report. The Fair Housing Act (FHA) prohibits discriminatory decisions based on protected traits. Because eviction records may remain visible for up to seven years, proper screening protects against legal risk and financial loss.

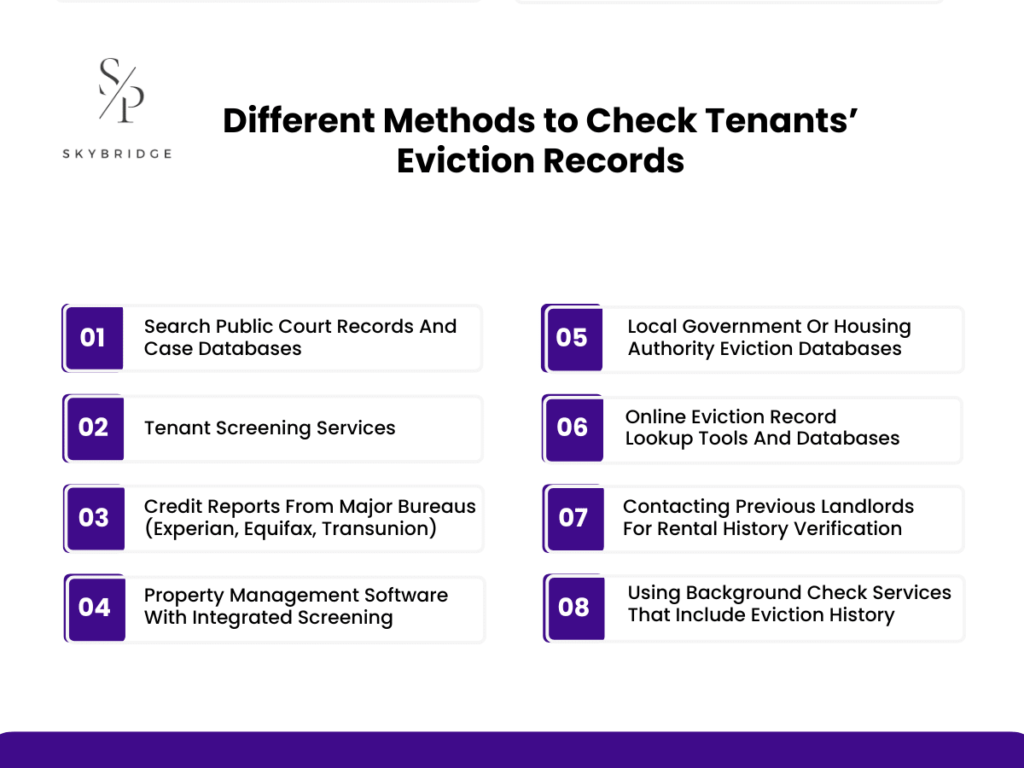

What Are the Different Methods to Check Tenants’ Eviction Records?

Landlords can check a tenant’s eviction record by using public court databases, tenant screening services, background check providers, credit reports, and property management software. Public court records offer direct access to formal eviction filings and are searchable by the tenant’s name and previous addresses. Screening tools and credit reports add depth by revealing rental history patterns, eviction-related debt, and other risk indicators that may not appear in court databases alone.

Search Public Court Records And Case Databases

Landlords can search public court records to verify if a tenant has a history of eviction by accessing online databases provided by local or state courts. These systems often list civil case filings, including unlawful detainers, which are formal eviction proceedings. Accuracy depends on using correct identifiers such as the tenant’s full legal name and past addresses.

Steps to check public court records:

- Visit the county or state court’s official website.

- Navigate to the civil or case search section.

- Enter the tenant’s full name and filter by location or filing date.

- Review case summaries for eviction-related actions (e.g., unlawful detainer).

- Save or document the findings for compliance and recordkeeping.

Not all jurisdictions offer online access, and some may require in-person visits or case number verification. Results may not include sealed or dismissed records, so it is recommended to use this method alongside professional tenant screening services.

Tenant Screening Services

For a more efficient and comprehensive view of a tenant’s history, landlords often rely on tenant screening services that assess tenant risk by delivering eviction history, credit reports, and background checks in one consolidated tenant screening report. Instead of manually searching multiple databases, landlords can access critical data from national and regional sources through a single platform. These services operate under the Fair Credit Reporting Act (FCRA), requiring tenant consent before generating reports.

A typical tenant screening report includes:

- Eviction history and legal actions

- Credit score and full credit file

- Criminal background records

- Employment and income details

- Prior address history

- Identity verification tools (e.g., SSN trace)

Trusted services such as SmartMove, RentPrep, and MyRental offer flexible packages with varying depth and cost. Using these tools allows landlords to identify red flags early, reduce risk, and make informed leasing decisions while remaining compliant with housing laws.

Credit Reports From Major Bureaus (Experian, Equifax, Transunion)

Credit reports serve as a valuable screening tool by revealing financial red flags that may be tied to past evictions, even if the eviction itself does not appear directly. Major credit bureaus like Experian, Equifax, and TransUnion may reflect unpaid rent, court judgments, or collection accounts, which are indicators of potential past rental issues. While credit data does not replace public record searches, it adds important financial context to a tenant’s application.

Key credit report indicators during tenant evaluation include:

- Rent-related collections or charge-offs

- Civil judgments connected to evictions

- Overall credit score and history

- Late payments or delinquent accounts

- Active credit lines and utilization

While eviction-related items are typically visible on credit reports for up to seven years, older evictions may not appear. Landlords should keep this time limitation in mind when reviewing credit data, as judgments or unpaid debts from previous evictions can still impact a tenant’s overall creditworthiness and rental reliability.

Property Management Software With Integrated Screening

Property management software offers landlords a convenient, automated way to screen tenants by integrating eviction checks directly into their platforms. These tools streamline the tenant application process by pulling eviction history, credit reports, and other background data in a single, comprehensive report. This integration saves time and reduces the risk of missing critical information when screening applicants.

Key features of property management software with integrated screening are:

- Automated eviction history checks

- Access to credit and criminal background data

- Centralized dashboard for managing tenant applications

- Lease and payment tracking integration

- Streamlined communication with applicants

By using property management software like Buildium, AppFolio, or Rentec Direct, landlords can simplify the tenant screening process, improve consistency, and maintain compliance with legal standards. These tools provide landlords with an efficient, streamlined workflow that helps save time, reduce errors, and ensure consistent, legally compliant tenant screening practices.

Local Government Or Housing Authority Eviction Databases

Many local governments and housing authorities provide access to eviction data through public-facing databases. These databases allow landlords to search for eviction filings within specific counties or municipalities, offering insights into whether a tenant has faced legal eviction proceedings in the past.

Here is how you can use housing authority eviction databases:

- Search by tenant name, case number, or address

- Check for case details, including eviction dates and outcomes

- Be aware of restrictions, such as date limits or sealed records

- Some jurisdictions may require in-person requests or registration for online use

The availability and format of these databases vary significantly by state or municipality. Some regions provide free online access, while others may impose fees or restrictions. Understanding local protocols is essential when using these databases to verify eviction history and access region-specific tenant information.

Online Eviction Record Lookup Tools And Databases

Online eviction record lookup tools offer a convenient alternative to in-person court searches, allowing landlords to quickly access eviction histories from the comfort of their office. These tools provide searchable databases of eviction records, making it easier to check tenant backgrounds without needing to visit local courthouses.

Here is how online eviction lookup tools work:

- Searchable by tenant name, address, or case number

- Typically offered on a pay-per-use or subscription basis

- Coverage may vary from local to national databases

- Provide access to court filings, legal judgments, and eviction histories

In some cases, tenant consent may be required before using these platforms. Since the data provided by online tools may not always be fully comprehensive, landlords should cross-check the results with official public records to ensure the accuracy of the eviction history.

Contacting Previous Landlords For Rental History Verification

Reaching out to prior landlords is a direct way to confirm a tenant’s rental history and check for any past evictions. By communicating with former landlords, you can gather valuable insights into the tenant’s behavior, payment consistency, and any legal issues that may have arisen during previous tenancies.

Key questions to ask previous landlords are:

- Did the tenant consistently pay rent on time?

- Were there any lease violations or complaints?

- Was the tenant ever evicted or involved in any legal disputes?

- Would you rent to this tenant again?

It is crucial to keep a record of the responses and compare them with the tenant’s application disclosures to ensure consistency. Always maintain respectful communication with previous landlords and follow local privacy laws to protect sensitive information during the verification process.

Using Background Check Services That Include Eviction History

Background check services are a comprehensive tool for landlords, offering in-depth reports that include eviction history as part of tenant screening. These services pull data from various sources, such as public court records, credit reports, and criminal background checks, to provide a detailed overview of a tenant’s rental and financial history.

Major elements included in tenant background check reports are:

- Eviction history and related court filings

- Criminal background and conviction records

- Credit profile and financial behavior

- Past addresses and rental history

- Employment and income verification

Tenant consent is legally required before running any tenant background checks under the Fair Credit Reporting Act (FCRA). There are differences between consumer-focused and landlord-oriented providers, with the latter offering more detailed, landlord-specific reports that are designed for tenant screening purposes.

What Is the Step-By-Step Process for Checking Tenants’ Eviction Records?

To check a tenant’s eviction record, gather their full name, date of birth, and prior addresses, search public court records, use tenant screening services, review credit reports for unpaid rent or judgments, and contact previous landlords for verification. Following this process helps landlords identify red flags, such as past evictions or unpaid rent, that could indicate potential risks. A thorough tenant eviction check also reduces disputes and protects against financial or legal complications by verifying the tenant’s history.

- Search Public Court Records

Searching public court records plays a critical role in tenant screening by providing landlords with verified, official information about prior evictions. Unlike third-party reports, court records offer direct evidence of legal actions such as unlawful detainers, helping landlords accurately assess a tenant’s rental history. Accessing these records reduces the risk of relying solely on self-reported information or incomplete data, which could result in financial loss, property damage, or legal disputes.

While the process involves using court databases to locate filings, the key value lies in confirming the tenant’s background and identifying red flags that may not appear in credit reports or screening services. Regularly consulting public court records strengthens a landlord’s ability to make informed leasing decisions and ensures that potential risks are addressed before signing a lease.

- Gather The Tenant’s Information

To gather the tenant’s information, landlords collect key details such as full legal name, date of birth, previous addresses, and employment history, which form the foundation for accurate eviction and background checks. It is essential to double-check for typos or inconsistencies, as even minor errors can lead to incomplete searches or overlooked red flags.

All information should be stored securely in compliance with data protection rules to safeguard tenant privacy. Accurate and verified data allows landlords to efficiently access public court records, screening services, and credit reports, ensuring a thorough evaluation of potential risks. This step directly influences the quality of tenant screening, helping landlords make informed decisions and reducing the likelihood of financial loss, property damage, or legal disputes.

- Use Third-Party Services

Third-party services provide landlords with a fast and reliable way to verify a tenant’s eviction history and background. These platforms consolidate data from public court records, credit bureaus, and criminal databases into a single, comprehensive report. Top providers such as RentPrep, SmartMove, and MyRental offer reports that include eviction history, rental addresses, credit profile, criminal background, and employment verification. Processing times range from minutes to 48 hours, with pricing varying by report depth, and tenant consent is required under the Fair Credit Reporting Act (FCRA).

Using these services ensures landlords have accurate, actionable data to make informed rental decisions. They reduce the risk of missing red flags, streamline tenant screening, maintain compliance with legal requirements, and help protect both the property and tenant privacy.

- Review For Legal Compliance

Legal review is essential before finalizing tenant screening decisions, as improper use of eviction records can lead to liability. Landlords must comply with the Fair Credit Reporting Act (FCRA), Sections 604 and 605, which govern permissible purposes for accessing consumer reports and define the timeframe for reporting adverse information. Additionally, the Fair Housing Act (FHA), Sections 804 and 805, prohibits discrimination based on protected classes during tenant selection. Written tenant consent is required under FCRA before accessing any background or screening report.

Special care is necessary when handling sealed, dismissed, or outdated eviction records. Misusing or ignoring these protections can result in fines, lawsuits, or discrimination claims. Following these legal requirements ensures safe, fair, and compliant tenant screening practices.

- Contact Past Landlords

Contacting past landlords provides landlords with firsthand verification of a tenant’s rental behavior and potential eviction history. Asking previous landlords about payment consistency, lease violations, and any prior evictions helps confirm the accuracy of the tenant’s application. It is important to obtain the tenant’s consent before reaching out and to keep records of all communications. Respectful and professional inquiries not only ensure compliance with local privacy laws but also provide reliable insight into the tenant’s reliability. Cross-checking responses against submitted applications helps identify inconsistencies and reduces the risk of leasing to high-risk tenants.

- Interview The Applicant

Interviewing the applicant is a final step to clarify any gaps or concerns uncovered during the screening process. Landlords should ask clear questions such as: “Have you ever been evicted?”, “Can you explain what happened?”, and “What has changed since?” These questions provide context and allow tenants to clarify past issues.

It is crucial to document the conversation carefully and cross-check responses against submitted applications, reference checks, and other verification sources. Conducting thorough interviews allows landlords to assess honesty, consistency, and tenant responsibility, ensuring that final leasing decisions are well-informed and compliant with legal and screening standards.

Legal Considerations When Checking Eviction Records

When checking eviction records, landlords must comply with federal laws such as the Fair Credit Reporting Act (FCRA) and the Fair Housing Act (FHA), which regulate access to tenant information and prohibit discriminatory use. Written tenant consent is required before running any checks, and sealed, dismissed, or outdated records must be handled carefully. Following these rules protects landlords from legal liability, ensures fair treatment of applicants, and helps maintain accurate, reliable tenant screening while reducing the risk of disputes or penalties.

Complying With Fair Housing Laws

Eviction screening decisions must comply with the Fair Housing Act to ensure all applicants are treated fairly and to prevent discrimination. Landlords should carefully consider which categories are protected to avoid selective or subjective rejections.

Protected categories include:

- Race or color

- Religion or national origin

- Sex or gender identity

- Familial status (presence of children)

- Disability or medical condition

By documenting consistent screening criteria and reviewing rejection decisions for compliance, landlords can maintain transparency, reduce liability, and ensure that tenant selection practices are both fair and legally defensible.

Tenant Privacy And Data Protection Rules

Tenant eviction screening involves handling sensitive personal data, making tenant privacy and data protection critical. Landlords must limit access to screening information, secure records, and ensure compliance with laws such as the Fair Credit Reporting Act (FCRA).

Key tenant privacy measures include:

- Obtain written consent before accessing records

- Store all tenant data securely and restrict access

- Limit data sharing to authorized personnel only

- Ensure compliance with federal, state, and local data protection regulations

Following these rules helps landlords maintain trust, avoid legal penalties, and ensure that eviction and screening processes protect tenant rights while supporting responsible rental decision-making.

State-Specific Screening Regulations

Each state has specific rules governing how eviction information can be used in tenant screening, so landlords must be aware of the local requirements. Variations commonly include sealed filings, notice periods, time limits for reporting eviction history, and restrictions on using certain records in housing decisions.

Examples of state-specific tenant screening rules are:

- California’s Consumer Credit Reporting Agencies Act (Cal. Civ. Code § 1785.13) prevents reporting criminal convictions that are older than seven years in tenant screening reports.

- New York State Senate Bill 2023-S9911 mandates that eviction court records be sealed one year after the entry of a final judgment.

Landlords should consult state housing authorities or legal aid resources regularly to stay current and maintain compliance in tenant screening.

Risks Of Renting Without Screening Eviction Records

Eviction screening is a critical risk mitigation tool that helps landlords identify high-risk tenants before signing a lease. Taking the time to verify a tenant’s eviction history ensures landlords make informed decisions and protects their rental investment. Meanwhile, skipping this step during tenant screening exposes property owners to avoidable financial and legal consequences.

Potential consequences of not screening eviction records include:

- Loss of rent due to tenant default

- Legal fees and court costs from eviction proceedings

- Time spent in lengthy eviction processes

- Damage to rental property or additional repair costs

Regular and thorough screening protects profitability, reduces risk, and ensures compliance with rental laws. By carefully evaluating applicants, landlords can secure reliable tenants, reduce turnover, and preserve the long-term value of rental properties for consistent financial success.

How Long Does An Eviction Stay On Your Record?

An eviction remains on a tenant’s record for up to seven years, depending on legal and industry standards. During this time, it can appear in public court records, tenant screening reports, and sometimes on credit reports if unpaid rent or related judgments were sent to collections. It is important to note that an eviction filing does not always result in a judgment, and reporting practices can differ between jurisdictions.

Additionally, sealed or dismissed cases may not appear in tenant screenings, and the timeframe for reporting can vary by state. Understanding these nuances allows landlords to accurately interpret a tenant’s rental history, make informed screening decisions, and maintain compliance with federal and state regulations, while avoiding misjudgments based on incomplete or outdated information.

How To Get An Eviction Off Your Record?

Tenants can remove an eviction from their record through legal processes such as expungement, motions to vacate, sealing, or disputing inaccurate reporting with screening agencies. Expungement clears the record or limits its visibility, giving tenants a chance to improve their rental eligibility and credit profile.

Common methods to remove or dispute an eviction include:

- Court-ordered expungement

- Sealing eviction cases to prevent public access

- Filing motions to vacate judgments

- Disputing errors with tenant screening agencies under FCRA

Tenant advocacy groups and legal aid organizations can assist in navigating these processes. Maintaining written documentation of filings, notices, and court approvals ensures the eviction is properly expunged or corrected.

How To Rent With An Eviction On Your Record?

To rent with an eviction on your record, proactively disclose the circumstances to landlords, demonstrate financial responsibility through higher security deposits, and secure a trustworthy co-signer or guarantor to strengthen your lease application. Provide supporting documentation that shows resolved disputes and any steps taken to improve financial responsibility. Together, these actions help landlords feel confident in approving your application despite a prior eviction.

Long-term improvement strategies include repairing credit, obtaining positive references from previous landlords, and maintaining transparency with future landlords. These steps rebuild trust, expand rental opportunities, and demonstrate responsibility, helping tenants overcome the challenges of a past eviction.

Do Evictions Show Up On Background Checks?

Yes, evictions can appear on background checks, but it depends on the type of check and the reporting source. Standard tenant background checks and comprehensive screening services often include eviction history from public court records, while basic employment-focused checks may not. Some credit reports may reflect eviction-related judgments or unpaid rent sent to collections, but the eviction itself may not always be listed.

Key points to consider:

- Not all background checks automatically include eviction history.

- Tenant screening services are more likely to provide comprehensive eviction information.

- Credit reports may only show related debts or judgments, not the filing itself.

Landlords should verify the scope of each background check and ensure tenant consent is obtained under FCRA before reviewing records. Proper interpretation of these reports ensures informed tenant selection.

How Property Management Company Helps Homeowners In Getting Qualified Tenants?

Property management companies help homeowners by handling the full tenant screening process, removing the burden of manually verifying applications, eviction history, and financial background. They use specialized industry tools to conduct eviction checks, background reports, and credit evaluations, ensuring each applicant meets strict criteria before approval.By managing these steps, a property management company saves homeowners time, reduces the risk of legal errors, and improves tenant quality. Their expertise ensures compliance with federal and state laws while identifying reliable, responsible tenants. This comprehensive screening process helps protect rental income, minimize property damage, and maintain long-term profitability and peace of mind for homeowners.